Indian port restrictions: BD needs a coordinated response

Published :

Updated :

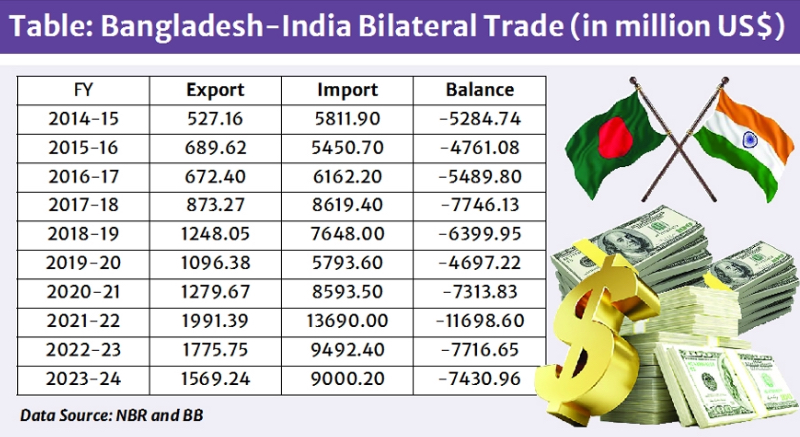

The land port restrictions imposed by the Directorate General of Foreign Trade (DGFT), Ministry of Commerce, Government of India, on several export items — including key products such as apparel — have dealt a significant blow to Bangladesh’s exports. If we analyse the bilateral trade between Bangladesh and India, it becomes evident that Bangladesh relies heavily on land ports as a competitive advantage in conducting exports to its neighbouring country. The total two-way trade between the two nations stands at US$ 10.57 billion, with the trade balance heavily in favour of India. In FY 2023–24, Bangladesh exported goods worth US$ 1.57 billion to India, with 86 per cent of this trade conducted through land ports. Exports to India by air and sea are 0.57 per cent and 13.44 per cent respectively.

The bilateral trade scenario of the past ten years between the two countries, clearly illustrates how India continues to dominate the Bangladeshi market.

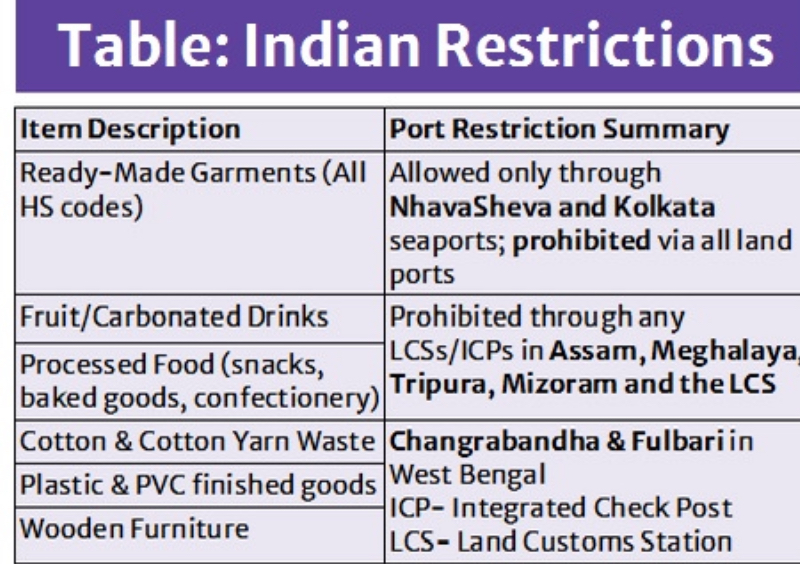

The Directorate General of Foreign Trade (DGFT) of India has imposed restrictions on the following products, which are expected to adversely affect Bangladesh’s exports to India.

Bangladesh exported apparel worth USD 548.83 million during FY 2023–24, with 99 per cent of the trade conducted through land ports. A negligible volume was shipped via seaports, and no trade occurred through air routes. Another key export category from Bangladesh to India is processed food, including fruit/fruit-flavoured and carbonated drinks, with a total export value of USD 311.68 million. These statistics clearly indicate that Bangladesh’s strength in conducting trade with India lies in land port connectivity.

POSSIBLE IMPACTS RESULTING FROM PORT-SPECIFIC RESTRICTIONS: Setback for apparel export. Bangladesh’s export performance in the Indian market has been uneven, yet the long-term trend remains upward. Exports rose from $421.86 million in FY 2020–21 to $715.42 million in FY 2021–22, before slipping to $548.82 million in FY 2023–24. The newly imposed port restrictions now threaten to deal a severe blow to Bangladesh’s key export sectors.

Dependence on land ports for competitive edge. It was unanimously observed that one of Bangladesh’s key competitive advantages in exporting to India lies in its ability to use land ports. This proximity-driven logistical benefit is vital in maintaining cost-effectiveness, particularly in serving the Northeastern states of India, which are logistically closer to Bangladesh than mainland India.

If exporters are forced to reroute shipments through seaports, transportation costs will increase substantially, eroding the price competitiveness. This could lead to a significant loss of market access in India’s Northeast region, with a population base of approximately 52 million.

Threat to market share in Northeast India. The Northeast region of India has emerged as a critical export destination for Bangladesh due to its demand for FMCG (Fast Moving Consumer Goods) products, readymade garments, plastic, Furniture, and other consumer goods. Losing access to this market could have far-reaching consequences for exporters and the broader value chain. Bangladesh exported $84.3 million to Northeast India in FY22, which increased to $91.7 million in FY23. However, the current situation may hinder this growth trajectory.

Significant setback for beverage. The beverage market for Bangladeshi exporters will be significantly affected during the upcoming four months (June to September). Due to port restrictions, major exporters such as PRAN, Sajeeb, Akij, and others are expected to face severe disruptions. Immediate action is highly expected to resolve this situation.

POSSIBLE WAY FORWARD: Exporter-level engagement with Indian buyers.: Exporters were advised to engage directly with their Indian counterparts and buyers to build consensus and raise awareness about the impact of port restrictions. Indian buyers, having a vested interest in ensuring the smooth flow of goods, may play a critical role in advocating policy revisions with relevant Indian authorities.

Leveraging Indian cotton export. It was noted that Bangladeshi importers of Indian cotton may also urge Indian cotton exporters to raise the issue with the DGFT, emphasising the reciprocal trade benefits of easing land port restrictions.

Diplomatic engagement. The government of Bangladesh, through the ministry of commerce and the ministry of foreign affairs, may consider pursuing diplomatic channels to resolve the issue amicably and expediently. Emphasis should be placed on maintaining the spirit of bilateral trade cooperation and the benefits of regional integration under the SAARC and BIMSTEC frameworks.

Dual-track approach. A dual strategy comprising government-to-government (G2G) and business-to-business (B2B) dialogue was recommended to address the issue holistically. (a) On the G2G front, formal communication should be initiated through the Bangladesh High Commission in New Delhi and the relevant ministries; (b) On the B2B side, business associations, chambers, and industry groups from both countries should coordinate advocacy efforts to promote mutual benefits and long-term cooperation.

END NOTE: India’s port restrictions on imports from Bangladesh represent a major setback for the bilateral trade. Although some exemptions have been allowed, the restrictions affect key export sectors such as ready-made garments (RMG), processed food, and plastics, all of which have shown strong performance in the Indian market. These measures pose a serious risk of disrupting Bangladesh’s trade momentum. To protect its export interests and maintain smooth access to the Indian market, Bangladesh urgently needs a coordinated response involving policy action, diplomatic engagement, and enhanced trade facilitation.

Abu Mukhles Alamgir Hossain, Director (Policy), Export Promotion Bureau(EPB).

amahepb75@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.