Published :

Updated :

Economic growth and poverty reduction performances have been very impressive in Bangladesh during the last few years. Real economic growth has been hovering above 7.5 per cent rate and poverty reduction rate was 24.3 per cent in 2016 according to the latest available household survey (i.e. HIES 2016). Given its ambitious growth targets propelled by investment to realise the upper middle-income status and zero extreme poverty by 2030 - mobilisation of revenue in the range of 15 to 16 per cent of gross domestic product (GDP) is a pre-requisite.

However, in one area where performance of the country has been disappointing is revenue mobilisation. Revenue effort (i.e. Revenue to GDP ratio; less than 11 per cent in FY 2018) has been one lowest in the World. This, though, is not a recent phenomenon. Historically revenue mobilisation has been poor in Bangladesh.

REVENUE STRUCTURE AND PERFORMANCE: There are two main revenue sources in Bangladesh: (i) tax revenue and (ii) non-tax revenue. Tax revenue is composed of two sources - taxes collected by National Board of Revenue (NBR) - known as NBR taxes; and taxes collected outside the National Board of Revenue (known as non-NBR taxes).

Share of non-tax revenue in total revenue collection has reduced by about half from 18 per cent in FY 14 to 10 per cent in FY 18. Share of non-NBR tax remained more or less stable at around 3.0 per cent between FY 14 and FY 18. On the other hand, the share of NBR tax increased from 79 per cent in FY 14 to over 87 per cent in FY 18. NBR taxes have been mobilised from four major sources such as income tax (i.e. 34 per cent share); VAT (i.e. 37 per cent); Supplementary duty (i.e. 16 per cent); and Import duty (i.e. 12 per cent). All together, these four sources generate more than 98 per cent of total NBR tax revenue.

In line with the ambitious growth projections as well as to cover ever increasing resource need for poverty reduction and SDG (Sustainable Development Goals) realisation, Bangladesh has been setting high revenue targets in budgets - relying mostly on NBR tax sources. In the last five budgets (i.e. from FY 14 to FY 18), it has set a revenue target of around 12 to 13 per cent of GDP - which implies raising additional 2.0 to 2.5 percentage points higher revenue. However, given the fast-expanding tax bases (especially the domestic tax bases for income tax and VAT due to sustained 13 per cent nominal GDP growth) as well as the revenue efforts of countries with comparable per capita income, setting a target of around 12 to 13 per cent appears on the lower side. Bangladesh should have set revenue targets of at least 15 to 17 per cent of GDP.

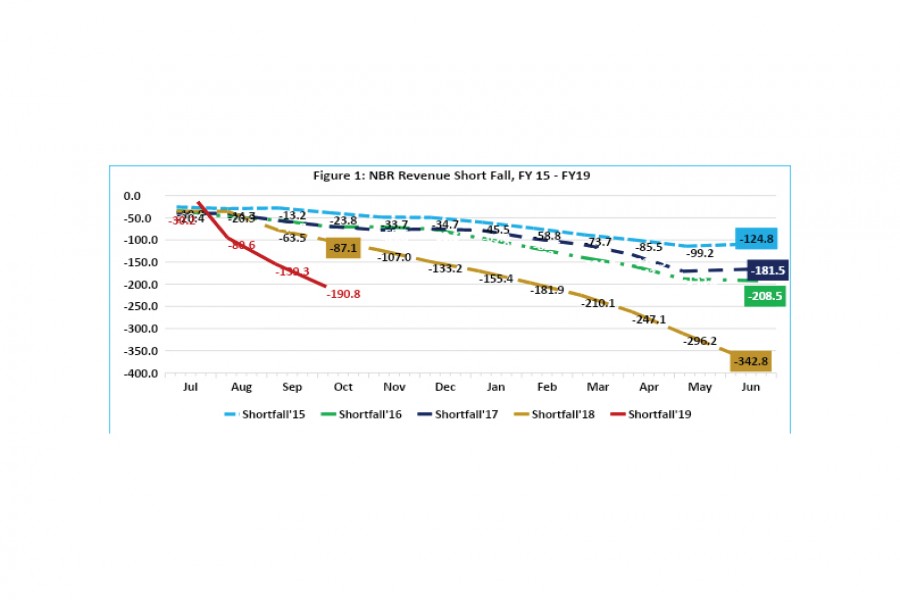

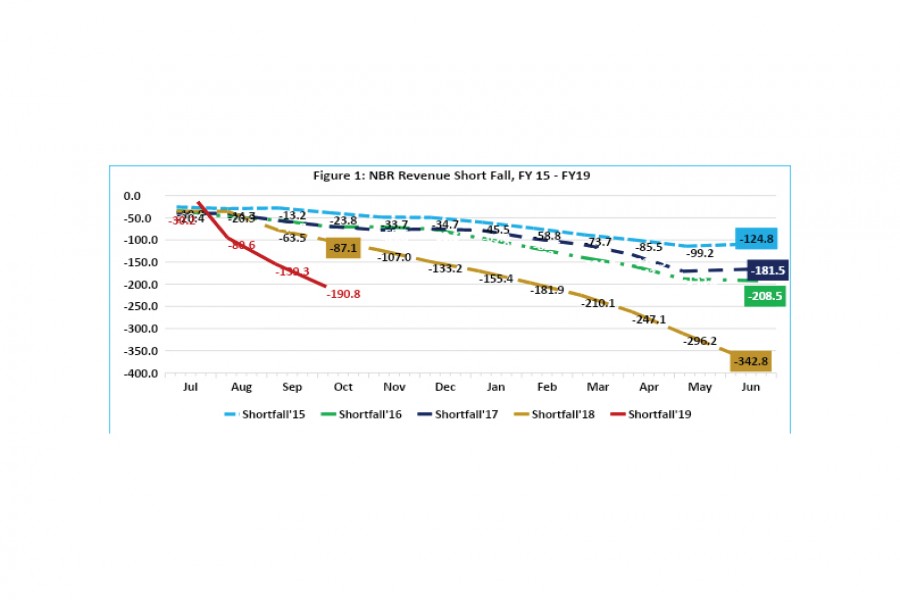

But the unfortunate development is that Bangladesh has not been able to realise the revenue targets (which are on the lower side) set out in the last five budgets. Figure 1 captures the cumulative revenue shortfalls in the last five budgets (i.e. from FY 15 to first six months of FY 19). Cumulative revenue shortfalls have been widening in each of the last five budgets. In FY 15, cumulative revenue shortfall was BDT 124.8 billion. In FY 18, the cumulative revenue shortfall increased by almost three times to BDT 342.8 billion. Cumulative revenue shortfall in the first four months of FY 19 has been estimated at BDT 190.8 billion - more than double of the amount reported for FY 18 - BDT 87 billion.

Shortfall in revenue from targets is not surprising as authorities are not fully prepared to mobilise the additional revenue. NBR could not implement important reforms in the income and VAT fronts during the last decade. As a result, the gap between targets and actual mobilisation has been widening.

WAY FORWARD

Value Added Tax: One of the most important tax revenue sources in Bangladesh is Value Added Tax (VAT). It was introduced in 1991 with the enactment of VAT Law 1991. Thereafter, various ad-hoc measures have been introduced into the VAT system - turning it into an excise-type system. Due to these ad-hoc measures, revenue generation from this source has weakened - directly impacting the realisation of revenue target. Considering the problems of the current VAT system - it has been agreed to introduce a new VAT law to modernise the VAT system for higher revenue mobilisation, improving resource allocation (i.e. allocative efficiency), boosting the export sector, and lessening the cascading effects. The VAT law was supposed to be in place in FY 2012. However, due to internal and external resistances, the new VAT law could not yet be implemented. Bangladesh should introduce the new VAT law in the coming Budget. This move may allow application of VAT in its proper form to service sectors including wholesale, retail, and a broad range of services in order to gain more VAT productivity. Introduction of the new law is likely to boost revenue by about 1.0 to 2.0 percentage points of GDP.

Arguments for lowering VAT rate is that it would lead to lower prices and thus encourage higher consumption. VAT is a consumption tax and consumers bear the VAT burden. Consumers have been accustomed to pay 15 per cent rate. Given that producers are more organised than consumers, there is no guarantee that reduction in VAT rate would be associated with commensurate fall in prices. Moreover, it has been estimated that 1.0 per cent reduction in VAT rate would lead to revenue loss of BDT 80 billion (8,000 crore) [PRI, 2018]. Thus, it would be wise to keep the VAT rate unaffected.

Moreover, VAT should be applicable in its proper form to service sectors, including wholesale, retail, and a broad range of services, in order to gain more VAT productivity. Furthermore, the VAT administration needs to be efficient in providing taxpayers' services through a series of administrative and policy reforms.

Personal Income Tax: Another important tax revenue source in Bangladesh is personal income tax. The individual income tax in Bangladesh, governed by the Income Tax Ordinance 1984 and Income Tax Rules 1984, is a major source of the government's revenue from direct taxes. It is levied at graduated rates ranging between 10 and 30 per cent on as many as seven sources of income, viz. wages and salaries, interest on securities, income from business or profession, capital gains, income from house property, agriculture income, and income from other sources.

The main problem with personal income tax is that only around 1.3 per cent of the population is under the personal income tax net. The number of personal income tax-payers fares poorly against the rise of personal income and growth of 'middle-class' in Bangladesh. According to PPP (Purchasing power parity) $5.50 and higher per day measure, the number of economically secure and middle class has increased from 12.3 per cent of the population in FY 2010 to 15.5 per cent in FY 2016. Accordingly, numbers of income payers should have been between 12 to 15 per cent of the population. Revenue potential of expansion of income tax net is huge. Using average income tax payment in FY 2017 and assuming 5.0 per cent of the population is brought under the income tax net, would likely to generate 3.0 percentage points of additional revenue.

Revenue mobilisation in Bangladesh can be improved significantly over the medium term by focusing reforms in the VAT and income tax fronts.

Dr Bazlul Haque Khondker is Professor, Department of Economics, University of Dhaka.

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.