Published :

Updated :

Despite various criticisms, Islamic banking has been growing continuously worldwide for a long time due to its profit-risk sharing structure, inclusiveness, and real asset-backed transactional features. This growth signifies the potential of Islamic banking to transform the financial landscape. Islamic banking is defined as a banking system that is in line with the spirit, ethic, and value system of Islam and governed by the principles laid down by Islamic Shariah. That's why Islamic banking or financial services is described as 'shariah-compliant'. It avoids interest, encourages partnership, and rejects harmful investment, offering a hopeful alternative to conventional banking.

Islamic banking is thus described as the transformation of conventional money lending into transactions based on tangible assets and real services. There are some shortcomings in Islamic banking for obvious reasons. Nevertheless, today, it is an industry worth more than US$4.0 trillion spread over more than 80 countries worldwide, although highly concentrated in 10 countries with a Muslim majority, including Bangladesh.

More than four decades ago, Islamic banking activities started in Bangladesh by opening the first branch of Islami Bank Bangladesh Ltd in Dhaka. Today, there are 10 full-fledged Islamic banks in the country operating with 1,697 branches. In addition to this, 34 Islamic banking branches of 16 conventional commercial banks and 825 Islamic banking windows of 20 conventional commercial banks are also providing Islamic financial services in the country, according to Bangladesh Bank statistics.

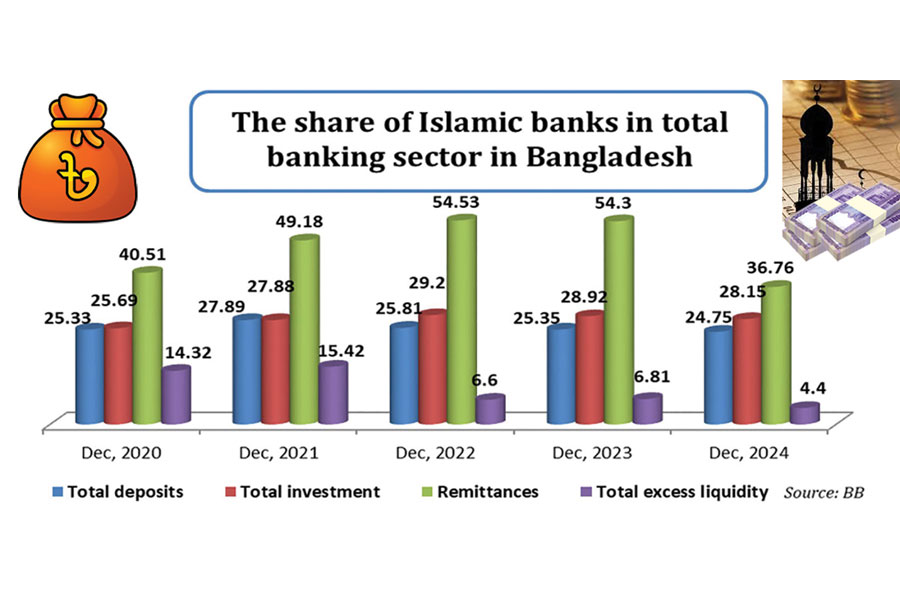

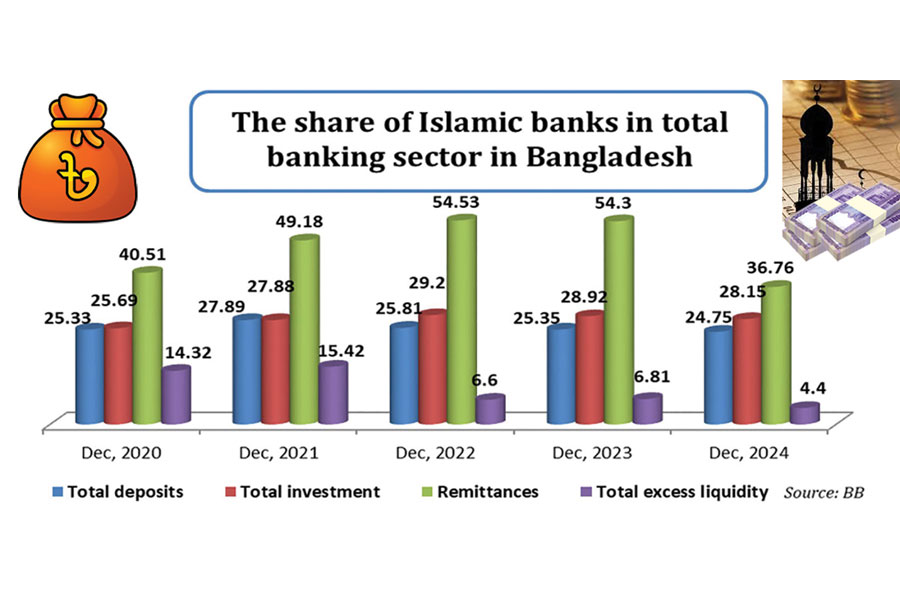

However, Islamic banking activities in the country passed another gloomy year in 2024, mainly due to poor governance and irregularities in some major banks. The decline in the market share of the Islamic banks to the total banking industry indicates the overall weakness of the sector. At the end of December 2024, the share of Islamic banks in the country's total banking industry was 24.75 per cent in deposits, which was 25.35 per cent at the end of December 2023. In terms of investment, which is loan and advance in conventional banking terms, the ratio stood at 28.15 per cent at the end of last year against 28.92 per cent at the end of 2023.

Despite a strong public demand for Islamic financing, Islamic banking in Bangladesh has faced significant challenges in the last decade, largely due to the turmoil in the country's overall financial sector. The previous regime, led by Hasina, was accused of systematically distorting the country's financial sector, especially the banks, by allowing scams, corruption, and irregularities. This regime's actions, including undermining Islamic financing, have significantly impacted the health of the Islamic banks.

An oligarch, closely associated with the ousted Hasina regime, literally grabbed the major Islamic banks only to deteriorate the health of the banks. In the name of removing the anti-liberation force from the country's pioneer and leading Islamic bank, Islami Bank Bangladesh PLC (IBBL), to be precise, the Hasina regime backed the Chattogram-based oligarch to take over the bank, defying all rules and norms in 2017. Despite being the country's central bank, Bangladesh Bank played a shameful role in this regard by allowing the forceful transfer of ownership and management in an unprecedented manner. Foreign investors also left the bank gradually. The bank has also started to go through a series of irregularities, weakening its financial strength and eroding its reputation. As IBBL alone shares around one-third of the Islamic banking industry's total deposit and investment, any disturbance in the bank negatively affects the whole industry. Nevertheless, IBBL has developed a solid foundation for over three decades and has attained customer trust for long. That's why, despite the persistent assault on the bank since 2017, its operation could not be stopped. The oligarch also grabbed three more Islamic banks and also put those under serious trouble.

A section of economists and intellectuals, unconditionally loyal to the Hasina regime, started a virulent campaign against overall Islamic finance in general, especially before the national parliament election in 2013. They argued that there was no such thing as Islamic financing or interest-free banking and alleged that the country's Islamic banks are deceiving people. Some of them also produced research papers to show that these banks are financing religious fundamentalism in the country. They particularly targeted the IBBL, alleging that the anti-liberation force operated the bank. Some leading newspapers and media also joined the campaign without trying to understand the nature and structure of Islamic finance. In this process, Hasina-loyalist intellectuals created a hostile atmosphere for Islamic financing in the country. These intellectuals, however, raised little voice against the persistent state-backed irregularities in the country's banking sector. Even a few of them were involved in some severe irregularities like foreign exchange reserve heist, BASIC Bank scam, Hall-Mark scam in Sonali Bank, and AnonTex Group fraud in Janata Bank.

Again, some of the politicians of Bangladesh Awami League and the partisan intellectuals spread Islamophobia over the last decade and used it as a tool against the country's Islamic financing. The net result is bad governance in Islamic banks, leading to various mismanagement and corruption in the sector.

Undoubtedly, Islamic banking in Bangladesh is not free from flaws. Some bankers, businessmen, and investors also misuse Islamic financing and exploit depositors and ordinary people. This misuse underscores the urgent need for better regulation in the industry. The previous government's distorted attitude towards Islamic financing was a serious obstacle to properly controlling the sector. The absence of necessary policies to support Islamic financing has worsened the situation further. For instance, despite repeated calls for introducing Shariah-compliant instruments to manage the liquidity crisis of the Islamic banks, the central bank did not take any effective steps. Thus, the excess liquidity of the Islamic banks in terms of total liquidity in the banking sector dropped to 4.40 per cent at the end of the last year and from 15.42 per cent at the end of 2021.

As the interim government has been trying to fix the problems of the country's overall banking sector, it's crucial that Islamic banks are also included in the process. As a critical part of the country's overall financial system, the banks require adequate attention for proper functioning. The role of the Islamic banks in the financial system is significant, and their proper functioning is essential for the stability and growth of the economy.

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.