Published :

Updated :

In early October 2022, the World Trade Organization (WTO) indicated that global trade growth would slow sharply in 2023 as the global economy faced strong headwinds. WTO economists revised their forecast for merchandise trade growth to 1 per cent in 2023 instead of their earlier prediction of 3.4 per cent. In April this year, the WTO also predicted that global trade might experience the biggest drop since the Great Depression and contract by as much as 32 per cent.

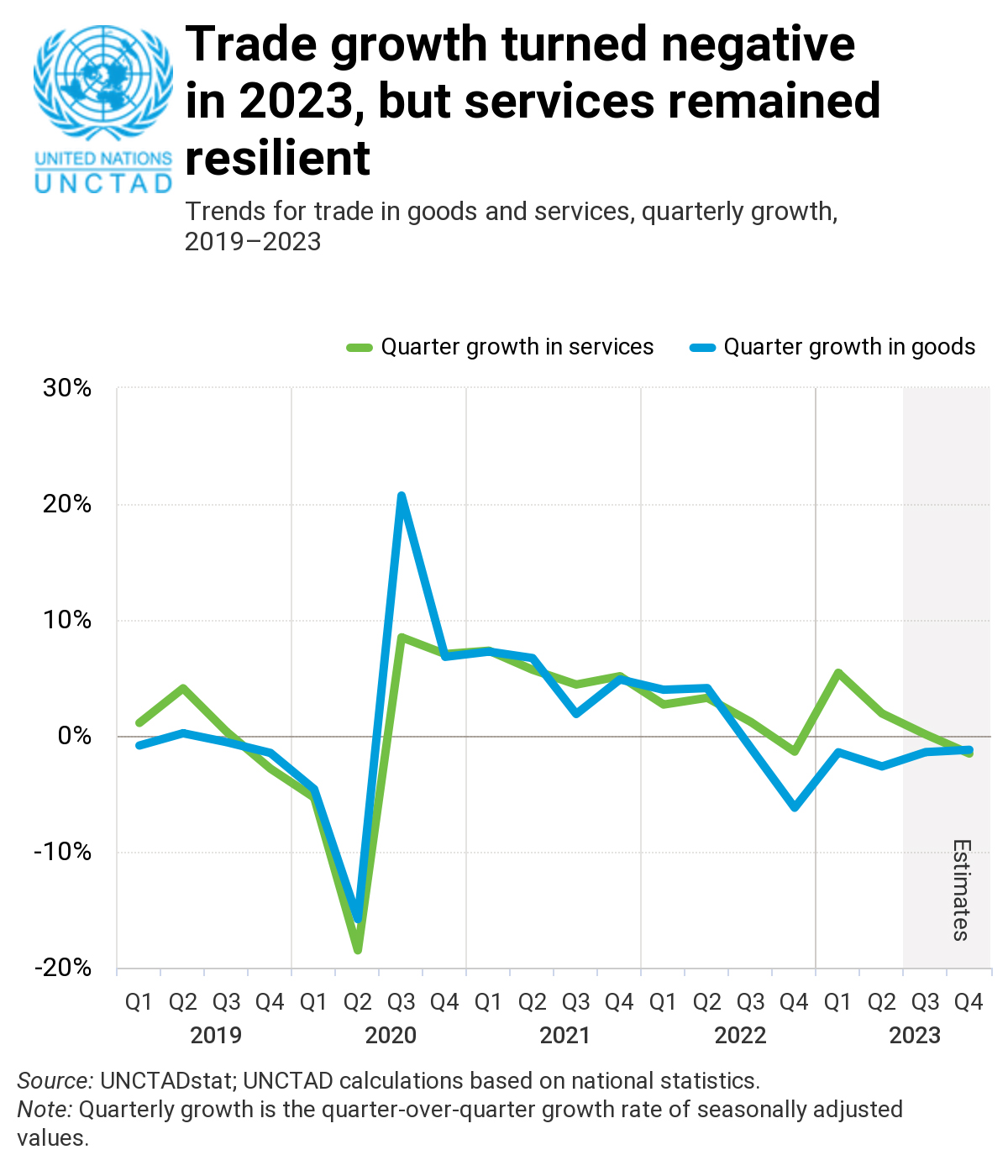

According to a report published by the United Nations Conference on Trade and Development (UNCTAD) on December 11 this year, global trade is expected to amount to approximately US$30.7 trillion. It projected a decrease in goods trade by about US$2 trillion, or 8 per cent, while trade in services may grow by approximately US$500 billion or 7 per cent.

Overall, global trade will contract by 5 per cent in 2023 compared to the previous year’s record level, shrinking by about US$1.5 trillion to below US$31 trillion. Historically, this represents the lowest decline in global trade since the Global Financial Crisis (GFC), marked by a decline in goods trade accompanied by the slowing exchange of goods.

The UNCTAD expressed a generally negative outlook for 2024 and said that the outlook for 2024 remains “highly uncertain and generally pessimistic”, citing factors such as ongoing geopolitical tensions, escalating debt and widespread economic fragility.

The UNTAD attributed the decline in global trade partly to the export underperformance of developing countries. Also, high interest rates in some countries have impeded commercial activity. Looking ahead to 2024, the commodities sector faces continued uncertainty due to ongoing regional conflicts and geopolitical tensions. The increasing impediments to securing critical minerals vital to the energy transition will add to further volatility impacting many countries.

The ongoing Russia-Ukraine conflict highlighted new risks for global trade. As Russia cuts energy supplies to European Union (EU) countries, energy prices skyrocketed, indicating underlying pitfalls in the worldwide supply chains. If the Russian action is extrapolated, imagine what further damages could occur if Western countries were to decouple from China.

The US introduced trade barriers against China in 2018, which did not reduce trade at a global level, while it curbed trade between the US and China. That trade did not decrease at a global level due to the imposition of tariffs on imports from China because trade in products affected by US tariffs on China grew among the rest of the world. In other words, trade was merely relocated, not reduced.

The Global Trade Update (June 2023) confirms that US-China trade dependence will decline in 2022. Earlier, the Global Trade Update (December 2022) indicated that geopolitical trends, including declining interdependence between China and the US, are having a growing impact on global trade.

In its latest Economic Outlook report, the OECD highlighted how trade restrictions have limited export sales since 2018. Additionally, demand for goods exports globally has weakened, resulting from higher inflation and rising interest rates since 2022. This decline in goods exports is reflected in a decrease in exports from China by 1.5 per cent, the EU by 2.5 per cent, and the US by 0.6 per cent, as recorded in July this year.

Further interest rate hikes by central banks are unlikely as inflation is easing in major advanced economies, including the US. The central banks will also likely cut borrowing costs shortly until they are convinced that the underlying price pressures are eased to their satisfaction. Last month, the Federal Reserve Chair Jerome Powell said the US central bank would continue to move carefully but wouldn’t hesitate to tighten policy further if needed to contain inflation.

It is to be noted that while headline inflation has continued to come down in many countries, core inflation – inflation excluding the most volatile components, energy and food – has not significantly slowed. It remains well above central banks’ targets. So, inflation is likely to stay persistently higher than expected. Therefore, continuing higher interest rates will negatively impact exports, particularly goods usually bought with borrowed money, like capital goods, cars, household durables, etc.

Also, economic growth and trade are intertwined. According to the OECD, the global economy has proved surprisingly resilient this year but is expected to falter next year under the strain of war, still elevated inflation and continued high-interest rates. It estimates that global growth will slow to 2.7 per cent in 2024 from an expected 2.9 per cent this year. This would amount to the slowest calendar-year growth since the pandemic year growth of 2020.

The UNCAD report indicated that some countries prefer politically aligned trade partners, a “ friend-shoring “ trend. This trend has become more pronounced since late 2022. However, the geographical proximity in international trade – near-shoring or far-shoring – has remained relatively stable.

The UNCTAD Trade Update (June 2023) again confirms that there has been a rising trend in increasing friend-shoring. But the report also highlights the increasing concentration of trade as estimated by the Herfindahl Concentration Index. The report also notes a significant uptick in 2023 in trade-restrictive measures, especially non-tariff measures (NTMs), adding: “These inward-looking policies are anticipated to impede the growth of international trade”.

The report points out a marked increase in trade concentration and said that “there has been an overall decrease in the diversification of trade partners, indicating a concentration of global trade within major trade partners”. Exports from developing countries underperformed, South-South trade sharply decreased, and East Asian trade remained below average.

Developing countries in general and least developed countries (LDCs), whose number now stands at 46 in particular, are likely to face more challenging situations as they face critical financial difficulties with shrinking fiscal space. Many of these countries depend on exporting commodities like oil, copper and cotton, which meet volatile global markets, further adding to the problem.

According to the UNCTAD, between 2019 and 2021, 74 per cent of LDCs relied on these commodities for at least 60 per cent of their merchandise export earnings. When their price drops, their fiscal space shrinks drastically. To further complicate LDCs’ economic situation, their debt/GDP ratio grew from 48.5 per cent in 2019 to 55.4 per cent in 2022.

It also provides a mixed picture across economic sectors and shows a decline in 2023 for office and communication equipment (-17 per cent), textiles (-13 per cent) and apparel (-11 per cent). The decline in textiles and clothing trade is of utmost concern for Bangladesh as the country heavily relies on RMG exports for its export earnings (RMG accounted for 84.5 per cent of Bangladesh’s total exports and was valued at nearly US$47 billion in 2022-23.).

Integrating national economies into a global economic system has been one of the most important developments of the second half of the last century. This process, often called globalisation, has resulted in a remarkable growth in trade between countries.

Trade with low-wage countries influenced goods prices and wages in developed countries, benefitting consumers of importing and workers in exporting countries. But many workers in advanced economies felt left behind, doing worse than their parents. Workers in advanced economies who were exposed to import competition from low-wage countries felt this distributional effect more acutely.

As a result, there has been a clear shift in policy and public attitude towards globalisation and free trade. While there had been a backlash against globalisation before, such as in Seattle in 1999, the anti-globalisation protests surrounding the WTO Ministerial Conference of 1999 held in Seattle did not influence policy.

However, since 2018, policymakers in some advanced economies and, particularly in the US, have decided to restrict further international integration and embrace protectionist or nationalist policies. The world trading system is reeling from the trade war between China and the United States. Global trade has also increasingly become regionalised and fragmented since then.

Also, multilateral rules that govern world trade are eroding. In fact, multilateral rules are allowed to fail in a fraught geopolitical environment, as reflected in repeated rule-breaking by WTO members, rendering the WTO Dispute Settlement Mechanism largely ineffective. This implies a greater risk of trade conflicts, reminiscent of the interwar period of the 1930s when the shift away from multilateral trade exacerbated tensions between countries ahead of World War II. Therefore, rising protectionism in developed and developing countries threatens to derail the rule-based, free, and open global trading system, causing global goods and services to decline.

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.