Published :

Updated :

A phenomenal worldwide US tariff hike stokes worries in Bangladesh's overall trade circles with apparel makers fearing chain effects especially on apparel export to its single-largest market.

According to exporters, Bangladeshi suppliers might face huge price squeeze from the US buyers as high tariffs would raise the products' price while the possibility of investment being relocated from other countries, especially from China, might face setbacks.

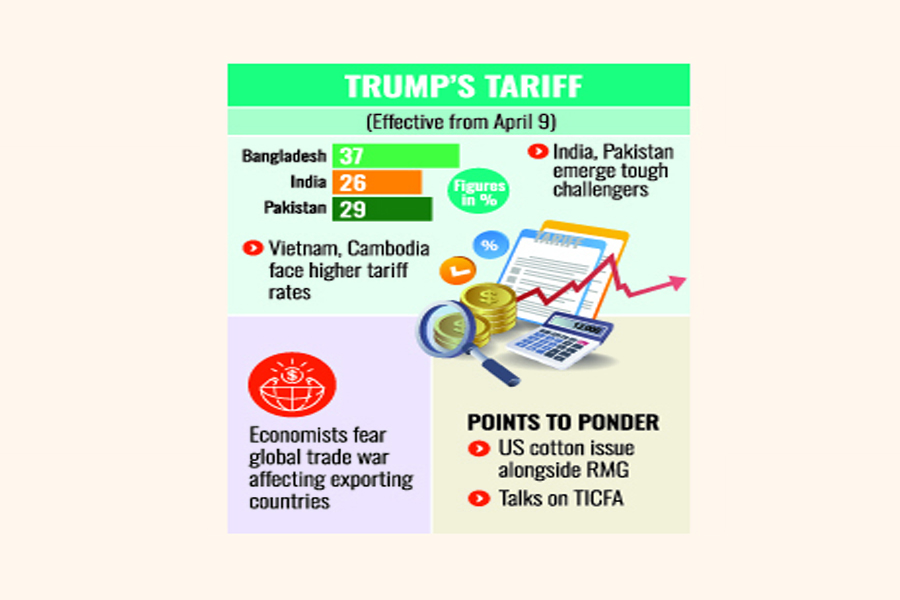

The fears stoked up as the United Sates announced a 37-percent tariff on imports from Bangladesh as part of President Donald Trump's sweeping new 'reciprocal tariffs' policy.

According to a chart published by the White House on Wednesday, the US government claims that Bangladesh effectively imposes a 74-percent tariff on American goods, and in response, a 37-percent "discounted reciprocal tariff" will now be levied on Bangladeshi products entering the US market.

The announcement is likely to have a major cascading impact on Bangladesh's exports as the country is largely dependent on the export of readymade garments.

Apparel makers have expressed concern, saying the steep tariff would erode the country's competitive advantage.

They also opine that they would face tough competition with India and Pakistan as the US has imposed 26-percent and 29-percent tariffs on them respectively.

US President Donald Trump imposed the sweeping revenge tariffs on products from nearly 185 countries with a redoubled duty rate of 37 per cent on Bangladeshi exports to the major market for its apparel.

The new US "reciprocal tariff" regime has already escalated tensions across the globe as the European Union, China, Japan and South Korea expressed their serious reaction and resolve retaliate.

The Trump-touted 'Liberation Day' tariffs' average rate would be highest since 1911, according to a US-based organisation, Tax Foundation.

Bangladesh's main competitors in apparel trade-Vietnam and Cambodia-would have to face higher taxes than that of Bangladesh, while China, India, Indonesia and Pakistan stand in an advantageous position compared to Bangladesh in the new tariff structure.

Vietnam would have to pay 46 per cent and Cambodia 49 per cent taxes, while China 34 per cent, India 26 per cent, Indonesia 32 per cent and Pakistan 29 per cent.

The US President imposed the new set of reciprocal tariffs on April 2 and will be effective from April 9, upending the current global trade system.

Since the countries levy higher tariffs on US products, so the US President enforces the jacked-up taxes in his avowed tit-for-tat action.

The Trump administration has claimed that Bangladesh levies an average tax of 74 per cent on the US products accessing the Bangladesh market.

According to the US-based Tax Foundation, the average tariff rate on all imports will rise from 2.5 per cent in 2024 to 8.4 per cent, the highest average rate since 1946, under the full tariffs under IEEPA tariffs on Canada, Mexico, and China and the Section 232 tariffs on steel and aluminum.

However, experts and economists think the new tariffs imposed by the US might not bring any major change in market competition as similar tariffs have been imposed on other garment-producing countries at different rates with some facing higher rates like Vietnam and Cambodia.

They, however, apprehend a possible global trade war that would result in economic recession and would affect almost all exporting countries.

Talking to The Financial Express, Syed Nasim Manzur, Managing Director of Apex Footwear Ltd, said the US is the single-largest export destination of Bangladeshi-made products, including RMG, footwear and leather goods, and there would be huge potential impacts.

There are multiple crises in the country with recent political change, high cost of production, high bank interest rates and graduation challenges, he mentions, raising the question whether Bangladesh could reduce the barriers to that extend of 37-percent tariff to remain competitive.

"Bangladesh needs to actively engage and explain its position as regards import duty and start immediate economic diplomacy," he suggests, citing as example like explaining the reasons why import duty is higher for automobiles, cars and alcohols and the volume of import from the USA.

He says exporters have long been asking the government to rationalize the import-tariff structure and Bangladesh has potential to turn the crisis into opportunity by rationalizing the tariffs on imports, especially for the US.

Vietnam has signed more than 50 FTAs while Bangladesh has yet to sign any mainly due to the high import tariffs that included high supplementary duty, he notes.

The leading businessman says though neighbouring countries are taking preparation and negotiating country-to-country level to reduce tariffs from January, Bangladesh is yet to start its homework.

Professor Dr Mustafizur Rahman, executive director at the Centre for Policy Dialogue (CPD), says the new US tariffs are unlikely to bring any major changes in market completion as the US has imposed similar tariffs for other competitors, higher for some, like Vietnam-the second- largest apparel exporter to the USA, and Cambodia, the sixth.

Though the tariff imposition is not unexpected but the rates have surprised, he says, terming the 37-percent tariff for Bangladesh 'high rate'.

"It would raise the products' prices, putting pressure on US consumers to reduce their demands," he told the FE, adding that as a result, the US market would squeeze and put a negative impact on Bangladesh's exports.

The tariffs for Vietnam and Cambodia are higher than Bangladesh's while they are lower for India and Pakistan, he mentions, adding that Bangladesh might take advantage of high rates while lose some benefits to those having lower rates.

A possible global trade war may take place as the EU and China have already announced that they would impose additional duty on US goods which would further shrink demand worldwide, negatively affecting Bangladesh's exports not only to the US but also other destinations, he notes.

He has stressed bilateral negotiations to raise the issue of using US cotton in making RMG and seek for reduced rate. "Bangladesh is the fifth-largest market for US cotton exports."

TICFA could be another platform to discuss, he says, stressing the need to boost Bangladesh's competitiveness by reducing cost of production, raising productivity, market diversification and engaging in negotiations with the US government.

When asked, RAPID chairman Dr MA Razzaque said the US imposed differential reciprocal tariffs on different countries and competitiveness depends on the higher or lower rates.

The overall RMG exports will decrease and so for all garment-producing countries, including Bangladesh, he said, adding that China's export might decline by a half to $25 billion which might create opportunity for other garment-producing nations.

Terming the situation 'complex' one, he said all countries across the board would be affected and this is not only based on tariffs as it has other associated impacts.

Explaining he says China's export might fall to the US or China diverts its market to other destinations like the EU, Australia and Japan. And if such happens, there would be a price pressure not only for Bangladesh but also for India and Vietnam.

When a big importing country like the US imposes duty, other exporting countries like India, China and Vietnam might devalue their currencies, he notes, adding that on the other hand, Bangladesh doesn't have the freedom to do so due to its inflationary pressure which according to him is a matter of 'concern'.

The US market would be squeezed as prices of products would go high affecting consumers' purchasing power, and as a result, demands will go down. In that case, India might gain or remain competitive compared to Vietnam and Cambodia.

On the other hand, if others like the EU and China retaliate, there would be a possible global tariff war which might result in an 'inevitable' impact as global recession and all countries would be affected.

Former president of Bangladesh Garment Manufacturers and Exporters Association (BGMEA) Rubana Huq says: "Consequences are going to be lethal. With our competitors in Turkey, India and Pakistan in a better position, we will encounter huge price squeeze from the US buyers."

Internal competition will be fierce, she predicts, adding that price dips will continue, which in turn, will make the industry unsustainable.

She has stressed active and advance lobbying and economic diplomacy and readjusting local tariffs on US products as an immediate measure.

US apparel imports from Bangladesh in 2024 stood at US$ 7.34 billion and some US$5.12 billion were cotton items while non-cotton and other items exports were US$2.21 billion.

"So 70 per cent of our exports to the USA are cotton-based. Now, if we can use more US cotton, we can significantly avoid additional duty," she notes.

Former BGMEA vice-president Abdullah Hil Rakib also stresses immediate government measure to look into the tax or revenue collection from US imports and their impact, if any, and decide steps accordingly.

Shams Mahmud, managing director of Shasha Denims Ltd, says the tariffs imposed by the US bring up some critical issues for Bangladesh which now finds itself with higher tariff structure for exports to the US as compared to other competitors.

"The relocation of industries from China to Bangladesh for exports to the US also faces a question mark," he says, adding that the fundamental issue they always had in Bangladesh in relation to tax collection whether it is collected from imports.

And now they highlight the issue more as Bangladesh has to respond to the US measures by reducing or waiving import taxes, he notes.

He, however, holds the opinion that Bangladesh gets ready to graduate from LDC status and with the new scenario unfolded it will not be a smooth transition which begs the question of re-evaluation of graduation.

"With the RMG sector which will be severely impacted by the actions of the USA, the overall macro-stability of Bangladesh will now be in stress," he says.

Former president of Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA) Fazlul Hoque says the exports in next few months might decline as US importers have already made a stock apprehending a possible tariff hike.

As Bangladesh produces huge volume-based products, buyers usually don't hike prices of such goods, he says, adding that buyers would either absorb the enhanced prices by cost cutting or cutting a part of their profits or ask suppliers to shoulder the price burden and even both.

"So the immediate challenge would be the huge price pressure on suppliers."

India could be a major competitor of Bangladesh as it faces a lower rate of 26-percent duty while it has been expanding its production capacity offering a number of incentives targeting the export increase.

"Government should immediately sit with stakeholders to devise its strategy in this connection," he suggests.

kabirhumayan10@gmail.com

Munni_fe@yahoo.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.