Published :

Updated :

Bangladesh finds itself at a watershed moment in its economic life today. Previously regarded with disdain, as a frontier economy beset by inherent problems, Bangladesh has registered tangible gains in its efforts to eliminate obstacles that had discouragingly deterred investment across its borders. Power plants have proliferated, industrial output has increased, and policy efforts have helped alleviate structural bottlenecks. Such gains have turned Bangladesh into a continent of great promise-pounding with one of the world's youngest workforces and a strategic gateway between South and Southeast Asia.

But the promise is only partially kept. The advances, while steady, remain far too short of their potential, held back by weaknesses in infrastructure, finance, and governance and regulatory predictability. Investors recognise both potential and risk-and that fragile balance still defines Bangladesh's international investment landscape.

The 2025 Bangladesh Investment Climate Statement, a 27-page report published by the U.S. Department of State, articulates this dual reality with honesty. The report acknowledges the nation's progress while highlighting the challenges that continue to impede its competitiveness. The report zeroes in on five key obstacles-ranging from poor infrastructure to enduring corruption-that continues to deter many potential investors.

The goal of this piece is to move beyond the diagnosis. By taking a close look at each of these obstacles and placing them in a regional and global context, it aims to underscore both the urgency of transformation and the magnitude of potential. The key question is not whether Bangladesh can lure foreign capital-it already is, nervous. The critical question is whether it can conjure the enabling environment needed to turn nervous interest into adventurous, long-term commitments. The answer will determine not only the fate of foreign capital but also the direction of Bangladesh's broader economic future.

INFRASTRUCTURE-THE BACKBONE CHALLENGE: One of its more immediate maladies is inadequate infrastructure. From ports that struggle with congestion to power lines that buckle under increased demand, infrastructure is the root problem that discourages both productivity and investor optimism, slowing down Bangladesh. Lacking solid roads, dependable power, and streamlined logistics chains, Bangladesh is unable to benefit from its strategic position or large workforce fully.

For instance, while Chittagong Port, which handles over 90 per cent of the country's foreign trade, lags far behind its competitors in terms of turnaround, Vietnam's Hai Phong and India's Jawaharlal Nehru ports have undergone significant upgrading over the last decade, drastically reducing shipping congestion. As much as Bangladesh is developing its initiatives, such as the Bay Terminal and Dhaka's flyover expressways, the pace of improvement still hasn't kept up with investor demand.

FINANCIAL INSTRUMENTS - NARROW AND UNDERDEVELOPED: No less critical is the limited access to financial products suitable for foreign investors. Bangladesh's financial markets remain shallow, with predominance of short-term bank products and poor capital markets. In contrast to India, where project financing is facilitated by corporate bond markets and credit derivatives, and Vietnam, where state backing of credit guarantees promotes strategic sectors such as manufacturing and green power, Bangladesh's financial sector is unable to extend beyond trade financing.

In Bangladesh, foreign loan servicing delays and currency transfer restrictions have long exacerbated investor anxieties; however, the temporary government is now seeking to improve its methods. Until Bangladesh diversifies its arsenal-despite its minority government -building hedging tools, long-term local currency loans, and project lending of a structured kind-it will continue to attract investors who expect increased risks compared to other Asian destinations.

BUREAUCRATIC COMPLEXITY: Dealing with Bangladesh's bureaucracy can be a prolonged and exasperating experience, as it often involves navigating multiple ministries with overlapping jurisdictions. Investors seeking industrial licenses or environmental clearances have been known to wait for months, sometimes indefinitely.

Although BIDA's "One-Stop Service" program is in the right direction, it is still infantile. Comparatively, Vietnam has implemented digital "single-window" clearance mechanisms across critical economic hubs, while India's "Ease of Doing Business" reforms have rationalized multiple state-level clearance procedures. Unless Bangladesh undertakes equivalent reforms, the country will lag behind its regional competitors in attracting capital.

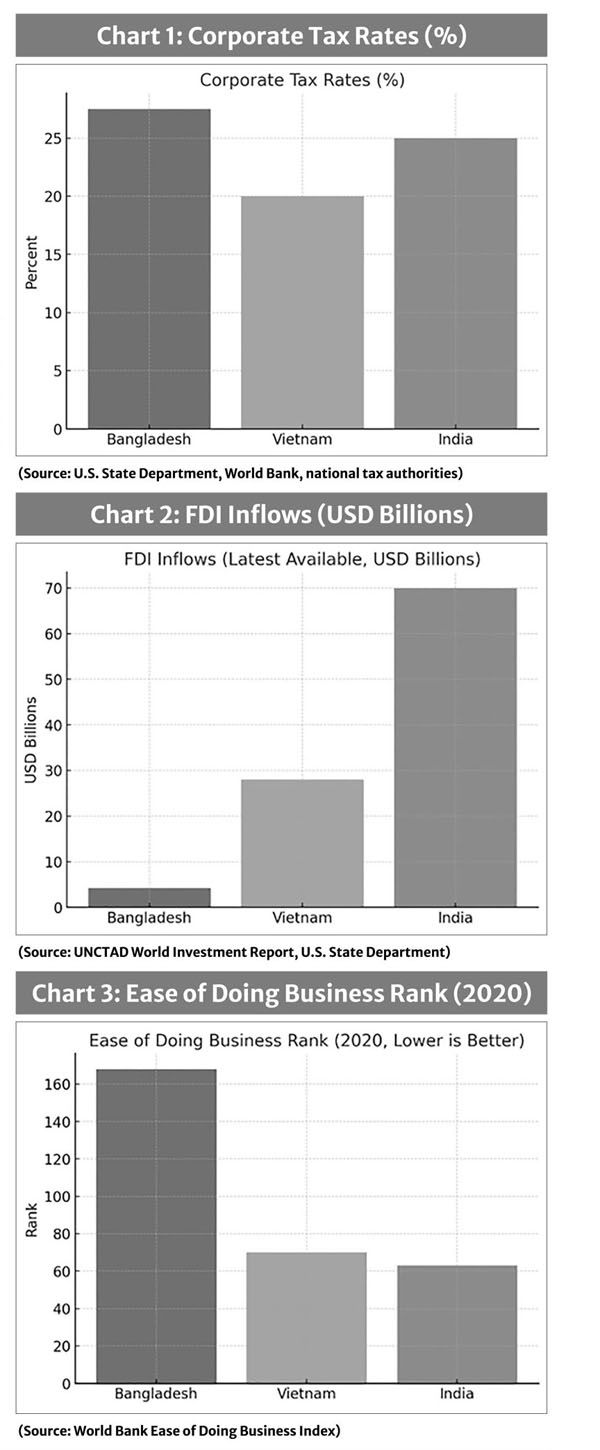

TAXATION IS A HEAVY AND UNEVEN BURDEN: Foreign companies regularly complain about high corporate taxation, the withholding of tax on repatriated dividends, and unclear transfer pricing rules, which are significant deterrents. The feeling of discrimination through unequal taxation creates reluctance to invest in the long term.

There, however, India and Vietnam have made vigorous use of selective tax incentives, such as "production-linked incentives" (PLI) in India for electronics and pharmaceuticals, or tax holidays within Vietnam's high-tech parks. Bangladesh offers exemptions to Export Processing Zones, but its regime remains segmented and uneven. One of the most apparent indications Bangladesh can give to global investors is a transparent and fair tax regime.

CORRUPTION -- THE MOST CORROSIVE OBSTACLE: The American report highlights how corruption distorts procurement, customs, and licensing procedures, resulting in skyrocketing costs and increased unpredictability. Transparency International consistently ranks Bangladesh below Vietnam and India on its Corruption Perceptions Index. Investors often find the "trust gap" itself to be frequently determinative, with reputational risk carrying the same weight as economic cost.

Vietnam and India have also experienced corruption issues, while both nations have instituted anti-corruption initiatives, specialised anti-corruption agencies, and digitalisation of government services to help minimise discretionary practices. Bangladesh's interim regime has expressed vigorous anti-corruption intentions, but its credibility will depend on the observable enforcement of these intentions.

HOW BANGLADESH STACKS UP AGAINST ITS PEERS: Put into Comparative Context, Bangladesh's Challenges Are Not One-of-a-Kind-but its Rivals Are Getting Tougher. Vietnam has been a global favourite for supply chain diversification due to Its Excellent Infrastructure Investment, Reform-Friendly Policies, and Neighbourliness with China. India, with its vast market size, Digital Reforms, and Ambitious Incentive Policies, remains poised to Attract Historic Levels of foreign direct investment.

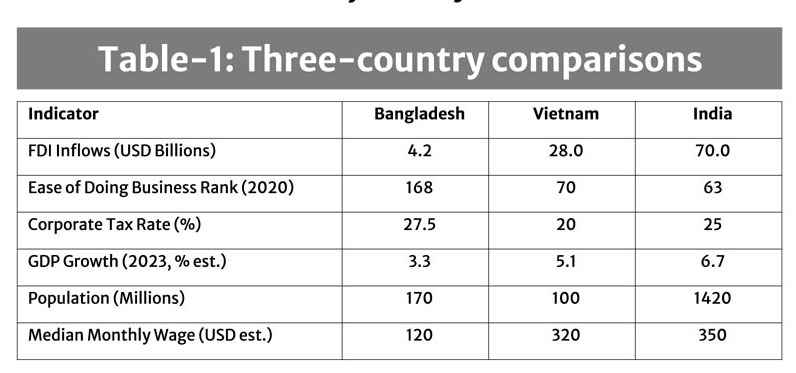

To understand the scale of the gap, consider the Table-1.

The table highlights why Bangladesh struggles to compete with regional counterparts in attracting foreign investment. Although Vietnam drew nearly seven times as much FDI and India over sixteen times as much, Bangladesh is held back by poor infrastructure, higher taxation, and a significantly lower ease of doing business index. Its large pool of labour and cheap wages remains significant assets, but with slow-pacing structural reforms, Bangladesh will lag in the regional competition to attract capital.

WHAT COMES NEXT: The future of Bangladesh belongs to strengthened, assertive reform. Infrastructure should be upgraded on a war footing; financial markets should grow to provide the products investors want; red tape should yield to transparent, digitalized procedures; taxation should be streamlined and fair; and corruption should be tackled straightforwardly.

The question is not now whether Bangladesh can lure foreign investment-it already does, with caution. The real question is whether Bangladesh can create an effective enabling environment to turn wary interest into reassured, long-term commitments. The outcome of these decisions will not only define the magnitude of future capital inflows but will also determine Bangladesh's future economic direction for decades to come.

Conclusion: Bangladesh's tale is that of resilience, aspirations, and unrealized potential. The last ten years have shown that dreams and visions can go hand in hand with reform. However, the challenges outlined in the 2025 Bangladesh Investment Climate Statement-breaks in infrastructure gaps, lack of financing, red tape, unequal taxation, and corruption-continue to be immense brakes on the country's potential. Unless checked, they can miss opportunities for Bangladesh's demographic dividend and strategic position instead of being drivers of growth.

But history provides an alternative route. Through fearless leadership, resolute reform, and unshakeable dedication to transparency and fairness, Bangladesh can reimaging its investment environment and position itself as a genuine regional hub. International capital is footloose and seeking destinations that combine dynamism with predictability. Suppose Bangladesh can step up to this challenge. In that case, Bangladesh can turn wary investors into long-term collaborators, diversify its way out of its over-reliance on garments, and tap into the entrepreneurial potential of its youthful citizens.

Bangladesh's decision is already made: to do nothing and see rivals such as Vietnam and India pass by, or to act now and pen its next chapter of economic fate. The future will not only dictate the nation's position within the world economy but will also shape and determine the future wealth of its citizens.

Dr Serajul I Bhuiyan is a professor of journalism and mass communications at Savannah State University in Savannah, Georgia, USA.

sibhuiyan@yahoo.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.