Published :

Updated :

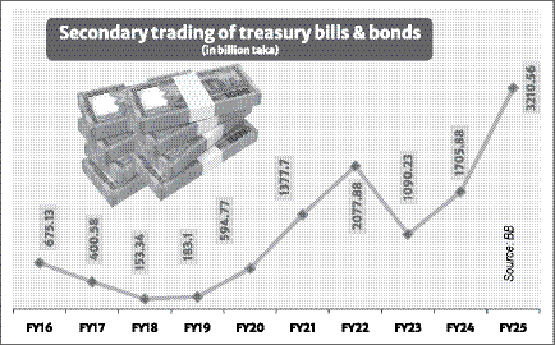

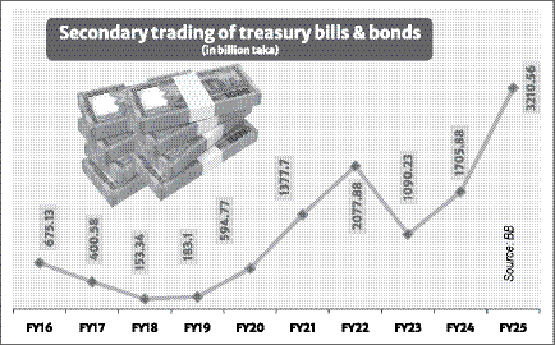

The bond market's performance last fiscal year was truly exceptional, particularly in the secondary trading of fixed-income government securities. The annual volume of secondary transactions in these securities soared to an unprecedented high, marking a significant 88 per cent growth over the previous fiscal year, and reaching a staggering Tk 3.21 trillion. This figure represents the highest annual secondary transactions of treasury bills and treasury bonds in the country's bond market, which is primarily dominated by government bonds. Notably, the third quarter of the past fiscal year witnessed a record-high secondary transaction of government securities, amounting to Tk 1.14 trillion, which is around one-third of the annual trading.

Earlier in FY22, the market experienced the highest annual secondary transactions worth Tk 2.017 trillion, which then saw a sharp decline of 47 per cent to Tk 1.09 trillion. However, the secondary trading of the government securities didn't stay sluggish for long, but later rebounded reaching Tk 1.70 trillion in FY24. This resilience was further demonstrated during the last decade, when the lowest amount of secondary trading occurred in FY18, with a value of Tk 153.34 billion.

The significant increase in secondary trading of government securities carries profound implications for Bangladesh's financial market. It not only reflects a burgeoning interest in secure returns among institutional and individual investors but also signifies the market's steady march towards maturity.

It is worth noting that treasury bills are short-term debt instruments of the government, while treasury bonds are long-term in nature. Bangladesh Bank, on behalf of the government, issues the treasury bills to manage day-to-day liquidity. It also issues treasury bonds to mobilise long-term debt for the government to finance the budget deficit. Selected banks are now authorised primary dealers (PD) to purchase the bills directly through the auction conducted by Bangladesh Bank. Other banks and financial institutions are allowed to buy and sell the bills and bonds among themselves in the secondary market as a secure investment. Individuals can also invest in these fixed-income securities.

A higher yield on treasury bills and bonds is a critical factor in attracting investors and facilitating the transfer of securities in the secondary market. Yield refers to the return that an investor receives from an investment, such as a stock or a bond. It is usually reported as an annual figure. In bonds, as in any investment in debt, the yield is comprised of payments of interest known as the coupon.

Bangladesh Bank statistics showed that the weighted average yield on 91-day, 182-day, and 364-day treasury bills increased to 11.94, 11.90, and 12.01, respectively, at the end of FY25, against 11.64, 11.98, and 12.01, in FY24. The rise in yield was significantly higher in FY24 compared to FY23, when the yield on all government securities was at a single-digit level. Moreover, the yield on all treasury bonds declined slightly at the end of FY25 compared to FY24, although it remains at a double-digit level. The higher yield, however, made borrowing through these securities costly for the government.

The central bank, in its latest annual financial stability report, stated that yields on government securities rose across all tenures, thereby increasing borrowing costs. "The Treasury auction yields in December 2024 were considerably higher for all maturities compared to those of December 2023," it added. "Consequently, the treasury auction yield curve shifted up notably and remained elevated in December 2024 for both the short-term treasury bills and long-term treasury bonds. The increasing cost of government borrowing is reflected in this upward shift in the yield curves."

Bangladesh Bank statistics showed that the government's net domestic borrowing in the last fiscal year stood at Tk 1193.65 billion against Tk 947.40 billion in FY24. Of these, the government borrowed Tk 416.85 billion through the issuance of treasury bills and Tk 1,225.87 billion through treasury bonds. The monthly report of the central bank in this connection said: "Government domestic borrowing from the banking system during July-June of FY25 showed slower growth compared to the same period of FY24, owing to larger repayment of the previous debt. However, non-bank borrowing (net) for the same period under review showed a significant rise relative to the corresponding period of FY24, primarily due to substantial holdings of government securities by different institutions and individuals other than banks."

Government borrowing through these instruments is linked to the secondary market in terms of issuance. After issuing these bills and bonds, the primary investors, specifically commercial banks, bring them to the secondary market for a higher return.

As the central bank maintained a tight monetary stance to curb inflation, it had to allow a rise in interest rates, which in turn affected the yield of the treasury bills and bonds. The issuance of treasury bonds with different maturities also increased in the past year, further influencing the market dynamics.

Around 99 per cent of the secondary trading of government securities was conducted using the BB system (Over-the-Counter and Trader Work Station mechanism), while the remaining portion was traded on the stock exchange platform. Trading of these securities on the stock exchange platform began in 2023. It means that secondary trading of treasury bonds in the stock exchange is still tiny. Moreover, institutional investors, such as provident funds, insurance companies, and mutual funds, primarily use the stock exchange platform, where individual participation is limited.

The number of listed treasury bonds was 234 at the end of the last fiscal year, when transactions of these bonds in the DSE increased to Tk 1.46 billion from Tk 1.45 billion in FY24. Interestingly, the capitalisation of listed treasury bonds was 49.77 per cent in the last fiscal year, although the ratio of transactions in these bonds was less than one per cent of the total turnover on the DSE.

Nevertheless, corporate bonds are nowhere in this market. In the last fiscal year, the market capitalisation of the 16 listed corporate bonds was less than one per cent in DSE. The issuance of corporate bonds also declined, indicating a subdued nature. Without a vibrant corporate debt segment, the government's debt securities, which dominate the bond market, will not bring the optimal maturity in the financial market.

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.