Published :

Updated :

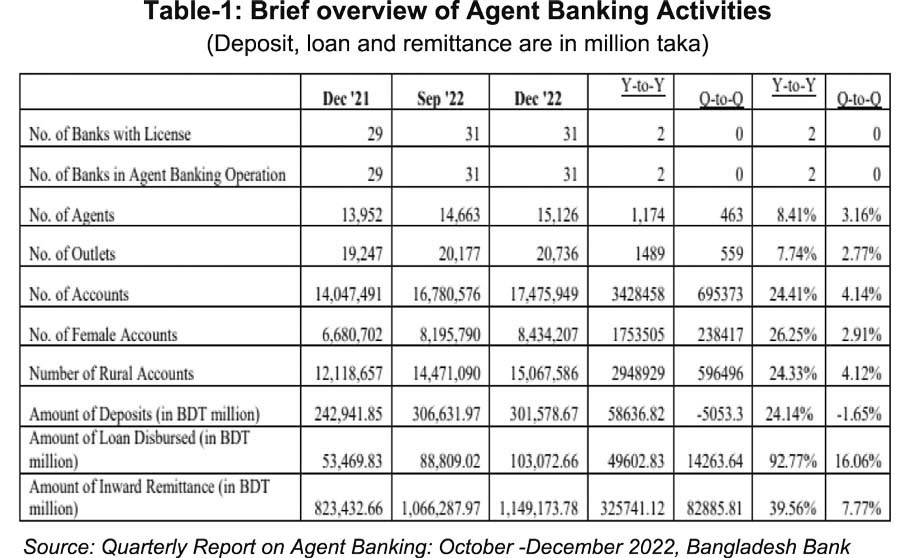

Agent banking, a new model of banking services across the developing world especially in Bangladesh, aims at providing formal banking services to the unbanked segment of the population who are excluded from formal banking services. Since agent banking can be offered without opening a full-fledged bank branch, compared to the conventional banking, this exclusive banking service is less expensive and can reach the remote areas of the country. Bangladesh Bank (BB), the central bank of the country, allowed agent banking in Bangladesh by issuing the 'agenting banking guidelines' in 2013. However, full-fledged agent banking operation started in 2016. According to the BB guidelines, agent banking is a limited scale banking and financial services for those living in remote areas through persons (owner of the agency) under a valid agency agreement, rather than a teller or cashier. Later, Bangladesh Bank has permitted agent banking in urban areas as well where conventional banking system is not available. Currently, 31 commercial banks are in agent banking operation in Bangladesh with 15,126 agents, and financial transactions are conducted through a network of 20,736 outlets across the country (Table-1).

In the agent banking model of Bangladesh, the commercial bank recruits or nominates an agent, a third-party owner of an outlet, who conducts banking transactions, such as cash deposits, withdrawals, disbursement and recovery of loans, fund transfers, payments of government's social safety net programmes, utility bills collection, inward and outward remittances on behalf of the concerned commercial bank. The transactions are recorded in the statement of affairs of the concerned bank or bank branch.

There are other models of agent banking across the world. Banking agents may include pharmacies, supermarkets, convenience stores, etc., for example, post offices are used as bank agents in Australia; corner stores work as agent bank in France; Brazil provides financial services through lottery outlets; mobile-based branchless banking and/or agency banking are available in Senegal, Pakistan, India, Kenya, Nigeria, Congo, South Africa and Philippines (Buri et al., 2018; CGAP, 2006; Cull et al., 2018; Kumar et al., 2006; Margaret & Ruth, 2019; Nezianya & Izuchukwu, 2014; Zaffar et al., 2019). In spite of different type of models, agent banking in general is considered cost-effective and closer proximity to underserved market segments promoting broader financial inclusion.

So far, there is no comprehensive study investigating the agent banking performance in Bangladesh since its inception in 2016. Therefore, it is timely to evaluate the performance of agent banking, especially how agent banking activities affect the mother/principal bank's profit over the years.

This study estimates a panel data regression model using bank level quarterly data of nine (09) commercial banks in Bangladesh which are operating full-fledged agent banking activities including both deposit mobilisation and credit disbursement. The sample banks are Bank Asia, Dutch-Bangla Bank, Al-Arafah Islami Bank, Islami Bank Bangladesh, Mutual Trust Bank, City Bank, Brac Bank, NRB Bank and Modhumoti Bank Limited. Although 31 commercial banks are currently in agent banking operation in Bangladesh, only nine banks have transaction history with both deposit and loan products. We have constructed a unique balanced panel dataset with 126 observations for the period 2018Q1-2021Q4 based on the available data and estimated a pooled regression model to examine the effects of agent banking activities on the financial performance of the sample commercial banks in terms of profitability measures, return on assets (ROA) and return on equity (ROE). The sample constitutes bank-level quarterly data of nine private commercial banks in Bangladesh for the period 2018Q1-2021Q4.The data has been collected from the balance sheet, income statement and other financial statements of the sample banks and from the Bangladesh Bank.

The study examines the effects of agent banking activities on the profitability of the sample commercial banks. In the regression analysis, two different profitability measures, return on assets (ROA) and return on equity (ROE) of the sample banks are considered as dependent variables and, six agent bank specific independent variables are number of agents, number of agent banking outlets, number of total accounts with agent banks, total deposit mobilisation and credit disbursement, and total remittance amount of agent banks.

Our empirical estimates from collected data of sample of Bangladeshi banks shows positive and statistically significant coefficients of total credit (TC) for both ROA and ROE, indicating that loan disbursement through agent banking has positive impact on the profitability of a bank in terms of ROA and ROE. One possible reason for the increased profitability is the higher income earned from the loan products of agent banks. Some clients prefer to do banking transactions with an agent rather than at a formal bank branch perhaps due to lower transaction cost and trustworthy personal relationship. At an agent outlet, it is the same person (owner of the outlet) dealing with clients who are entrepreneurs within the locality and therefore, gradually a trust relationship is developed over the time between them. In addition, the poorer section of the clients who lack knowledge of financial products may depend on one-to-one relationship with the agent for their financial needs, such as loans. Furthermore, gender may play a significant role in building trust; for example, female clients may be more comfortable doing financial transactions with a female agent.

For both ROA and ROE, the estimated coefficient for the number of agents is negative and statistically significant, indicating that an increase in the number of agents does not necessarily increase bank profit. Most of the banks utilise their agent banking network for deposit mobilisation, especially from rural areas. Since deposit is not an income earning product, the agents (if not disbursing loans) are not directly contributing to banks' profit. The estimated positive coefficients for the number of accounts (AC) for both ROA and ROE indicate that an increased number of agent banking accounts may contribute banks' profitability positively because additional account holders do more financial transactions with agent banks and thus contribute to banks' earnings. However, the estimated coefficient is statistically significant for ROE but not for ROA.

The contribution of agent banking activities to the profitability of the concerned commercial banks (mother/principal banks) in Bangladesh is noteworthy. Employing bank level quarterly data for the period 2018Q1- 2021Q4, the study estimates a pooled OLS regression model. The estimated regression results show that bank's profit has a positive and statistically significant relationship with the amount of credit disbursement by agent banks and the number of agent banking account holders. One possible reason for such increased profitability is the income earned from loan products of agent banks and more financial transactions by the increased account holders. Some clients prefer to do transactions with agents rather than at a formal bank branch perhaps due to lower transaction cost and trustworthy personal relationship. However, the number of agents and/or outlets do not necessarily affect the profitability of the principal/mother bank. The findings of this study would help the policy makers, bank management and other stakeholders for decision making and improving the performance of agent banking in developing countries like Bangladesh. Due to small scale operation of agent banking in Bangladesh, the inference drawn from this study may have limitations due to small sample size.

Kabir Hassan is Professor of Finance at the University of New Orleans, USA.

KabirHassan63@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.