Published :

Updated :

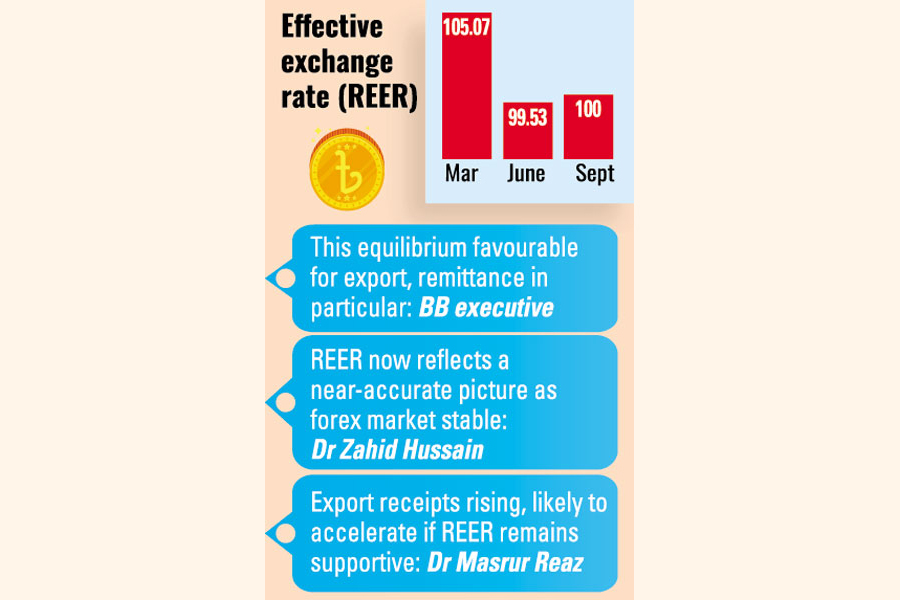

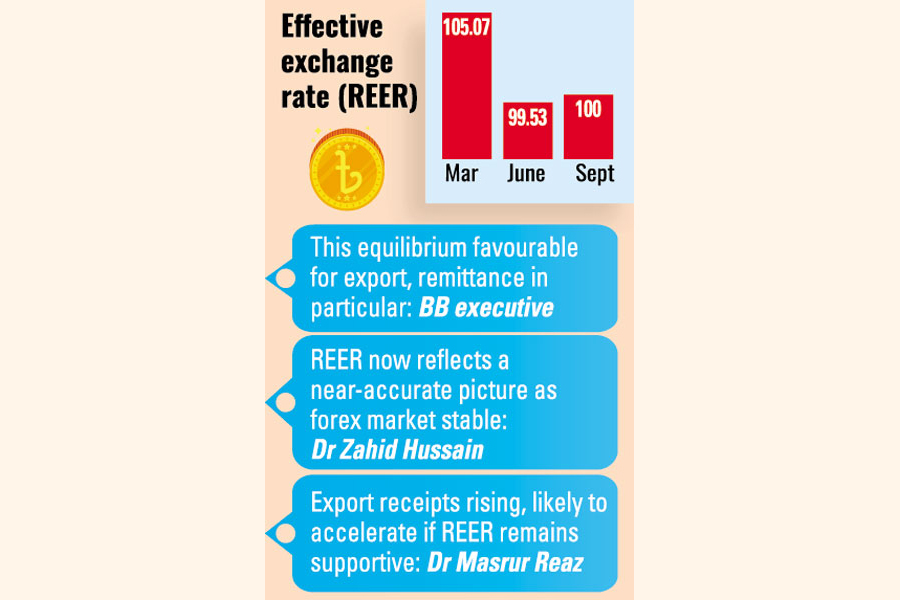

Bangladesh's currency now appears to be at equilibrium amongst the peers as the real effective exchange rate (REER) of the taka in a 15-currency basket representing major trading partners stood around 100 by the end of September.

Sources in business and banking circles say this shoring up of the local currency's standing has particularly bolstered export performance in the country's external trade.

According to the Bangladesh Bank, the REER just climbed over 100 in September from 99.53 in June 2024. The reading was 105.07 in March.

Sources familiar with the developments at the central bank told The Financial Express that the dollar-taka exchange rate, which currently hovers around 120, is fairly stable.

They think this equilibrium is favourable for export and remittance. Additionally, the point-to-point inflation dropped to 9.92 per cent in September that contributes to the REER stabilization.

In financial literature, REER is a critical measure for assessing the equilibrium value of a currency. A REER below 100 indicates that exports are becoming more competitive while imports are becoming more expensive. A figure above 100 suggests the opposite.

Among Bangladesh's key trading partners are China, the European Union, and India, among others. The REER takes into account the currencies and inflation rates of top 15 trading partners.

"Our aim is to maintain the REER at 100, otherwise there will be pressure to depreciate the taka against the dollar," a senior official at the central bank told the FE Friday.

A taka valued at this level of the REER is expected to enhance the competitiveness of Bangladeshi products on the international market, according to bankers and economists.

"Yes, this is having a positive impact on export earnings. In July-August 2024, exports expanded by 2.5 per cent to $7.16 billion, up from $6.896 billion during the same period last year," the central banker says.

Economists believe that this exchange-rate stability will boost the country's external trade. "We have long advocated for stability on the foreign-exchange market, and this indicator shows we are now in a favourable position," says Dr M. Masrur Reaz, chairman of the Policy Exchange of Bangladesh.

He notes that export receipts have been rising and will likely accelerate further if the REER remains supportive.

Dr Zahid Hussain, former lead economist at the World Bank's Dhaka office, echoes this sentiment, saying that the REER now "reflects a near-accurate picture as the foreign-exchange market remains stable".

jasimharoon@yahoo.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.