Published :

Updated :

Bangladesh is experiencing a higher level of inflation at the moment. Higher inflation lowers the standard of living and the people need to earn more money to retain the same standard of living.

The rise in prices of goods and services over a certain period of time is referred to as inflation. Higher inflation denotes abrupt, extreme and unrestrained price increases that affect our lives in small doses in the short term, but its long-term implications can be significant. Real income is reduced by inflation, which lowers the purchasing power of people. Not only marginalized, but even lower-middle and middle-class people are under a lot of pressure due to higher inflation. People who have few options for employment and those who work in the informal sector of the economy continue to struggle. As income or wages are not being adjusted for high inflation, the majority of people live in insecurity.

Worldwide, currently, there has been an increase in inflation due to the recovery from the COVID-19 pandemic, followed by the Ukraine-Russia war and its subsequent impact on supply chain. South Asia is no exception. While the current inflation rate is low in Bhutan at 3.29% followed by the Maldives (3.91%) and India (4.25%), it is high in Nepal (7.41%), Bangladesh (9.94%), Sri Lanka (25.2%) and Pakistan (38%). On the other hand, Afghanistan (-1%) is facing deflation as its economy has shrunk by 30% since 2021. South Asian Network on Economic Modeling (SANEM) claims that marginalized people in Bangladesh experience inflation rates (more than 10%) that are higher than the official (Bangladesh Bank) rate (9.94%). A local daily on March 30, 2023 reported that 37 per cent of households were skipping one meal each day, 71 per cent of households were eating less than they needed to, and 18 per cent of households were staring at the possibility of going unfed continuously for six months due to higher inflation.

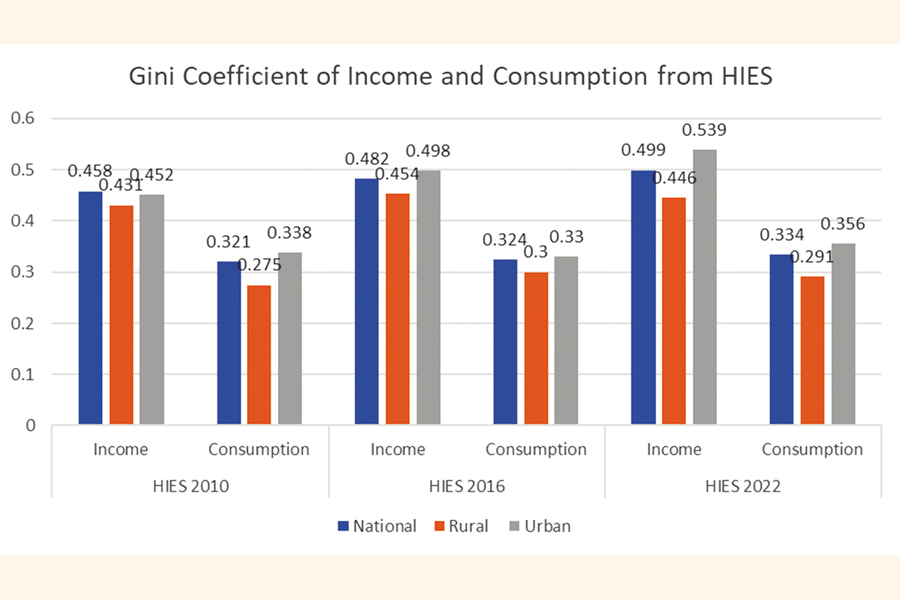

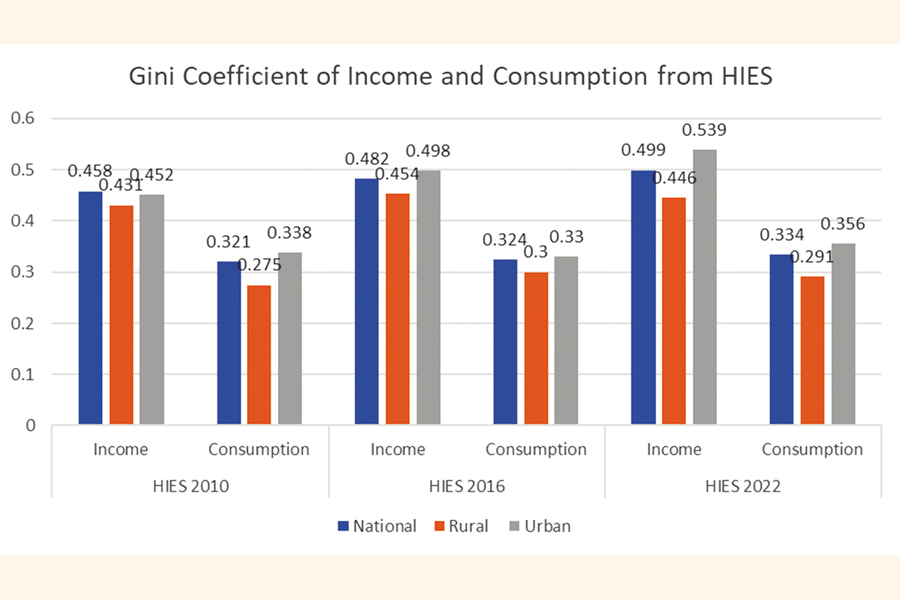

According to the Bangladesh Bureau of Statistics (BBS)'s "Household Income and Expenditure Survey (HIES)-2022" report, the Gini Coefficient for income increased to 0.499 in 2022 from 0.482 in 2016 and 0.458 in 2010. The consumption-related Gini Coefficient increased from 0.324 (2016) and 0.321 (2010) to 0.334 in 2022. In 2016, the average monthly income increased to Tk 15,988 from Tk 11,479 in 2010 whereas in 2022 the average monthly household expenditure rose to Tk 31,500 from Tk 15,715 in 2016 and Tk 11,200 in 2010. In 2022, food consumption expenditures decreased by 45.8%, and non-food consumption increased by 54.2%, compared to 47.7% for food and 52.3% for non-food in 2016.

What can we deduce from the HIES survey? According to HIES, mass people's monthly household expenses climbed threefold compared to their monthly income. As a result, lower and middle-income households are dealing with terrible circumstances during this vital time. To conserve money, they are reducing their consumption. Instead of starving once, twice, or for the whole day, they are fighting an invisible battle that they cannot reveal to others. On the contrary, rich people continue to live opulent lives. In their daily lives, the price hike has no bearing. Instead, because of FOMO, they constantly hurry to buy some unimportant goods. Now the question is: what is FOMO?

FOMO means Fear of Missing Out which implies that before the stock runs out, the rich will purchase extraordinary items. For instance, "Gold Jilapi" with a price of Tk 20,000 per kg suddenly appeared in the Ramadan Iftar market. The confection was made with 20-22 pieces of edible gold set in 24 carats, but it ran out of stock in less than a week. This is an example of income inequality. Because, while lower or middle-income people are struggling to manage a whole day's meal, the rich are busy meeting their lavish demand. While lower-income and lower-middle-income people are standing in a queue to collect TCB goods at low prices, the rich are buying goods at double or re-double prices.

Income inequality is exacerbated by higher inflation. The consumption bundle of the poor is significantly impacted by the recent increase in the relative prices of consumption bundles because food is their single largest expenditure. Therefore, the recent increase in daily necessities' cost creates inflation which would push more people into poverty. Inflation, as a silent killer, causes a redistribution of income and wealth which has a negative impact on the poor by reducing their purchasing power and leaving them dependent only on their income. The poor get poorer because of inflation which encourages income inequality by widening the gap between various income groups.

The world is experiencing crisis after crisis, and the Ukraine-Russia conflict has significantly hampered efforts to recover from the COVID-19 pandemic's effects, which affected both local and global food supply systems. Numerous people have lost their jobs and means of support due to the economic and supply chain constraint. However, the people's purchasing power has been hurt by rising energy prices on the global market and the inflation rate. Low- and middle-income people have been under pressure due to the rising cost of commodities, including oil and gas, which has negatively impacted their purchasing power and consumption patterns.

The World Bank estimated that the COVID-19 pandemic made 62-71 million people new poor in South Asia in 2020 and left 48-59 million more in poverty in 2021. The Power and Participation Research Centre (PPRC) and BRAC Institute of Governance Studies (BIGD) stated in a report (2022) that 2.1 million (21 lac) became new poor in Bangladesh due to higher inflation. During COVID-19, the number of new poor was 30 million (3 crore). But the number has declined gradually after the effect subsided.

Higher inflation has no sign of abating. Although the main cause of inflation is exogenous like the rising value of the US dollar, this cannot be a justification for the government not to step in and safeguard the low-income population. Precautionary steps must be taken by both the public and private sectors, and a strong recovery strategy must be in place to handle shocks. Any crisis increases the vulnerability of the weak due to the lack of necessities, such as safe and secure food. We can overcome food crises by having a healthy economy, access to affordable essentials, and a stable food system that favours the underprivileged and unserved.

The fiscal policy is very important as it can be used in revising taxes, addressing unemployment, enhancing social safety nets, etc. On the other hand, the monetary policy can be used in regulating the money supply and inflation. Continuous efforts must be made to lessen the degree of income inequality through the implementation of laws because income inequality is a global issue that necessitates a worldwide solution. Furthermore, Bangladesh desperately needs to keep inflation under control to reduce income inequalities.

Dr. Soma Dhar is an economist based at the University of Chittagong, Bangladesh.

Dr. Tapan Sarker is a Professor of Finance and former World Bank scholar based at the University of Southern Queensland, Australia.

soma.chowdhury7@yahoo.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.