Published :

Updated :

The government's move to increase insurance coverage of single depositor of any bank has created some confusion and debate regarding the protection of depositors' money. The existing insurance coverage of any bank deposit is Tk 1.0 lakh only. It means, no matter what the deposit amount is, a depositor will definitely get at least Tk 1.0 lakh in case of closure or liquidation of any bank while there is no insurance coverage for non-bank financial institution (NBFI).

Now the government has proposed to increase the coverage amount to Tk 2.0 lakh for a single depositor of both bank and NBFI. To do this, the government has decided to amend the current Bank Amanat Bima Ain 2000 (The Bank Deposit Insurance Act, 2000). It will be replaced by Deposit Protection Act 2020. Under the Act, a depositor will get back Tk 2.0 lakh within six months of the liquidation of a bank of NBFI.

The move came when depositors of three non-bank financial institutions (NBFIs) are in deep trouble. They are facing uncertainty as regards refund of their money in these three NBFIs. Though the central bank has been trying to assure the depositors that they will get back their money, it is yet to be clear how things will happen.

It is to be noted that Deposit Insurance System (DIS) was introduced in 1984. There is also Deposit Insurance Trust Fund (DITF). Banks pay the premium of the insurance and the amount is deposited with the trust fund. The fund is invested in five-year and 10-year treasury bonds. Yield received from the investment is also credited to the trust fund account.

The proposed increase in insurance coverage of deposit money, however, should be considered a positive move. Nevertheless, confusion caused due to lack of clarification from the government regarding the amount of deposited money not under the insurance coverage. Neither the finance ministry, nor the central bank feels that the depositors should be assured that non-insured amount of deposit is also refundable as there is a clear legal provision in the Bank Company Act 1991 (Amended in 2013). This has led to speculation and rumour that depositors would not get beyond the insured amount in case of bank closure or liquidation.

CLARIFYING THE CONFUSIONS: Amidst of the outcry, Bangladesh Bank finally came up to clarify the matter. At a press briefing in the last week of February, senior officials of the central bank said that there was nothing to worry in getting back depositors' money. They also said that under existing rules and regulations, some 92.0 per cent of the depositors' money remained under the insurance coverage.

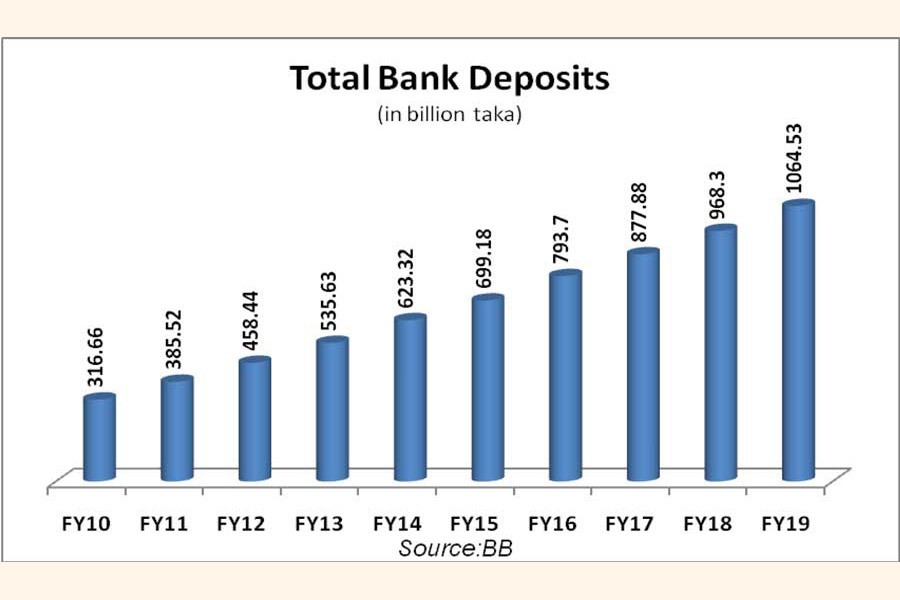

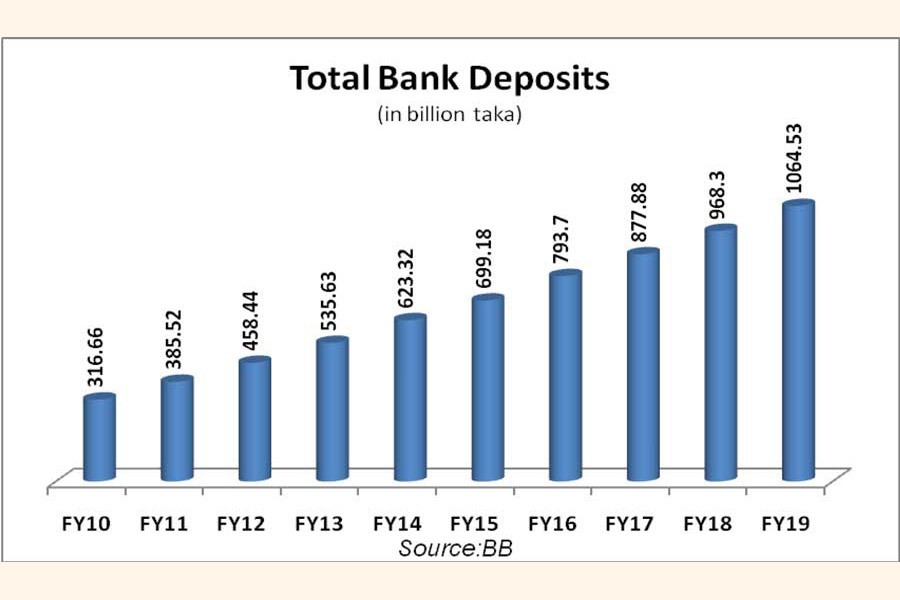

As the total amount of bank deposit in the country stood at Tk 10.64 trillion at the end of FY19, according to Bangladesh Bank statistics, it may be assumed that deposit worth Tk 9.78 trillion is fully insured.

The central bank officials also said that the proposed deposit protection act will make the depositors' money more secured. They further added that in the bank company act, there is a clear provision for repayment of all deposits from the assets of the bank in case a scheduled bank falls.

Despite the explanation, as reported in media, the central bank is yet to fully clarify the question regarding the amount of deposit not under the coverage of insurance. The officials stressed on the benefit of doubling the insurance amount.

As per the bank company act, any depositor is legally entitled to get back his or her money when a bank or NBFI become non-functional. Provision 73, 74 and 75 of the act provides the legal path in this regard.

Any bank or NBFI has its fixed and liquid assets, reserve with the central bank and other deposits. In case of fall, government appointed liquidator is responsible to estimate the total asset of the bank or financial institution and create a scheme using the asset.

The depositors are the first to get their money back. In that case, bank's asset will be liquidated and distributed among the depositors on pro-rata basis. It means assigning the liquidated asset to a depositor, according to his or her share on the whole. Nevertheless, things are not very easy. It is a time consuming process due to legal complexities which should be eased as far as practicable.

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.