Published :

Updated :

Soon after its independence in 1971, western communities and foreign development agencies largely wrote off Bangladesh. Food insecurity for roughly 70 million people in a war-torn nation was the reason for labelling the country a "bottomless basket." But the country's agri-might has largely proven these assumptions wrong.

Despite declining farmland and almost annual crop devastation from natural disasters, Bangladeshi farmers have managed to feed a population that has grown to 180 million. This agri-magic, powered by farmers' remarkable ability to increase crop production up to sixfold since 1971, is appreciated by the majority of the population. However, Mabroor Mahmood challenges this rosy picture.

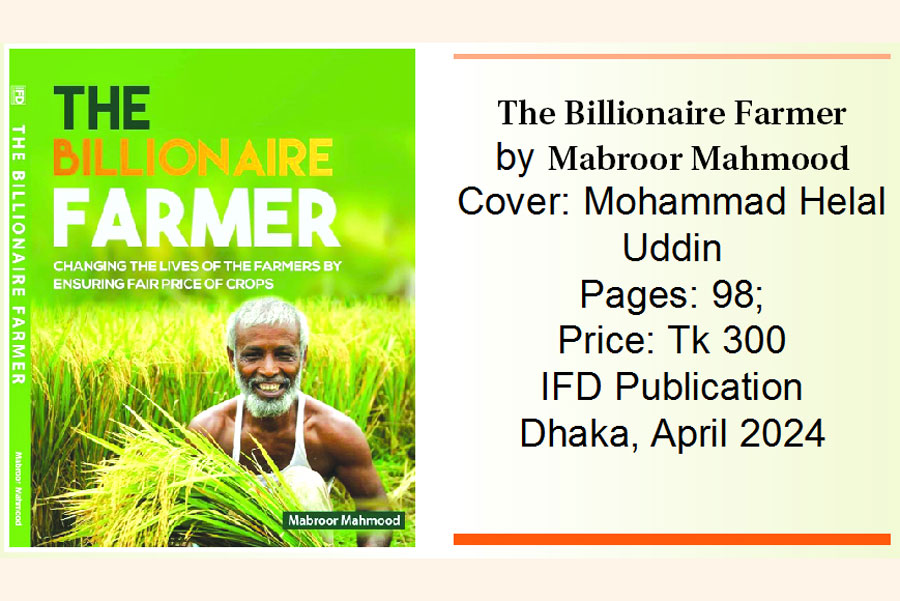

In his book The Billionaire Farmer, Mahmood rather raises some serious questions, including why farmers' share of consumer prices has been declining, why many skilled growers leave the country for manual labour abroad and why a growing number of farmers are forced to migrate to cities and take odd jobs to make ends meet. He argues that simply increasing crop production does not benefit farmers unless the market offers fair returns for their produce.

Mahmood identifies a poorly functioning market infested with intermediaries as the culprit behind farmers abandoning their profession. Unequal market practices, he argues, fail to offer farmers the minimum return they need to sustain their businesses for the next season.

In his concise four-chapter, 98-page book, Mahmood brilliantly proposes solutions and elaborates on how they could be implemented. All the articles were earlier published in The Financial Express. For the book, the author revised and update those.

To illustrate the concept of successful entrepreneurs, profit and fair prices for farmers, Mahmood opens with the rise of steel giant Mittal Group. He argues that farmers share similarities with entrepreneurs. They invest in cultivation, use their skills to achieve a good harvest and sell their crops at a price that allows them to recoup their investment.

The author focuses on staple rice and its "Farmer's Share in Consumers' Prices" (FSCP) to assess fair price dynamics across the crop marketing board. "If the consumer pays Taka 100 for a kilo of rice, and the farmer receives Taka 80, then Farmers' Share in Consumers' Prices or FSCP is 80 per cent. The higher the share is, the better is the bargaining power of the farmers and vice versa," he explains.

The author cites seven studies on FSCP for rice between 1983 and 2018. The 1983 study found that rice farmers received around 71.07 per cent of the retail price. This study concluded that Bangladesh's rice market was then one of the world's most efficient due to the high farmer share.

However, the market picture gradually worsened due to rice millers and intermediaries. By 2018, farmer shares for coarse and fine rice fell to roughly 45 per cent and 51 per cent, respectively.

Using these statistics, Mahmood sets the stage for his argument: the free market fails to benefit farmers. He then dives into his "mega model to ensure fair prices for farmers" -- the book's central proposition.

In Mahmood's proposed model of a government-regulated supply chain, the features can be divided into infrastructure, players and functionalities.

For infrastructure, Mahmood proposes building large warehouses: supply warehouses at the rural grassroots level and demand warehouses in urban areas.

Farmers will sell their produce, rice in this case, to the rural warehouses, which will then refill the urban demand centres. These warehouses will also have grading terminals. Each rural warehouse will have two selling points: a large one for retail and a smaller one for wholesale.

Besides, each rural centre will have at least one branch of Krishi Bank to facilitate sales, transactions and provide low-cost or free farm credits. The supply centres will charge a fixed or minimal fee to cover operating costs.

Farmer cooperatives will manage the rural supply centres. Licensed market specialists, who can be private sector players or intermediaries, will only transport rice to refill the urban demand centres.

Now imagine a farmer carrying a sack of rice to the mega model's supply centre in a distant district.

A floor price, a minimum rate set by the authorities, guarantees a fair return in the first place. As his sack reaches the grading terminal, officials assess the rice, assign a price quote based on quality and then store it in the warehouse for bidding. Following the bidding process, the sale proceeds are deposited directly into the farmer's bank account, eliminating the need for the farmer to interact directly with market specialists.

For transparency and system integrity, Mahmood proposes displaying key sales and bidding stages on public screens. Other processes, such as licensing, would be available online for everyone to access.

He provides a detailed and clear explanation of his "mega model", which he subsequently links to poverty alleviation and sustainable economic growth, calling it the "Bangladesh Accelerated Poverty Reduction Model." He wisely suggests piloting the scheme before full implementation to learn from any challenges encountered.

In the next chapter, the author explores the connection between ensuring fair prices and poverty alleviation and examines whether policymakers have overlooked any crucial aspects in this regard.

Mahmood argues that "to alleviate poverty from a country whose economy is largely dependent on agriculture, we should first pay attention to the income earning potentials of the farmers."

In the following paragraph, he expands on his argument for fair prices and a regulated agricultural market: "If the market is not able to provide them with sufficient return, then the Government should intervene in the market so that the farmers stay in their profession generating enough return for meeting their daily needs."

However, Mahmood acknowledges that this concept of poverty reduction is not anything new. Multinational lenders like the World Bank have advocated for agricultural growth within poverty reduction programmes in low-income countries for decades. He cites World Bank reports to demonstrate how the focus on fair prices for farmers as a means of poverty alleviation has waned over time, influencing local policymaking and planning documents that solely prioritise growth.

"It seems to us that our policy planners largely assumed that faster economic growth is the solution and if such a high growth can be attained, all other problems will be automatically solved," says the author.

"Bangladesh had to pay a heavy price for shifting its focus from a farmer-centric development approach to an economic growth-driven development approach," he notes in his verdict cautiously.

In the fourth and final chapter, Mahmood examines Bangladesh's export prospects for agricultural products compared to its neighbours like India and Pakistan. He attributes the country's poor performance in agricultural exports to a lack of sound and consistent planning and policymaking. He elaborates on India's long-term export planning and corresponding adjustments to rules and regulations.

Mahmood concludes by questioning Bangladesh's tendency to blindly imitate India in areas like fashion, movies, and television shows, while neglecting to adopt its precious and necessary agricultural development and pro-farmer policies.

sohelmahamud@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.