Published :

Updated :

The country's trade in services has been gaining momentum over the years, a trend that is not in line with the services sector's dominant contribution to the gross domestic product (GDP). However, the share of services in total external trade has doubled to around 10 per cent, a significant leap from less than 5 per cent almost a decade ago.

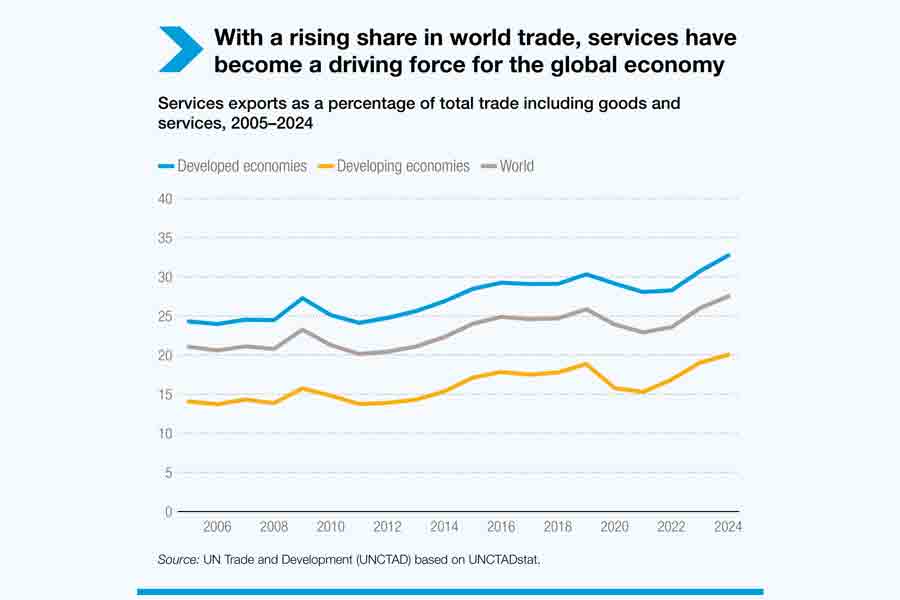

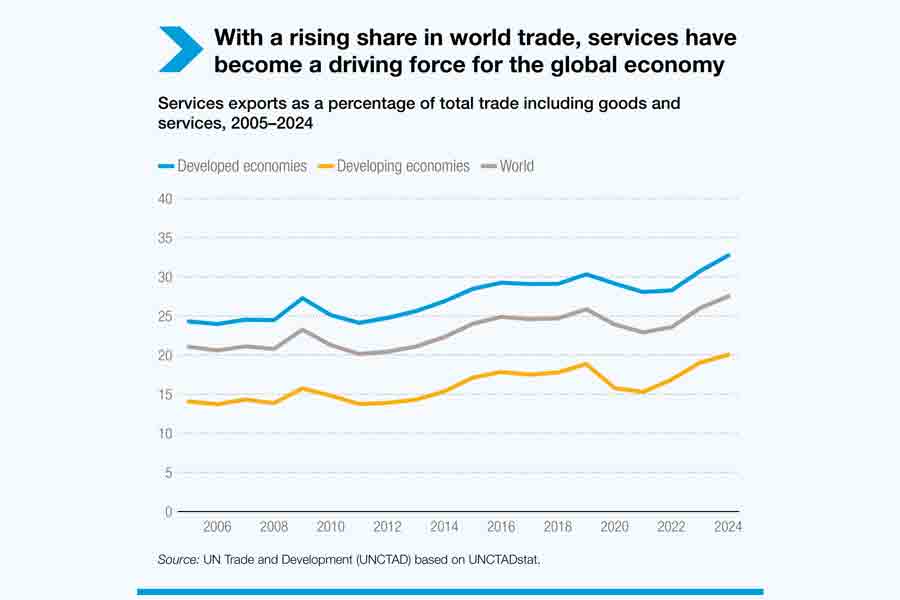

Currently, the services sector accounts for approximately 70 per cent of the global GDP and around one-fourth of global trade. The key activities include transportation, travel, telecommunication, information, and digital services.

Global trade in services typically occurs under the rules established by the General Agreement on Trade in Services (GATS), which was concluded in 1995 during the establishment of the World Trade Organization (WTO). The WTO classified the supply of services under four modes. These are: cross-border supply, consumption abroad, commercial presence and movement of a natural person. These modes encompass a wide range of service activities, including the transport of people and goods, financial intermediation, communications, distribution, hotels and restaurants, education, healthcare, construction, accounting, and many others.

Over the last decade, global trade in goods has increased by an average of 2.20 per cent annually in nominal US dollar terms, while trade in services has grown at around 4.80 per cent annually. Over the same period, the global economy (measured by world GDP in US dollars) expanded at a rate of 3.0 per cent annually, according to the International Monetary Fund (IMF). According to the UN Trade and Development (UNCTAD) estimate, global services exports grew by an average of 5.30 per cent per year between 2014 and 2024, outpacing goods exports at 2.50 per cent. Digitally deliverable services, however, expanded at a faster rate -- 6.40 per cent per year globally and 8.60 per cent in developing countries. UNCTAD termed the services as a new engine for global trade, which is "increasingly powering economic diversification, resilience and inclusive growth." Global services trade, in terms of exports, reached $8.90 trillion last year, recording a robust 10 per cent growth over the previous year. The global exports of goods, however, stood at $24.40 trillion in 2024, which was 2.30 per cent higher than in 2023, according to the UNCTAD statistics.

Trade in services in Bangladesh stood at approximately $19 billion in the last fiscal year (FY25), up from $16 billion in FY24. Although the final estimate of the trade in services for the last fiscal year is yet to be available, a provisional estimate based on balance of payments (BoP) data shows that exports of services stood at $6.72 billion, whereas import payments for services reached $12 billion. Thus, the trade deficit in services was recorded at $5.40 billion last fiscal year.

To make the picture of services trade clear and comprehensive, the Bangladesh Bank has started refining the statistics of services exports and imports over the last couple of years. Therefore, it takes three to four months after the completion of a fiscal year to obtain a refined estimate of the services trade. The refined figure differed from the services of the BoP table due to some adjustments as per the International Monetary Fund (IMF) sixth manual of the BoP.

According to Bangladesh Bank statistics, the services sector in Bangladesh experienced a modest rebound last fiscal year after a decline in FY24, which was largely attributed to the domestic political turmoil in the country. The shutdown of the internet by the autocratic regime in July 2024, aimed at curbing student-led protests, had a significant impact on trade in services. Although the internet service resumed fully after the fall of the regime on August 5, the ripple effect of the shutdown continued for a couple of months, affecting the overall economic situation. The first quarter of FY24 was marked by uncertainty and instability, making it difficult for commercial activities to grow. However, the overall economic situation began to rebound in the second quarter and gained momentum in the third and fourth quarters of the year.

Bangladesh Bank statistics also showed that major destinations of services exports are the United States of America (USA), China, Hong Kong, Singapore and India. More than 50 per cent of invisible receipts come from these five countries. Transportation, telecommunication, construction and travel account for around two-fifths of the total earnings of services exports. The classification by economic purposes, however, needs further clarification.

Transportation alone accounted for 60 per cent of the total payments on imports of services, followed by 18 per cent on payments for travel services. India is the top source of imports of services, followed by Singapore, the United Arab Emirates, the USA and China. These five countries supply around 55 per cent of the total import of services.

Though Bangladesh has made some improvements in the quality of statistics related to trade in services, many limitations are still there due to the complex and newly emerging activities of services globally. Manufacturing firms are gradually bundling services such as design, logistics and finance into their products. Services are no longer an output, but also inputs for nearly everything produced, traded and consumed globally. The traditional definition of services is insufficient to capture the rapid diversification and its associated trading patterns. Therefore, globally, it becomes increasingly challenging to provide more comprehensive and accurate statistics on the trade in services.

Against the backdrop, UNCTAD released 'Primer on data for trade in services and development policies' in the last week of this month to provide a better understanding of the required data on services trade and its use, cognizant of its characteristics and potential limitations. The primer pointed out that despite services contributing over 40 per cent of global value addition in exports, many countries still lack robust data. Only 15 developing economies regularly publish partner-disaggregated services trade statistics, compared to 95 per cent of developed economies.

The publication is a timely and quite helpful resource for policymakers, researchers, and businesspeople in Bangladesh to understand the dynamics of services trade and improve the statistics in the near future.

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.