Published :

Updated :

Who doesn't remember Tamim Iqbal charging down the wicket to hit a 6 off Zaheer Khan in 2007? Sadly, despite all of his heroics, who doesn't remember the overuse of his 'anchor role' to defend his sudden loss of striking ability and earning the name 'Dotbaba'? We have something similar in the corporate sustainability world. In Bangladesh, it is done using three terms, used interchangeably. Like every great trio in pop culture, these three elements-CSR, CG and ESG-are used to cover it up. Call it PR whitewashing or corporate value signalling, it is gaining traction amongst the companies. But these days, these concepts aren't just corporate jargons; they're critical to both survival and success. It's not just about saving face anymore; it's about saving the planet (Yes, I am a Power Ranger), creating equitable workplaces, and doing it all while keeping up with regulations that would make even the most diligent manager's head spin. But what do these terms mean when we strip away the corporate gloss? Why should the average person-or the average board member, for that matter-care? How does it relate to the capital market?

If CSR, ESG, and CG were characters in a series, they'd be fighting for the corporate throne in a game where every move counts. CSR, ESG, and CG might overlap, and intertwine, but they're not identical, just like Harry Potter, Ron Weasley and Hermione Granger.

Corporate Social Responsibility, or CSR focuses on company actions that give back to society; it's the feel-good, Instagram-friendly part of the business, it is a lot like that one friend who volunteers at every community event, posts about it with hashtags like #ForThePoor, but secretly does it for the Instagram likes. CSR is essentially a company's pledge to give back, usually by supporting social causes, helping the environment, or boosting employee well-being. But it's a complex game, balancing genuine efforts and PR stunts. In Bangladesh, CSR is seen as both a genuine attempt to help society and as a tool for brand-building. But CSR has its critics. Some argue that it's little more than greenwashing, with companies funding programmes that sound great on paper but have minimal real-world impact. Think of it like that "philanthropic" billionaire who donates a fraction of their wealth to a cause while dodging taxes on the rest. There's also the issue of "project-based" CSR versus systemic impact. Project-based CSR is like dropping a few dollars in a charity box-sure, it helps, but it doesn't solve anything long-term. Systemic CSR, on the other hand, would mean structural change within the company that addresses core social or environmental issues. According to a 2024 report from the Federation of Bangladesh Chambers of Commerce and Industry (FBCCI), CSR activities in Bangladesh have primarily focused on education, healthcare, and disaster relief. However, compared to other South Asian countries like India, where CSR is mandatory, Bangladesh lags in embedding CSR into core business strategies.

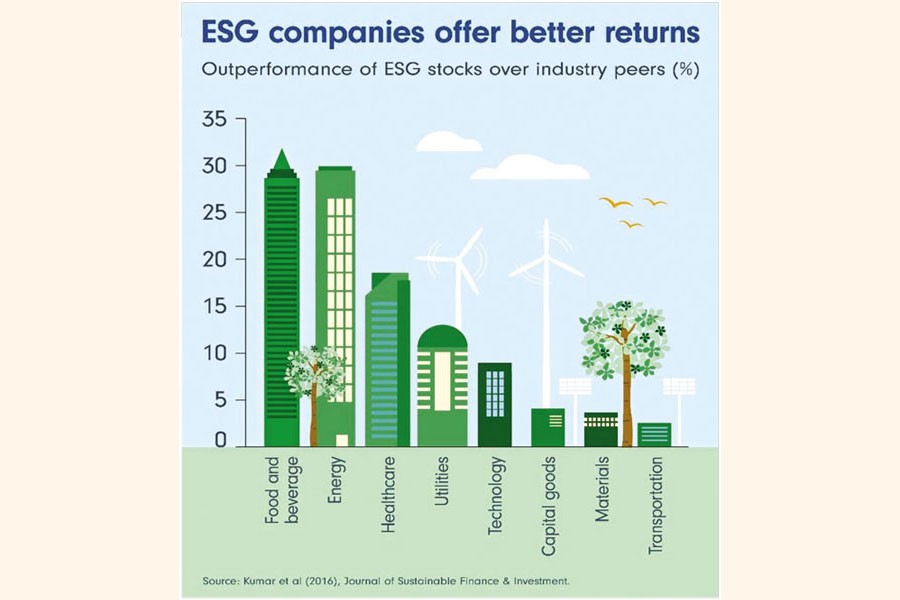

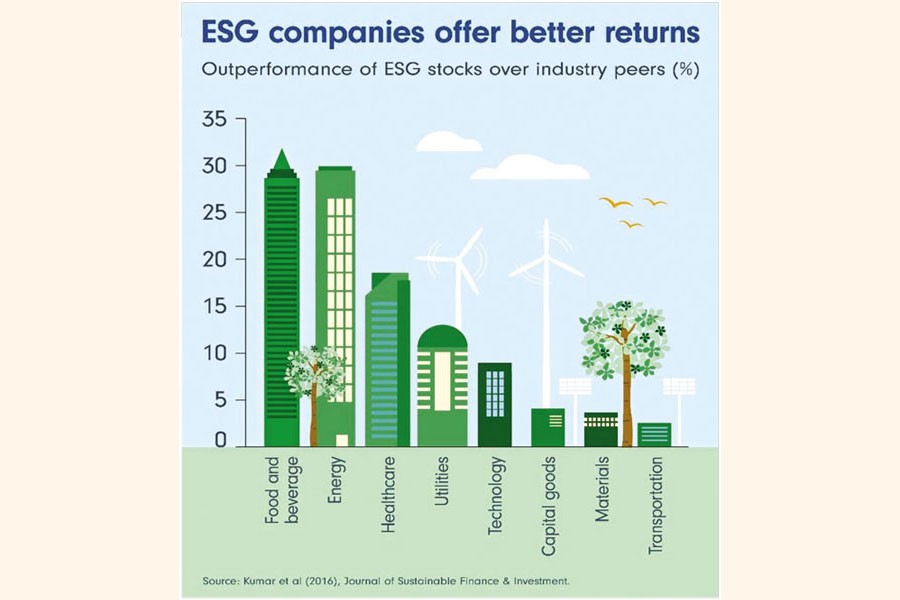

ESG, on the other hand, isn't just a buzzword; it's the Taylor Swift of modern investment-a magnet for global investors and policymakers alike. It is a measurement framework that evaluates how a company performs in specific areas of environmental and social impact, plus governance. ESG, short for Environmental, Social, and Governance, is the golden trifecta for measuring a company's real-world impact. This framework moves past traditional profits and dives into whether companies are sustainably contributing to society or just cashing in on a trend. For instance, the "E" gauges how green (or not) the company is, the "S" covers social impact, and the "G" is all about governance-basically, who's calling the shots and how transparent they're being about it. Here's the catch: unlike what your favourite influencer might suggest, ESG isn't all aesthetic vibes and "Greta Thunberg" memes. Globally, investors are piling into ESG like it's the new Bitcoin. According to the Global Sustainable Investment Alliance, global ESG assets are projected to hit $50 trillion by 2025; for good reason-companies with strong ESG credentials aren't just doing good; they're often doing well financially too. For instance, the NYU Stern Center for Sustainable Business has found that companies effectively managing ESG factors report improved Return on Assets (ROA), Return on Equity (ROE), and even stock price growth, underscoring how strategic ESG initiatives can directly enhance operational efficiency and financial stability (Wolters Kluwer; MSCI). Investors are also willing to pay a premium for ESG-aligned companies, particularly in sectors with significant exposure to environmental risks, like energy and materials. In these industries, ESG excellence often means focused efforts on reducing emissions and operational risks, which can directly impact company valuations.

McKinsey's recent report revealed that 87 per cent of investors believe comprehensive sustainability disclosures (without "greenwashing") are critical for investment decisions, which translates into stronger investor confidence and market support for high-ESG performers. Notably, consumer trends align with this shift: over 64 per cent of consumers now consider a brand's ESG credentials before purchasing, particularly in areas like climate response and ethical labour practices. The power of these consumer-driven preferences further pushes companies to integrate ESG rigorously, thus linking ethical responsibility with profitability and resilience in today's markets (JPMorgan Chase; Wolters Kluwer).

In Bangladesh, where industrial growth meets environmental vulnerability, ESG can be a game-changer-or a greenwash minefield. Bangladesh's ESG journey includes strides in renewable energy, particularly solar initiatives aimed at reducing the country's carbon footprint. However, reliance on fossil fuels still raises concerns. The country targets a 15 per cent reduction in emissions by 2030, but current investment levels in clean energy are inadequate to hit these goals. On the social front, labour rights and equitable growth remain essential. Given that 80 per cent of the workforce is employed in the informal sector, raising standards across industries is both a challenge and an opportunity. The RMG (Ready-Made Garments) sector has witnessed positive strides post-Rana Plaza; however, enforcement of labour rights and welfare policies requires a sustainable boost (Transparency International Bangladesh). With a Corruption Perceptions Index score of just 24 (Transparency International 2023), Bangladesh ranks among the most corrupt globally. The governance component in ESG here, therefore, is aimed at anti-corruption and regulatory transparency.

Lastly, CG is the rulebook-the behind-the-scenes director ensuring that CSR and ESG actions are carried out responsibly and transparently. It is the third wheel of CSR and ESG, but arguably the most crucial. If CSR is the heart, ESG the face, then CG is definitely the backbone. It's the part of the trio that makes sure everyone's playing by the rules, avoiding corruption scandals, and actually delivering on those lofty promises. Good corporate governance is like having your house in order, ensuring that no one's hiding skeletons in the closet or secret offshore bank accounts. In Bangladesh, the capital market has had its fair share of governance challenges. Cases like the 2010 stock market crash highlighted the need for more stringent regulations and board accountability. Despite recent reforms by the Bangladesh Securities and Exchange Commission (BSEC) and Dhaka Stock Exchange PLC (DSE), the country still has ways to go in terms of CG practices that align with global standards. In markets like the U.S. and Japan, governance is a well-oiled machine with detailed accountability frameworks, while in Bangladesh, it's still a work in progress. Poor governance doesn't just hurt the company-it damages investor confidence. Globally, we're seeing how poor CG practices can lead to massive repercussions. Think of the 2008 financial crisis or, more recently, the Wirecard scandal in Germany. Weak governance practices cost investors billions and trigger regulatory overhauls worldwide. For Bangladesh, adopting robust CG practices isn't just about preventing crises; it's essential to attract and retain foreign investment. But even here there is a lack of coordination between the regulators of the money market and capital market, like if the offence and defence don't coordinate in a game.

Lastly, CG is the rulebook-the behind-the-scenes director ensuring that CSR and ESG actions are carried out responsibly and transparently. It is the third wheel of CSR and ESG, but arguably the most crucial. If CSR is the heart, ESG the face, then CG is definitely the backbone. It's the part of the trio that makes sure everyone's playing by the rules, avoiding corruption scandals, and actually delivering on those lofty promises. Good corporate governance is like having your house in order, ensuring that no one's hiding skeletons in the closet or secret offshore bank accounts. In Bangladesh, the capital market has had its fair share of governance challenges. Cases like the 2010 stock market crash highlighted the need for more stringent regulations and board accountability. Despite recent reforms by the Bangladesh Securities and Exchange Commission (BSEC) and Dhaka Stock Exchange PLC (DSE), the country still has ways to go in terms of CG practices that align with global standards. In markets like the U.S. and Japan, governance is a well-oiled machine with detailed accountability frameworks, while in Bangladesh, it's still a work in progress. Poor governance doesn't just hurt the company-it damages investor confidence. Globally, we're seeing how poor CG practices can lead to massive repercussions. Think of the 2008 financial crisis or, more recently, the Wirecard scandal in Germany. Weak governance practices cost investors billions and trigger regulatory overhauls worldwide. For Bangladesh, adopting robust CG practices isn't just about preventing crises; it's essential to attract and retain foreign investment. But even here there is a lack of coordination between the regulators of the money market and capital market, like if the offence and defence don't coordinate in a game.

Like the cartoon, the powers of the Planeteers combined forming Captain Planet, here is how the three collectively influence Bangladesh's market. CSR is the Foundation, CG is the Framework and ESG is the Vision. CSR lays the groundwork for ESG by embedding corporate responsibility into core operations. For instance, community-based projects reflect CSR in action, which can naturally evolve into more structured ESG frameworks as stakeholders demand measurable outcomes. CG ensures that companies adhere to ethical standards, with oversight structures like independent boards that monitor ESG activities. Bangladesh's adherence to CG codes is improving but with room for rigorous enforcement. ESG goes beyond philanthropy, seeking to quantify social impact and integrate it into corporate strategies. By leveraging CSR foundations and CG principles, companies can advance a genuine ESG agenda, improving long-term value and resilience.

Now that we have gotten a clearer picture between CG, ESG and CSR, let's put Bangladesh's capital market on a global spectrum. Bangladesh's DSEX index had a -3.07 per cent return as of April 2024, whereas India's Sensex posted 1.13 per cent, underscoring a different investor sentiment in a more robust market. In terms of equity market cap as a percentage of GDP, we are lagging far behind our counterparts, and globally our market P/E is neither looking very bright either, as we can see from the charts.

Globally, markets have seen a surge in ESG-based investments, with trillions flowing into sustainable funds. The U.S., Europe, and even China are miles ahead in ESG, with regulations mandating disclosures and incentives aligning with sustainability goals (Morningstar, 2023). Western markets have established rigorous ESG reporting standards, with funds flowing into sustainable investments. Europe, with the Sustainable Finance Disclosure Regulation (SFDR), has led the way, requiring investment managers to disclose ESG risks. Meanwhile, in the U.S., the SEC is proposing similar regulations for listed companies. Bangladesh could adopt similar practices, aligning with international standards to attract global capital. India's mandatory ESG disclosure requirement has increased the country's attractiveness to foreign investors, who prioritise transparency. By mirroring India's approach, Bangladesh could improve regulatory compliance and global competitiveness. ASEAN markets are also catching up, with countries like Singapore implementing the ASEAN Green Bond Standards. Bangladesh, as part of the South Asian economic bloc, could benefit from adopting regionally compatible ESG frameworks, enhancing cross-border investment flows.

In contrast, ESG reporting in Bangladesh is still voluntary and lacks the depth seen in developed markets. An agreement between DSE and the Global Reporting Initiative (GRI), in the Netherlands was signed in 2018. It also became a partner exchange of the United Nations Sustainable Stock Exchanges Initiative (UN SSE) in 2018. DSE and BSEC have made elementary progress in laying down ESG guidelines, but adoption remains voluntary, and few companies provide comprehensive ESG reports. The PMDD team of DSE recently initiated a separate section for Sustainability in the DSE Website. A collaborative effort with the GRI and the International Finance Corporation (IFC) will provide easy access to information on ESG initiatives, along with a one-stop solution for stakeholders interested in sustainability reporting as well. Not bad for a capital market which is lagging behind much in comparison to its counterparts, no?

Then again, like any paradox, the onus is on the companies as well. A 2024 study by the Financial Institutions Training Institute (FITI) found that only 23 per cent of listed companies published sustainability reports. This lack of robust ESG reporting limits Bangladesh's appeal to international investors, who increasingly demand ESG compliance as part of their investment criteria. In contrast, India's markets are seeing rapid adoption, partly due to mandatory ESG disclosures for the top 1,000 listed companies by the Securities and Exchange Board of India (SEBI). Bangladesh's voluntary ESG reporting policy creates a gap between potential and practice. For instance, while local banks have led the way in issuing green bonds, which align with ESG's environmental pillar, many other sectors lag behind. We see banks have a staggering 18.19 per cent of the total market cap. But what about the other leading sectors?

What is the key missing link here? The dreaded one we keep on talking about, but owing to the short attention span and goldfish memory we seem not to care for it.

The missing link is, well, 'you'. Yes, YOU, the investors. Traditionally, Bangladeshi investors have focused on short-term gains rather than long-term value creation. With zero interest in learning, zero interest in acquiring knowledge, always going for the herd mentality. Programmes that promote ESG literacy can help shift this mindset, enabling investors to make more informed decisions. The Bangladesh Institute of Capital Market (BICM), in cohorts with DSE and BSEC, has initiated investor education programmes, yet there's room to expand their focus to include ESG literacy. Increasing awareness about how ESG factors can drive better returns and mitigate risks could prove transformative. By educating investors on sustainability's value, Bangladesh can turn CSR, ESG, and CG from corporate jargons into powerful tools for growth and resilience.

For Bangladesh's capital market to thrive under ESG, investor awareness and education are essential. Increasing investor awareness about the importance of ESG in boosting resilience could catalyse capital inflows, transforming perceptions of the market from risky to resilient. Ergo, knowledge gives you power. To quote Captain Planet once again, "The Power is Yours."

The writer is an engineer-turned-finance-expert-ESG-enthusiast.

galibnakibrahman@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.