Published :

Updated :

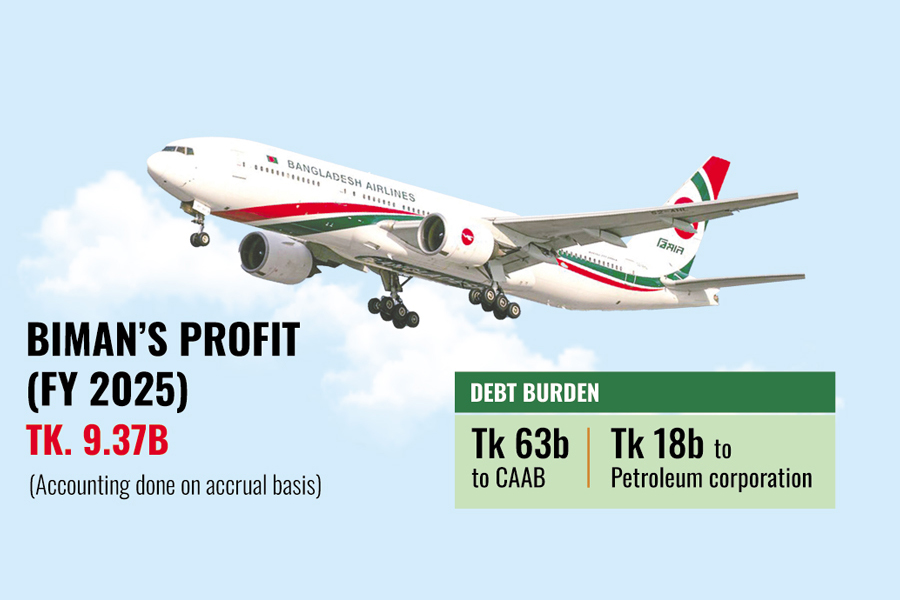

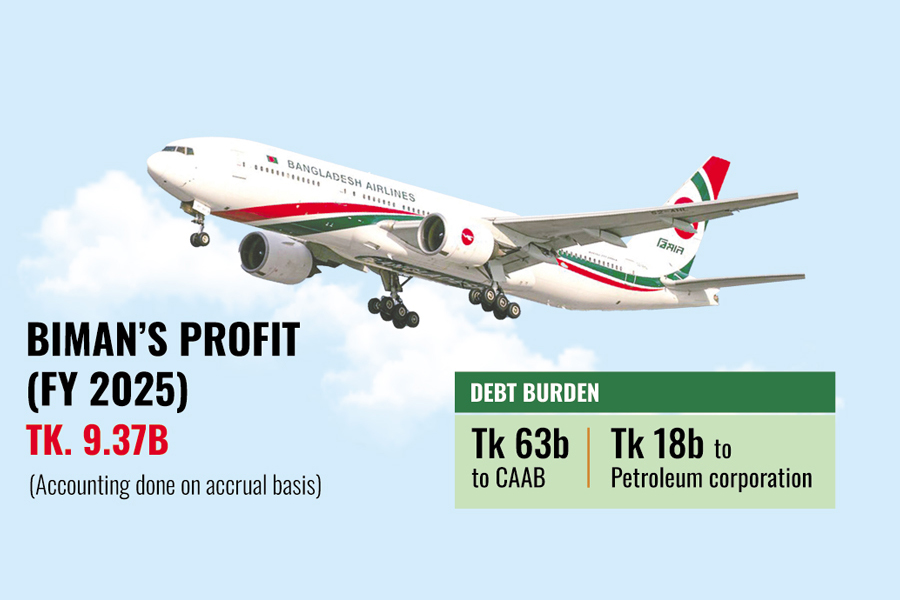

Not long ago, the Biman Bangladesh Airlines reported its highest ever annual profit of Tk 9.37 billion. The record earnings in the financial year (FY) 2024-25 seemed at first to offer a rare moment of good news for the national carrier and a reason for celebration. But instead of being welcomed with applause, the news started a big argument on social media and in the Press, as the profit figure was soon overshadowed by revelations that the airline owes more than Tk 81 billion to state bodies. Consequently, many have dismissed the reported profit as little more than a paper gain.

A breakdown of these debts reveals that Biman owes about Tk 63 billion to the Civil Aviation Authority including Tk 9.0 billion in principal debt and Tk 54 billion in surcharges, income tax, VAT and other charges. On top of that, the airline reportedly owes Tk 18 billion to the Bangladesh Petroleum Corporation for fuel purchases. It is this heavy load of unpaid dues that fuelled public scepticism over how an airline so deeply in debt can credibly claim to be in its best condition.

In response, Biman defended its position by arguing that such criticism fundamentally misapplies accounting principles. The airline clarified that liabilities are recorded on the balance sheet and that settling these debts does not directly impact the profit and loss statement under the accrual accounting method it follows. From a strict accounting perspective, this rebuttal has merit, as a company can indeed record profits even while carrying significant outstanding dues. However, the airline's announcement came through a press release without publishing the accompanying financial statements and explanatory notes. Much would be clearer had the statements been made public providing crucial context and perhaps easing the public controversy. Thus, while Biman's profit figure may be technically accurate, the omission of its full financial context left the public struggling to reconcile it with the airline's overwhelming debt obligations.

Moreover, this good accounting news does not mean everything is fine. It actually opens up other big questions. Just one year prior, in FY 2023-24, Biman's profit was only Tk 2.2 billion. The leap to Tk 9.37 billion therefore represents a 300 per cent increase in just twelve months. This is sure to raise eyebrows especially in the absence of major fleet additions or new routes during the period. If operations stayed almost the same, why did profit rise so suddenly? Such a spike warrants closer scrutiny to determine whether this stems from a genuine operational turnaround, adjustments in accounting or the rectification of past mismanagement. Until Biman authorities can satisfactorily explain the factors behind this anomalous profit growth, its record-breaking announcement will carry an asterisk in the court of public opinion.

An even more alarming concern is not the accounting treatment of the debt but the sheer scale of the liabilities themselves. The latest available audit report on Biman's website is from 2023-24 financial year which showed non-current liabilities of Tk 78 billion and current liabilities of Tk 70 billion. Assuming these figures hold, if Biman were to apply its entire record profit solely towards debt repayment every year, it would still require over 15 years to settle its obligations. This is a serious financial situation. It shows the company has been living beyond its means for a long time and depends on the patience of its creditors.

The weaknesses in Biman's balance sheet are mirrored in its service quality as well. The airline holds a three-star rating out of five from the globally recognised SKYTRAX system, a score that places it in the same league as other underperformers like Air India. Customer reviews across online platforms frequently describe the service as poor also. Despite that, Biman has survived largely on a guaranteed market of migrant workers travelling to and from Bangladesh. This safety net means it has not been forced to compete on the kind of quality that usually drives improvements in the aviation industry.

These shortcomings facing Biman have not gone unnoticed at the policy level. In fact, following the formation of the interim government, a task force led by KAS Murshid was established to address pressing economic issues of which Biman was one. In the report, the task force offered a blunt assessment of Biman. It urged the government to set clear performance targets for the airline and to allow Biman to exit the market if it fails, rather than propping it up with endless subsidies. That tough love approach shows just how little faith experts have in Biman's ability to turn itself around.

Biman also faces a significant hurdle relating to its international operations. Reports indicate that the airline is not even authorised to fly to New York because the US Federal Aviation Authority downgraded Bangladesh's aviation safety rating back in 2006 due to operational irregularities, a status that has not yet been fixed. This is how operational weaknesses at home direly strangle opportunities abroad!

Amid all this, a potential turning point came in late last month with the appointment of adviser Sk Bashir Uddin as chairman of Biman's board. His high-ranking government position means he might finally have the clout to cut through bureaucratic inertia and force some decisive actions in need. This appointment also suggests that the government is treating Biman's crisis with heightened seriousness. Whether this change in leadership can deliver meaningful reform will surely be closely watched by the people.

Biman's current state blends promise with peril. Certainly, the record profit is welcome, but it is a faint glimmer against a mountain of debt and service shortfalls. The ultimate test for the new leadership will be to turn this fragility into a genuine recovery and finally build a foundation for lasting and tangible success.

showaib434@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.