Published :

Updated :

Startup funding in Bangladesh have marked a significant jump during the first six months of the current year, mainly on the back of merger and acquisition (M&A) deal between a local company and a global one.

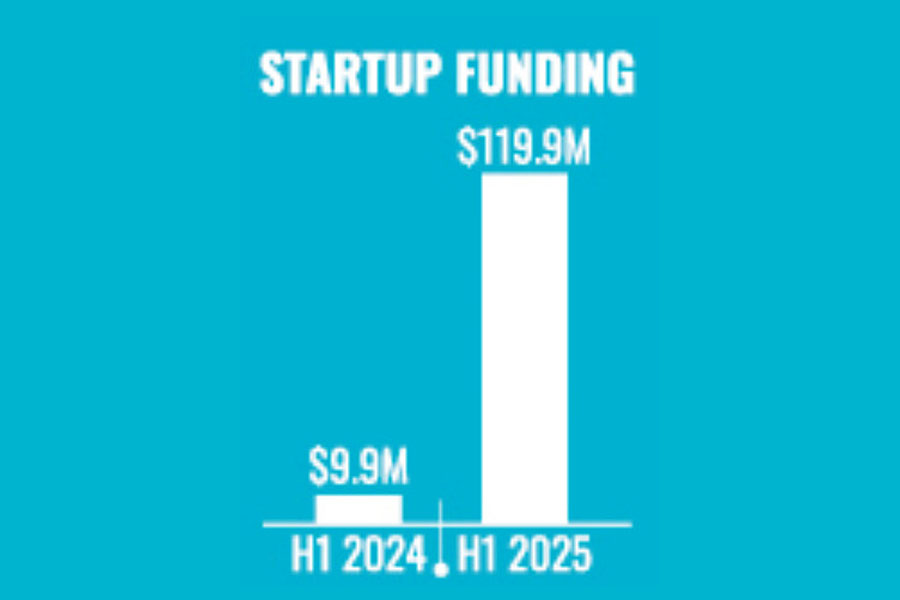

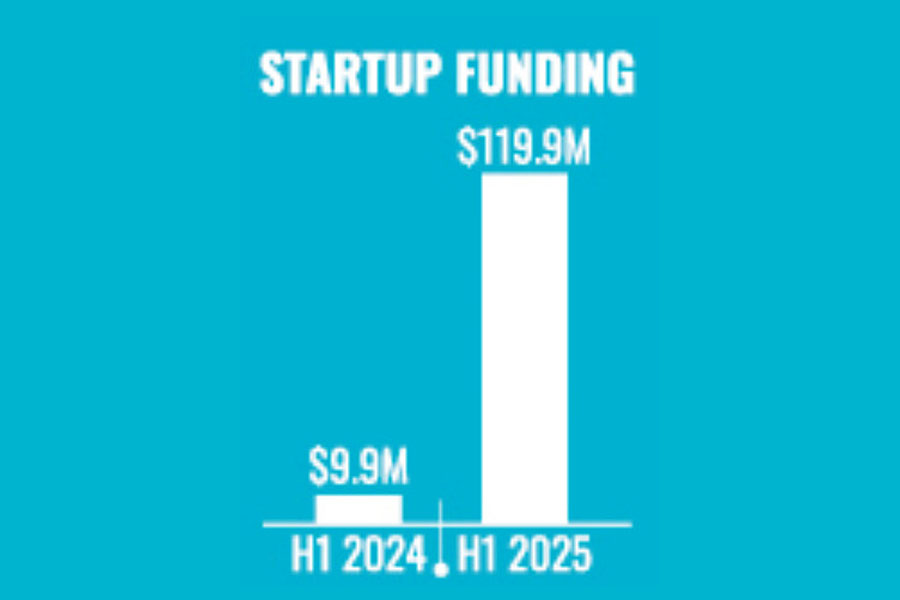

Funding in such businesses reached nearly $119.9 million during the period which is almost 12 times higher than $9.9 million recorded in the first half of last year, according to data compiled by a local think tank LightCastle Partners (LCP).

The sharp increase was primarily attributed to a $110 million strategic M&A deal between Bangladesh-based B2B commerce platform ShopUp and Sary, a similar platform headquartered in Dammam, Saudi Arabia, which led to the formation of SILQ Group.

The strategic merger between ShopUp and Sary, culminating in the creation of SILQ Group with a USD 110 million backing, accounted for more than 90 per cent of the total capital raised, reveals the report.

The deal has been the second largest deal since the bKash-SoftBank investment in 2021. This deal alone redefined the funding narrative for the period, propelling total startup investments to $120 million across only nine deals. Other start-ups receiving funds include Ecommerce & Retail, Education Technology, and Enterprise Solutions.

However, initial or seed funding remained drastically lower during the period. No investment activity was recorded in debt, pre-Series A, and Series A rounds in the first half of 2025, a stark contrast to H1 2024 when pre-Series A alone captured 40 per cent of total funding, amounting to $3.9 million.

In the first half of 2025, the investment landscape was dominated by venture capital, which accounted for $117 million, representing 98 per cent of the total funding raised, according to the report.

When contacted, Rahat Ahmed, founder and managing partner of Anchorless Bangladesh, a venture investment fund, emphasised the need for more synergistic efforts to propel the local startup ecosystem forward, as funding remains very limited beyond the ShopUp-Sary deal.

"With roughly 93 per cent of startup capital still coming from international investors, we need a more coordinated effort to help operationally strong companies scale so they become more attractive compared to regional peers," he told the FE.

It includes better access to working capital and stronger incentives to encourage investment from local families, he said. "Most importantly, local ecosystem partners and policymakers still aren't engaging enough with downstream institutional investors who fund Series A and B rounds," he said. Underscoring the need for early-stage funding, Rahat said: "If we want to make our companies more attractive, we need to understand what these investors look for and build toward that from the start."

Musabbir Hosain, founder of a gaming startup NapTech Labs said: "It is vital to establish seed-stage and blended capital funds, along with improved mentorship and globally aligned curricula to give local startups a strong footing."

Additionally, targeted support should be provided for game development and esports startups through event sponsorships and hardware grants, he said. Strong ties between industry and universities for skills and research is also required, he added.

saif.febd@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.