Published :

Updated :

Can an oral and maxillofacial surgeon (dental surgeon) can conduct the heart surgery like a cardiac surgeon? Two are complete different professions with different professional frameworks like the Cost and Management Accountant (CMA) and Chartered Accountant (CA). Both of these accounting professions are based on two different (a) laws, (b) national and global perspective and (c) learning process, training and development and continuous professional development. Here, CA is for statutory audit under Section 212 of the Companies Act 1994 and CMA is for an audit of cost accounts under Section 220 of the said Act. Considering all relevant laws of the country, global standard practice and professional framework designed by the two institutes based on their respective ordinance and Act, conducting the statutory audit by CMA is unlawful, not globally accepted and not covered with learning process of the statutory audit assignment too.

Why it is unlawful:

In accordance with the Article 2(2)(ii) of the Bangladesh Chartered Accountants Order 1973, the regulating law of The institute of Chartered Accountants of Bangladesh (ICAB) and the professional body of CA, the members of the institute (i.e., C!) will be engaged to perform the services of 'the auditing or verification of financial transactions, books, accounts, or records or the preparation, verification or certification of financial accounting and related statements or hold themselves out to the public as an accountant' in addition to other professional services. As per section 2 (2)(d) of the Cost and Management Accountants Act 2018, the regulating law of The institute of Cost and Management Accountants of Bangladesh (ICMAB) and the professional body of CMA, the members of the institute (i.e., CA) will be engaged to perform the services of 'involving the costing or pricing of goods or services or services related to preparation, verification, audit or issuance of certificate of cost accounts and related statements, mentioned in section 220 of the Company Act, 1994 (Act No. XVIII of 1994)' in addition to other professional services except the financial audit termed as statutory audit. So, the two institutes are formed for two different broad perspectives aligned with the global professional framework. Section 212 of the Companies Act 1994, the mother Act for regulating the statutory audit of all companies registered with RJSC, stipulates, 'No persons shall be appointed an auditor of any company unless he is a "chartered accountant" within the meaning of the Bangladesh Chartered Accountants Order, 1973, (P.O. No. 2 of 1973).' Section 220 of the said mother Act stipulates the requirement of audit of cost accounts by a government order and states that 'an audit of cost accounts of the company shall be conducted in such manner as may be specified in the order by an auditor who shall be a cost and management accountant" within the meaning of the Cost and Management Accounts Ordinance, 1977 (L III of 1977).' So, the jobs are specific for the members of the two institutes based on the regulation laws of each profession and the mother act, the Companies Act, 1994, of regulating the audit of all Companies.

Other relevant laws like the Financial Reporting Act, 2015, the Securities and Exchange Rules, 2020 in governing statutory audit may be reviewed to find the scope. Section 2(16) of the Financial Reporting Act, 2015 defines the 'Audit Service' as the services to be rendered under sections 210 to 220 of the Companies Act, 1994. As stated above, sections 212 and 220 of the said Act specify the audit job of CA and CMA. So, the FRC Act 2015 has also defined fairly the jobs of two institutes.

Rule 14(3) of the Securities and Exchange Rules, 2020 formed under the Securities and Exchange Ordinance, 1969 reveals-'the financial statements of an issuer of a listed security shall be audited by a firm of auditors' duly appointed from the panel of auditors as per guidelines declared by the Commission from time to time, where a firm of auditors includes a partnership firm of chartered accountants within the meaning of the Bangladesh Chartered Accountants Order, 1973 (P. O. No. 2 of 1973). In case of audit of accounts of stock broker, dealer and stock exchange, similar provisions have been made in the said rules.

So, conducting the statutory audit by CMA is unlawful under the above legal frameworks of the country.

Why it is not globally accepted:

Globally the institutes of CMA and CA have been established for two broad perspectives as the audit of cost accounts and statutory audit respectively in addition to other services as stipulated in the regulating law of each institute.

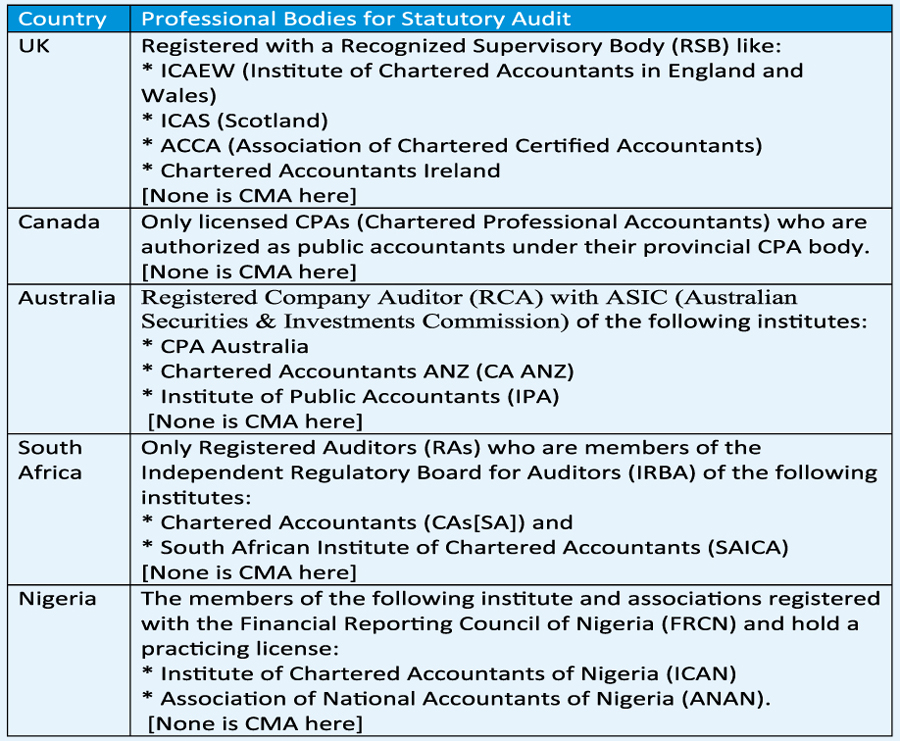

ICMAB has presented that multiple professional bodies are allowed for statutory audit in the UK, Canada, Australia, South Africa and Nigeria which is true but not allowed to CMA. In those countries, all professional bodies except CMA are engaged in statutory audit as follows:

The above professionals are CA in different names and none is CMA there in spite of having the separate CMA institute in those countries. Not only the above countries, no other country in the world allows CMA to conduct the statutory audit.

How the learning process is different:

In CA, the learning of audit and assurance has been covered in-depth in two stages -- at certificate level and professional level -- for advance level analysis, work process and reporting. ICAB conducts continuous workshop and development programmes on audit process and methodology as per the global framework as well year after year, whereas CMA has only a basic scope to know about audit in intermediate level being not legally and globally authorised in conducting statutory audit. Similar basic learning of audit is given at the university level as well. Are they capable enough to conduct statutory audit legally and professionally? Is it given to them anywhere in the world? As no CMA institute has the advance level audit coverage, the member of the institute will be engaged on cost accounts, audit of cost accounts, management accounting as decision tools based on the audited financial statements, accounting and preparation of financial statements, internal audit, compliance and performance audit, etc.

Some other information as provided by ICMAB needs to be verified evidently, specially the number of the clients is over 300,000, the number of CA is inadequate to serve the audit and the audit quality of ICAB is substandard. As per DVC records of ICAB, total audited clients are less than 50,000 and in serving theses clients over 2000 CAs are adequate. The quality of audit has been enriched significantly which could be assessed by a finding of Bangladesh Securities and Exchange Commission (BSEC) disclosed recently in a meeting that the number of qualified reports increased significantly compared to the past. This reflects the comparatively fair position of the Company and the output of quality audit.

Considering the legal, global and professional barrage of CMA, they should focus on their professional framework as stipulated in the relating law specially cost accounts, audit of cost accounts, management accounting as decision tools based on the audited financial statements, accounting and preparation of financial statements, internal audit, compliance and performance audit, etc.

The writer is a partner of Basu Banerjee Nath & Co., a Chartered Accountant firm.

dkroy.ca@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.