Published :

Updated :

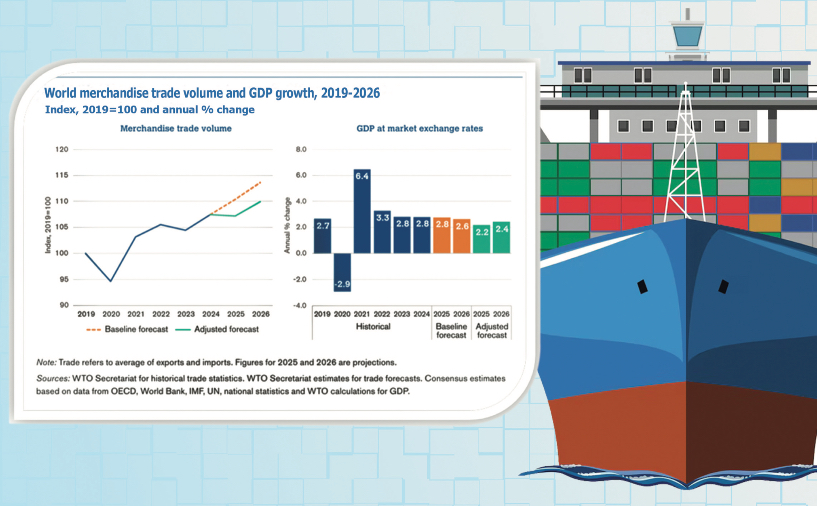

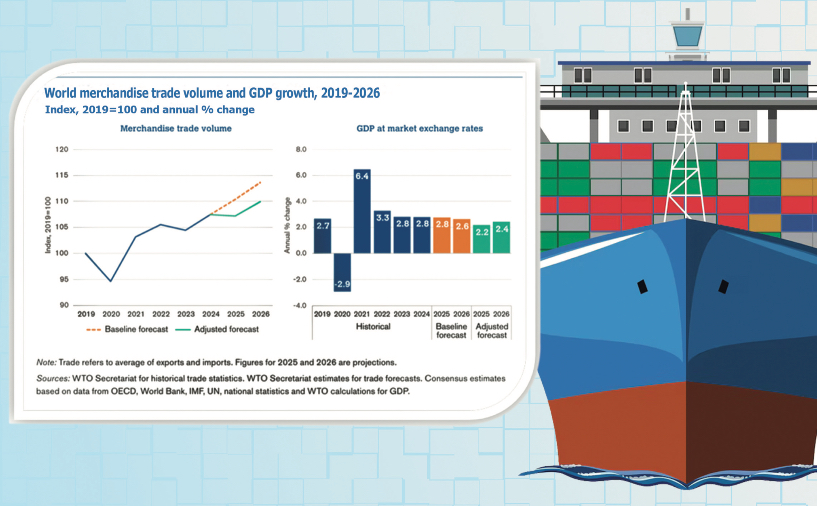

The world Trade Organisation (WTO) in its report titled "Global Trade Outlook and Statistics--April 2025" published on April 16, warned that the outlook for trade had "deteriorated sharply" because of the US tariff hikes and the "trade policy uncertainty" they have caused. Based on the tariffs currently in place, and including a 90-day pause of "reciprocal tariffs", the volume of world merchandise trade is expected to decline by 0.2 per cent in 2025 compared to an increase of 2.9 per cent in 2024. This estimated figure for 2025 is nearly three percentage points lower than what would have been expected under a "low tariff" baseline scenario,

This decline in merchandise trade is premised on the tariff situation as of April 14. Trade could decline even further to 1.5 per cent in 2025, if the situation deteriorates This will pose risks for export oriented least-developed countries (LDCs). The WTO also says risks to the merchandise trade forecast persist, particularly from the reactivation of the suspended "reciprocal tariffs" by the US, as well as the spread of trade policy uncertainty that could impact non-US trade relationships.

Trump's sweeping, unprecedented tariffs on countries around the world are threatening to reshape the global economy. The significance of Trump's protectionism is that the US has clearly conveyed the message that the global trading system it helped create no longer works for the US.

As Trump launched an economic war against the rest of the world under his banner of "reciprocal tariffs" on his "liberation day", the global economy is heading towards a systemic crisis. The London Based Financia Times summed up the current situation and said "No one doubts at this point President Donald Trump's intention is to tear down the international economic system that the United States fostered since the end of the second world war. The confusion is what might replace it".

The report further added that merchandise trade growth could have been as much as 2.7 per cent this year and 2.9 per cent in 2026 had tariffs remained low. However, the WTO expects a "modest" recovery of trade by 2.5 per cent in 2026 but with a caveat that "The unprecedented nature of the recent trade policy shifts mean that predictions should be interpreted with more caution than usual".

The Director General of the WTO expressed her concern that the contraction in merchandise trade would spill over into broader GDP growth. She pointed out, "We have seen that the trade concerns can have negative spill overs into financial markets, into other broader areas of the economy". She also raised alarm about the impact on developing countries.

According to the WTO, the imposition of a 145 per cent tariff on China by the US could lead to trade between the world's number one and number two economies to contract by 80-90 per cent. The head of the WTO said that her greatest fear was that economies of China and the US were decoupling from one another. She further added, "A decoupling could have far-reaching consequences if it were to contribute to a broader fragmentation of the global economy along geopolitical lines to two isolated blocs". In this scenario global GDP could decline by 7 per cent which is "significant and substantial".

As the US steps up its economic war, China also is hitting harder almost matching the US tariff hikes as well as restricting exports of critical minerals. China also added US entities to its export control list, restricting their ability to do business in China. Chinese companies have been figuring out how to circumnavigate Trump's tariffs since 2018, when Trump's first US-China trade war started.

Services accounted for 26.4 per cent of global trade based on the balance of payments statistics. Rising demand for services and advances in digitisation have contributed to expand services trade. Services trade totalled US$8.69 trillion, increasing by 9 per cent in 2024, the highest since 2005. This is in sharp contrast to goods trade which rose by 2 per cent in value terms in the same year.

Services trade, though not directly subject to tariffs, is also expected to be adversely affected, with global volume of commercial services trade now forecast to grow by 4 per cent, slower than expected. It is to be noted that the US runs trade surpluses in services trade. The US accounted for a significant portion of global services trade, being the largest exporter and importer. The US exported $1.08 trillion in commercial services and imported US$787 billion in 2024.

While Trump tariffs are limited to goods, their effects are expected to ripple across the broader economy, including services trade. A decline in the volume of goods traded, will lead to weaker demand for freight shipping and logistics services and a whole range of other related services for the movement of trade in goods across national frontiers.

The US market is very critical to many countries like Bangladesh and Trump is leveraging access to it for concessions as Bangladesh had immediately done. Many other countries also opted not to retaliate against Trump tariffs, instead opted for negotiation. But Beijing took a different approach to confront US tariffs head on with its own tariff of 125 per cent.

In fact, Trump has boasted that about 75 countries "kissing my ass" to enter negotiations, but China is not among them. Even if the tariffs are not enforced immediately, their very existence in the background gives the US significant leverage in shaping more favourable terms for the US to negotiate.

The US is the largest export destination for Bangladeshi ready-made garment (RMG).The RMG industry occupies an outsized position in Bangladesh's economy accounting for over 40 per cent of industrial employment. Bangladesh is currently the world's second largest exporter of RMG behind only China. The industry contributes 85 per cent of Bangladesh's export revenue and 15 per cent of its GDP. Bangladesh's RMG exports to the US have generally shown strong growth and remained a significant portion of the country's overall export earnings. Bangladesh's RMG exports to the US reached US$7.34 billion in 2024.

With the pause on US' "reciprocal" tariffs, Bangladesh may benefit from trade diversion as the country's export structure is like China's in respect of textile goods. But the RMG industry thrives on its competitive edge rooted in low labour costs, a key factor enabling it to stay globally competitive. This unsustainable reliance on low pay and poor working conditions, particularly for women, will likely face increased production targets, working overtime, further slashing of wages in the face of Trump tariffs.

Head of Bangladesh's interim government Muhammad Yunushas written to US President Donald Trump requesting a three-month pause on a 37 per cent tariff on imports from Bangladesh, citing efforts to boost imports from the US. To reduce the US$6.2 billion trade surplus with the US in 2024, Bangladesh has pledged to add 100 American products to its duty-free list, according to the commerce advisor. "We hope the letter will have a positive impact. Our main goal is to narrow the trade gap," he further added.

According to the UNCTAD, the reciprocal tariffs in many cases disproportionately affect LDCs without significantly reducing the US trade deficit or contributing to additional revenue collection. Also, small countries and LDCs account for a marginal share of the US trade deficit.

The trade war between the world's two biggest economies the US and China, threatens to drag in other nations. China has already warned it will hit back at countries that make deals with the US that hurt Beijing's interests. The comments came after reports that the US plans to pressure governments to restrict trade with China in exchange for exemptions to US tariffs. China says they are "in this until the bitter end".

During a meeting with Azerbaijan President Ilham Aliyev on April 23, Chinese President XiJinping said trade wars "undermine the legitimate rights and interests of all countries, hurt the multilateral trading system and impact the world economic order".

Trump tariffs have caused the stock market to stumble and interest rates to rise on US debt as investors worry about slower economic growth and higher inflationary pressures. The uncertainty over tariffs in the financial markets has also been amplified by Trump calling on the Federal Reserve to cut its benchmark interest rate, with the president saying he could fire Fed chair Jerome Powell if he wanted to do so. To add to Trump's woes the IMF forecasts the US economy will grow just 1.8 per cent in 2025. It looks even worse for next year, with growth projected to slow further to 1.7 per cent.

But now Trump backed off this threat and later said he wanted Powell to "be early" in lowering rates and that he has no intention of firing the Fed chair, despite previously suggesting that he would. In fact, there now appears to be renewed hopes of a trade deal between the US and China, a sign Trump may be backing down from his tough stance on Beijing amid market volatility. It was not a great day for the champions of MAGA. The Trump administration was on the back foot.

On April 23, Trump said during a White House news conference that high tariffs on goods from China will "come down substantially, but it won't be zero". Trump's remarks were in response to earlier comments on the day before by treasury secretary Scott Bessent, who said that the high tariffs were unsustainable and that he expects a "de-escalation" in the trade war between the worlds's two largest economies. Bessent further described the current situation as a trade embargo and it was not a US goal to decouple from China. Global stocks surged after comments by Trump and top administration officials raised hopes of a trade deal between the US and China.

muhammad.mahmood47@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.