Published :

Updated :

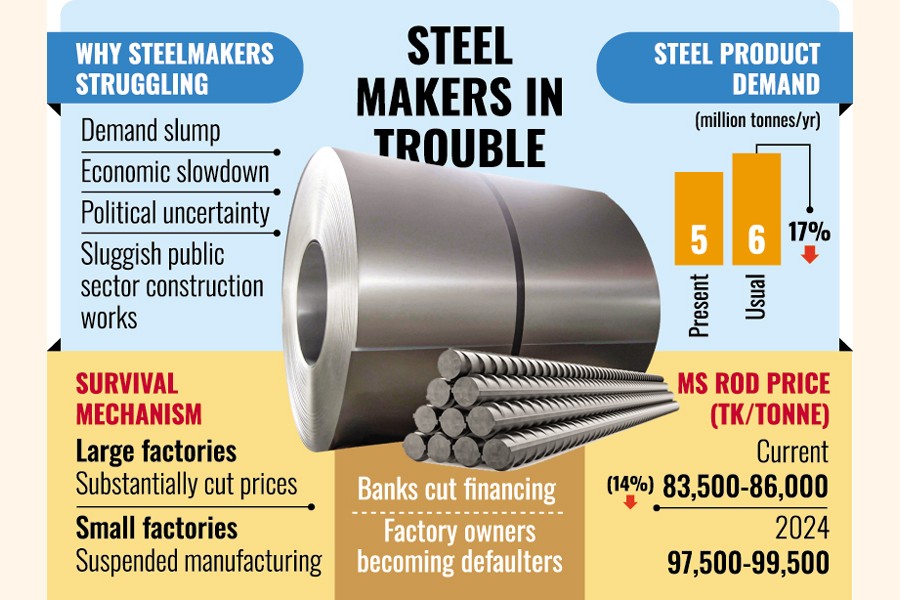

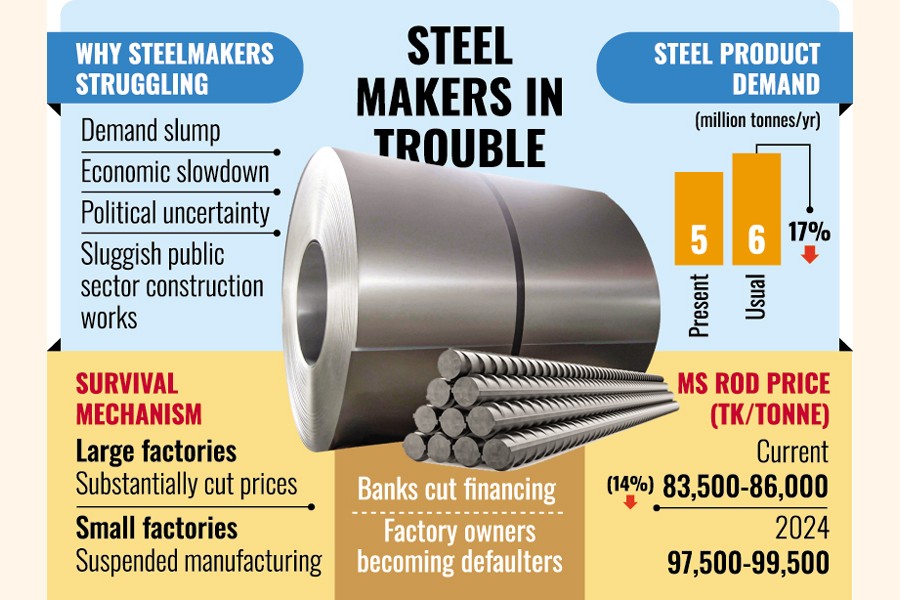

Steelmakers across Bangladesh struggle to keep afloat mainly for demand slump amid economic slowdown, political uncertainly and sluggish construction works especially in public sector, insiders say and seek remedies.

They have said large-scale millers have substantially scaled down price as a means of survival with hope of rebound in future while a number of smaller factories have suspended manufacturing.

There are nearly 200 steel mills, including 40 large-scale ones, operating in the country. The widely known major steel companies are affiliated with Bangladesh Steel Manufacturers Association (BSMA).

According to estimated data available with BSMA, the aggregate installed production capacity is 11 to 12 million tonnes per year.

Demands for different types of steel products-such as mild steel (MS) rods, galvanised steel sheets, corrugated sheets, beams, angles, plates, rebar-hovered usually above 6.0 million tonnes a year.

However, it has tumbled down to 5.0 million tonnes now, which is nearly 17-per cent lower than usual estimated demand.

A global platform of steel sector, World Steel Association, also estimates that crude steel production in Bangladesh declined by 0.5 million tonnes to 4.5 million in the last calendar year (2024) from 5.0 million tonnes in the previous year.

Contacted, former BSMA Chairman Sheikh Masadul Alam Masud said a number of mills are facing setbacks for the lower demand.

"Mills after mills are getting closed, not only in our sectors but also in many other different sectors," said Mr Masud, who is Managing Director of Shahriar Steel Mills Ltd (SSRM).

A slowdown had started and prevailed in the last four years of the previous government which exacerbated now as the interim government is much focused on reform rather than other issues like private sector, he told The Financial Express.

Overall economy, in his view, is facing setback and, as a result, banks have become tight-fisted limiting finance in the sector.

"Nearly 40-per cent mills have suspended operations so far," he said, adding that a handful of large mills in Chattogram and Dhaka are running now.

Sources have said banks, on the one hand, have scaled down financing and, on the other, mills are becoming defaulter, affecting overall economy.

Demand for steel products along with other construction materials largely depends on infrastructure-development projects, especially in the public sector. Such projects are mostly incorporated into Annual Development Programme (ADP).

As per data available with the Planning Commission, in the last fiscal year (FY 2024-25) ADP-implementation rate was 68 per cent-the lowest in 20 years.

According to sources, more than 80 per cent of the ADP involves development of physical infrastructures. Following the July uprising in 2024, most public-sector development works virtually halted as a number of contractors suspended operations. Such activities have yet to return to their usual course. As a result, millers have to sell steel products at subsidised rates or with little profit margins.

Data available with the Trading Corporation of Bangladesh show per-tonne MS rod was selling between Tk 83,500 and Tk 86,000, depending on different brands and retail markets. The price was almost 14-percent less than that of a year ago, when the price hovered between Tk 97,500 and 99,500 per tonne.

Price in Chattogram hovered between TK 79,000 to Tk 84,000 per tonne in the last couple of days which was lower by Tk 5,000 to Tk 7,000 comparing to that of a month ago.

Chattogram accommodates most of the major steel factories. They include Bangladesh Steel Re-Rolling Mills (BSRM), Abul Khair Steel (AKS), GPH Ispat, Ratanpur Steel Re-Rolling Mill (RSRM), Kabir Steel Re-Rolling Mill (KSRM), HM Steel, Golden Ispat, Shitalpul Auto Steel Mill (SARM), Bayezid Steel, Seema Steel Mills, PHP Integrated Steel Mill etc.

These factories meet about 70 per cent of the rod-production needs of the country's steel sector.

However, several steel industries, including RSRM, SS Steel, Golden Ispat, and Islam Steel, are currently closed owing to increased production costs and decreased demand.

Contacted, GPH Ispat Additional Managing Director Mohammad Almas Shimul said currently, steel industries are operating at 50-70 per cent of their capacity.

"Although production costs have increased, rod prices have decreased," he says about the paradox.

saif.febd@gmail.com

nazimuddinshyamol@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.