LDC graduation: Bilateral partnership agreements can mitigate loss of preferential access

Published :

Updated :

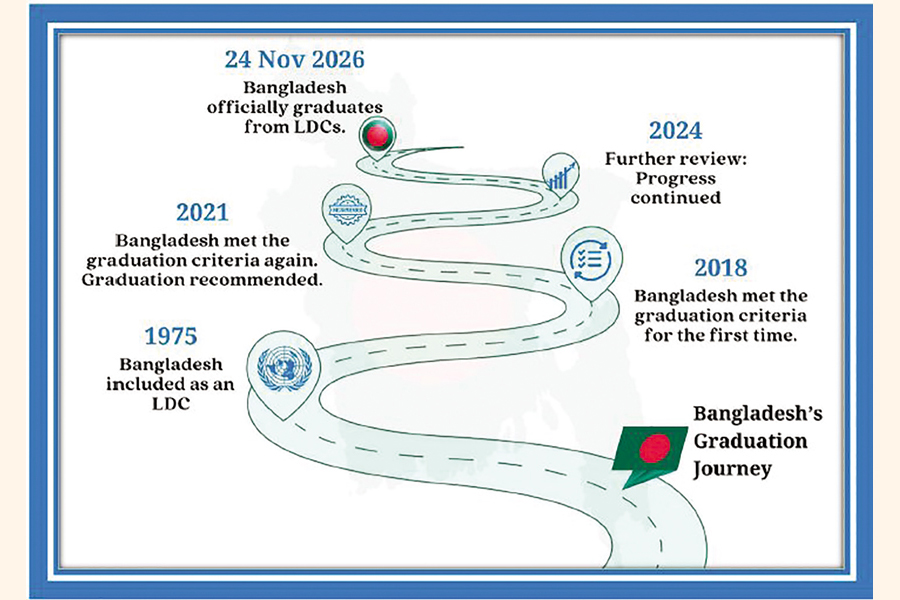

Graduation from Least Developed Country (LDC) status to a developing nation is a new milestone in the development journey of Bangladesh. Upcoming graduation in November 2026 is a testimony of the strides that Bangladesh has made over the decades in improving income levels, reducing poverty and fostering human development. While exit from the LDC group is an obvious recognition of progress and economic maturity, graduation nonetheless poses a new set of challenges, especially for the export-oriented sectors.

As LDC, Bangladesh has been enjoying 'zero tariff benefits' under the Generalised Scheme of Preferences (GSP) of the European Union. 'Everything But Arms' (EBA) initiative was introduced in 2001, as per which almost all products, except arms and ammunition, originating from LDCs got duty-free and quota-free access to the EU market. Graduation from LDC will mark the end of trade benefits under the EBA regime for Bangladesh.

Bangladesh enjoys zero-duty benefits in developed and developing countries under the World Trade Organisation (WTO) declaration approving duty exemptions for all goods originating in LDCs. The US government did not fully comply with the declaration, and so garment exporters in Bangladesh have faced a 15.62 per cent duty on apparel exports to the US.

Bangladesh receives preferential treatment in 38 countries. Of the total merchandise shipped from Bangladesh annually, 73 per cent is LDC-induced. Around 84 per cent exports from Bangladesh comprises readymade garments (RMG).

The EU and the UK combined account for almost 60 per cent of merchandise exports from Bangladesh and more than 90 per cent of those export earnings come from RMG industry. Except for the US, which accounts for approximately 16 per cent of the exports, Bangladesh enjoys duty free market access in all major export destinations including Australia, Canada, India, Japan and China;.

Apart from direct trade benefits, Bangladesh enjoys Special and Differential Treatment (SDT), which includes Trade Related Intellectual Property Rights (TRIPS). Under the TRIPS agreement Bangladesh enjoys free access to numerous Intellectual Property Rights (IPRs). The TRIPS allows pharmaceutical companies in Bangladesh to manufacture patented drugs without paying royalty fees. Nullification of TRIPS after LDC graduation would affect the pharmaceutical industry adversely and put significant burdens on exporting industries reliant on the TRIPS agreement.

Once Bangladesh graduates from LDC category, local exporters may face an 11.5 per cent duty in major export destinations in the EU. On the other hand, duty imposed on exports in some emerging markets could be as high as 20 per cent in India and 18 percent in Japan. It is estimated that increased tariffs could result in decrease in exports ranging from 5.5 per cent to as high as 14 per cent. The loss of preferential market access, especially for the garments sector, will be a major challenge for Bangladesh after LDC graduation.

LDC graduation will also bring restriction on providing subsidies to bolster the export sector. So far, Bangladesh has been implementing extensive export subsidy programme to support the apparel and other export industries. According to the WTO rules, developing and developed nations are not allowed to provide direct cash subsidies on export receipts.

The WTO Ministerial Conference took the decision in 2024 to give preferential access facilities to graduating LDCs for three more years. The EU, the UK and some countries such as Canada and Australia have already agreed to continue duty-free access benefits for Bangladesh up to 2029. Trade relationship with Japan, China, South Korea and the South Asian countries will, however, depend on bilateral negotiations.

Graduating from the LDC group does not necessarily imply loss of preferential treatment. Developing Countries Trading Scheme of the UK would continue to provide improved market access after graduation to developing economy. Proactive engagements with the EU may pave the way to secure similar preferences.

An extension of the regular GSP, the GSP+ scheme is a special incentive arrangement for 'vulnerable developing countries'. The GSP+ scheme for Sustainable Development and Good Governance grants full removal of tariffs on over 66 per cent of EU tariff lines. To qualify for the GSP+ scheme, Bangladesh has to fulfill the 'vulnerability' criteria set by the European Union and ratify 27 international conventions. Moreover, Bangladesh is unlikely to qualify for being a large supplier to the EU, as under the GSP+ scheme an exporting country's share in total EU import should not exceed 7.4 per cent.

It is important for Bangladesh to maintain economic strength and resilience, which has been made obvious by the fact that Bangladesh has outperformed all previously graduated LDCs by fulfilling all three criteria of graduation: gross national income (GNI) per capita, human assets index (HAI), and economic and environmental vulnerability index (EVI). Fulfilling any two of the criteria would suffice for graduation from LDC.

To overcome the challenges arising from loss of preferential market access, Bangladesh needs to engage in proactive negotiations with major trading partners to sign Free Trade Agreements (FTAs), Economic Partnership Agreements (EPAs), Comprehensive Economic Partnership Agreements (CEPAs) and Preferential Trade Agreements (PTAs).

Bangladesh signed its first bilateral PTA with Bhutan in December 2020. Engagements for penning agreements with 13 major trade partners are ongoing, including China, India, Japan, and the US.

The first session of formal negotiation with Japan to sign a trade deal allowing manufacturers to retain duty-free export benefits after LDC graduation was held in Dhaka in May 2024. Both sides have set the goal to conclude the negotiations for signing EPA by December 2025. Japan is Bangladesh's 12th largest trading partner in exports and seventh-largest in imports.

Bangladesh and South Korea have begun negotiations to accelerate trade and investment growth through bilateral EPA. Both countries announced the commencement of these negotiations by signing a memorandum of understanding (MoU) in November 2024. The Republic of Korea was the first country to set up an exclusive foreign Export Processing Zone (KEPZ) in Bangladesh and is till date one of the top sources of Foreign Direct Investment (FDI). Bilateral trade between Bangladesh and Korea registered US$ 2.3 billion in 2023.

India is the largest neighbour and the second biggest trade partner of Bangladesh in Asia. Bilateral talks to initiate negotiations on a CEPA between Bangladesh and India have been underway, with the goal to enhance economic relations, streamline trade processes, and promote investment between the two countries.

It is also crucial for Bangladesh to forge strategic regional and global partnerships to maintain growth as a developing economy. Strengthening economic partnerships with emerging economies and exploring new markets in Asia, Africa, and Latin America would widen up opportunities of growth as well as mitigate the risks associated with overreliance on developed markets in EU and the US.

Overreliance on the RMG sector makes Bangladesh economy vulnerable in face of tariffs and external shocks. Bangladesh has to prepare cautiously to navigate transition to developing economy and accelerate its economic diplomacy engagements to mitigate the impact of lost preferential access. It is imperative for Bangladesh to take up pragmatic steps to protect its dominant industry and speed up efforts for economic diversification.

T I M Nurul Kabir, Executive Director, Foreign Investors Chamber of Commerce and Industries (FICCI) is an analyst on Business, Technology and Policy.

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.