Published :

Updated :

The agro-food processing in the country is way behind its potential. The sector's below par performance is often attributed to factors that are largely reliant on government's efforts. Declaring it a thrust sector by the government hasn't worked to stimulate it as it should have. In fact, the facilitation to cause the required thrust has, so far, remained elusive.

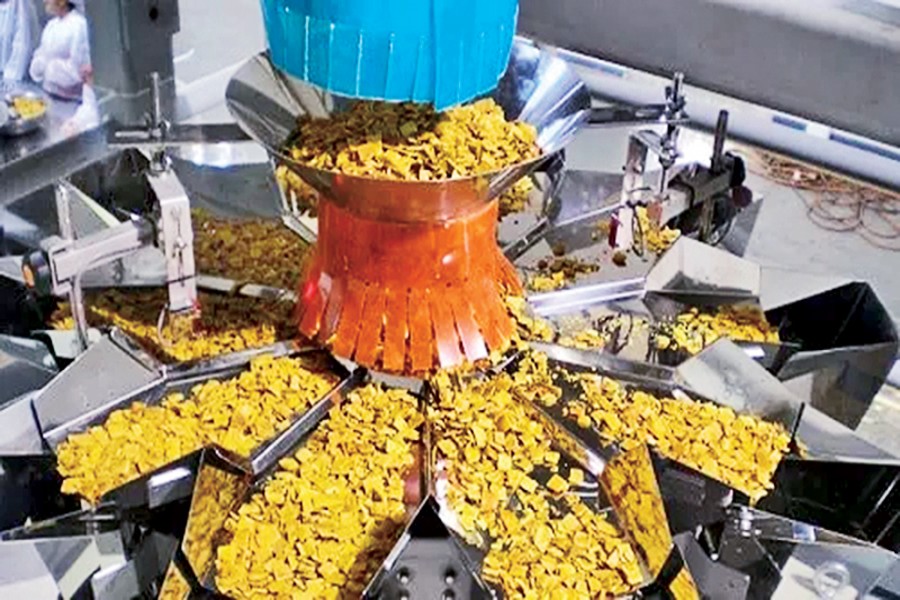

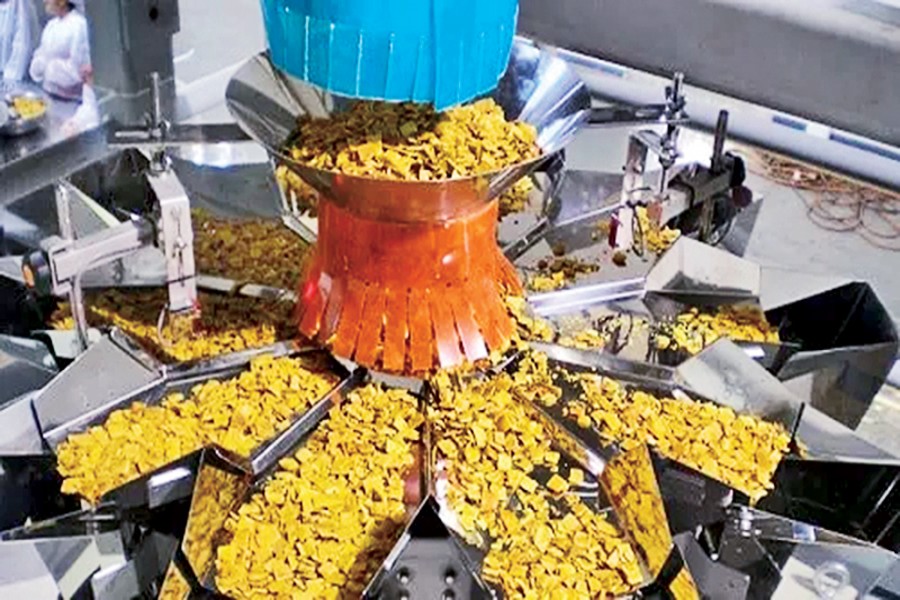

Agro-processed foods with the essential marker of value addition are considered to have brighter prospect than many other processed products because of their growing demand globally. This sector with its strong and integral link to the livelihood of millions of farmers has more prospect than any other to thrive, for both the domestic and export markets.

Bangladesh, a country firmly positioned for its myriad varieties of agro products should, for all valid reasons, be a formidable contender to produce substantial quantities of agro-processed foods for both local consumption as well as exports. Although exporting is altogether a different ball game, shying away from accessing overseas markets up to the potential does not at all validate the country's commendable growth in agricultural produce over the decades.

The country's food processing industry has over the years grown moderately, catering mostly to increasing domestic demand while also engaging in overseas marketing-albeit in a small way. What actually stands in the way of the industry's flourishing, especially on the export front, is inadequate lab testing facilities as well as a lack of facilities to maintain compliance norms of the destination markets. While lab testing is the only means to ensuring quality compliance of most products, it is most crucial in respect of food products, and unless food items meant for export are channelled through proper laboratory tests in line with internationally recognised protocols, Bangladesh's export market of agro-processed foods would continue to remain untapped despite high potential. This is more pronounced these days than in the past as the destination markets, especially those in the developed countries, are resorting to stricter non-tariff measures on standards relating to, among others, sanitary and phyto-sanitary aspects.

There is no point harping on the issue. Agro-processors know it well, and have been suffering for this while exporting. However, not all overseas markets are equally sensitive, but most importing countries go by standard procedures with strict compliance requirements. The country's agro-processors have been urging the government to establish a quality control lab of international standard where processed food items will be tested in order to obtain better branding in the world market. The issue, in fact, is more than branding because unless products are able to access prospective markets, the question of branding is a far cry. More importantly, if an importing country comes up with an embargo owing to deficient quality control, the fallout would take its toll on the entire industry.

Experts blame low investment in the sector as a key hindering factor. Besides, they say due to unplanned setting of processing plants, agricultural products grown in different parts of the country cannot be mobilised for the processing industry. The country has more than 200 food processing firms but only a dozen of them are in exporting, and of these, one or two dominate the market -though with a moderate export volume. Import dependence on packaging materials, a lack of appropriate quality control mechanism and absence of a nodal agency to monitor and supervise the activities of the sector are the main challenges for tapping its actual potential.

Currently, although Bangladeshi processed foods are being exported to many countries ranging from the advanced to less advanced regions, the key markets---because of the concentration of migrant population---are the United Kingdom, the USA, Canada, Malaysia and countries in the Middle Eastern region. The products include among others spices, fruit juice, fruit drinks, biscuits, processed nuts, potato chips, potato flakes and pickles. Primarily, Bangladeshi migrants are the main consumers of these products, and with more and more quality products made available to them, their preference for home-grown products is likely to increase. But it must not be taken for granted that these products are meant for the Bangladeshi migrant community only. There is no reason why a large number of sub-continental migrant communities should not be taken as potential consumers, provided the foods are able to match their tastes and preferences.

Domestic market for agro-processed products is growing as people are getting increasingly inclined to ready-to-cook and ready-to-eat food items. Basically, it is the domestic demand that the industry caters to. But reaching out to wider consumer groups demands that food products, especially those processed, must conform to the compliance requirements of respective countries. The EU being such a destination asks for fulfillment of its stringent compliance requirements. To access markets like the EU, quality assurance would allow, besides accessing the markets, the opportunity of diversifying product range.

In this context, the issue of accredited labs may also be found pertinent. Human, technical and logistic resources may not always be enough to assure exporters of entry of their products into the target markets. What is important here is compatibility that can be ensured through accredited agencies, authorised to conduct tests as per strictly followed and monitored guidelines. It is high time the government looked into the matter to bring about the desired vibrancy in the agro-food processing sector.

wasiahmed.bd@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.