Published :

Updated :

According to the International Monetary Fund's (IMF) Global Debt Database (IMF Annual Report, 2022), overall global borrowing rose by 28 percentage points to 256 per cent of GDP in 2020. Government borrowing accounted for half of this increase, and the remainder from non-financial corporations and households. Public debt now represents close to 40 per cent of the global total, highest in almost six decades.

According to the Institute of International Finance (IIF), the global association of the finance industry, global debt hit a record US$300 trillion or 349 per cent of global GDP as of June, 2022, 26 per cent higher than the pre-Global Financial Crisis (GFC) figure of 278 per cent (June, 2007). It further adds to amplify the critical situation that the US$300 trillion works out to US$37,500 debt for every person in the world compared to a GDP per capita of US$12, 000.

S&P Global Ratings estimated late last year that central bank rate rises could land global borrowers with US$8.6 trillion in extra debt servicing costs in the coming years, warning a slowdown in economic activity as a result. The world is also at risk of a crisis as governments, households and financial institutions binge on debt, a habit that S&P Global Ratings warns could push overall debt to global GDP ratio to 366 per cent by 2030. More troubling is the decline in economic value add from every additional dollar of debt, or put to it differently-- productivity from debt has declined.

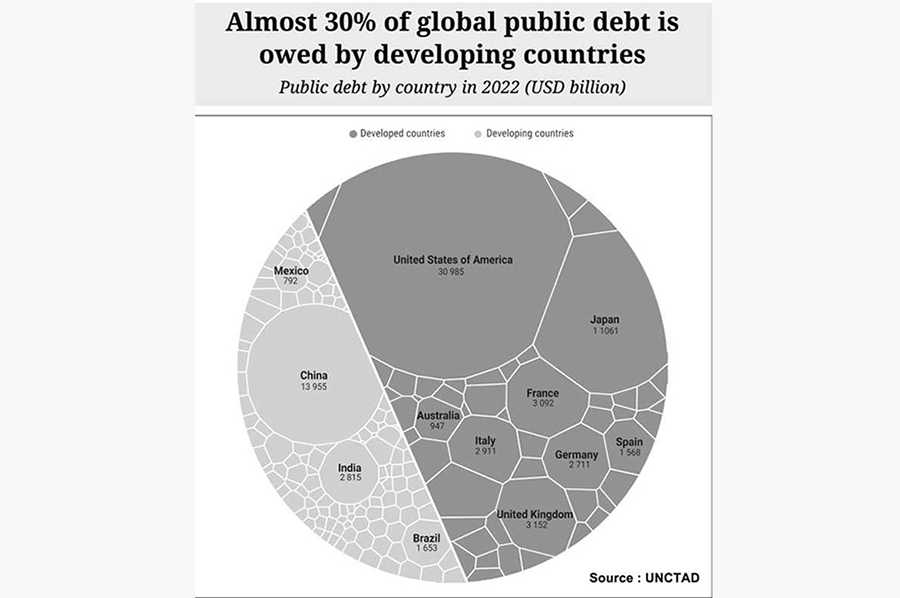

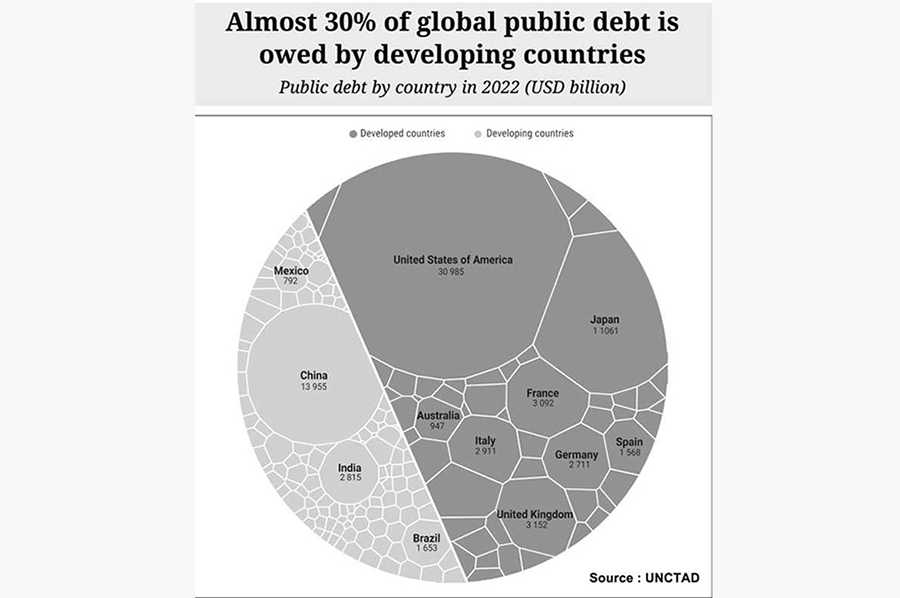

The United Nations (UN) Secretary General released a report on July 12, 2023, titled "A world of debt: A growing burden to global prosperity" and issued a grave warning as global public debt reached an all time high of US$92 trillion in 2022. This five-fold surge in public debt levels since 2000 demands immediate action to tackle the escalating crisis affecting developing countries in particular.

The UN Secretary General further emphasised, "On average, African countries pay four times more for borrowing than the United States and eight times more than wealthier European economies. A total of 52 countries -almost 40 per cent of the developing world - are in serious debt trouble".

The IMF Annual Report, 2022 also indicated that governments around the world are now struggling with rising debt liabilities in a highly uncertain environment of elevated inflation and slow down in growth. As monetary policy tightens to tame inflation, sovereign borrowing costs will rise, narrowing the scope for government spending and increasing debt vulnerabilities in developing economies.

As interest rates are rising, debt servicing is becoming increasingly more difficult, especially for developing countries. With slowing economies, the debt burden is getting even heavier. As the UN Secretary General warned that 52 countries had no way to reduce their debt burden and were approaching default, yet the subject of debt restructuring at the G20 finance ministers meeting held in India recently has gone nowhere.

Debt levels have been rising over the 20 years but since the onset of Covid -19 pandemic, debt levels have escalated. High debt levels are obviously associated with increased interest costs. But developing countries are likely to be burdened with higher levels of interest payment than advanced countries. This has prompted the UNCTAD to say that that the "inherent inequality in the international financial system is burdening developing countries disproportionately".

UNCTAD further noted that African countries were paying four times more interest than the US, and eight times more than the richest nations in Europe. Restructuring this debt is proving difficult because 62 per cent of this debt is now held by private creditors, up from 47 per cent a decade ago.

Why it is so? Because interest costs are directly related to a country's credit rating or risk. A sovereign credit rating is an independent assessment of a country. Sovereign credit ratings can give investors and financial institutions insights into the level of risk associated with investing or lending to a particular country, including any political risk. A country with good credit rating would pay lower price for its interest and in case of a weak economy and higher risk, then it will pay higher price for its interest,

At the request of a country, a credit rating agency will assess the credit worthiness of the country based on its economic and political environment. Most countries seek credit ratings from the largest and most prominent credit rating agencies such as Standard & Poor's (S&P), Moody's and Fitch Ratings which help them to attract foreign direct investment (FDI) or to obtain credit from large financial institutions. Together these three credit rating agencies control around 95 per cent of credit ratings in the financial markets. It is very essential for developing countries that want to attract FDI or borrow from financial institutions or want to have access to international bond markets for funding to get a credit rating.

Therefore, if an advanced economy such as the US can obtain funds at 2 per cent interest rate, a developing country with low credit rating is likely to pay far more such as 10 percentage point or more interest to obtain credit. The debt/GDP ratio for developed country now stands at 112.4 per cent and the same for developing economies is 67.5 per cent.

The debt/GDP ratio of some of the developed countries is even higher than the average. In case of Japan it is 258 per cent, Singapore 135 per cent and the US 128 per cent. The US claims both as the world's biggest nation with debt in terms of the US dollar and the largest economy with a debt-to-GDP ratio of approximately 128 per cent. But for a developing country like Bhutan the ratio is 130 per cent, almost double the developing country average.

While developed countries are far more debt-laden economies, developing countries need to pay far more than the developed in interest payments because of the way the international financial system operates based on the credit rating.

Just little over a decade since the GFC of 2008, interest rates were falling, even moved into the negative zone in some countries and that enabled governments around the world to pile up huge debt. Those days have now gone, most central banks around the world including the US Federal Reserve are raising interest rate higher and will continue to do so until inflation is brought to the target range.

The US will spend more on debt interest payment this year as a share of GDP than any time before. In the US, net interest payments on the national debt rose from $352 billion in 2021 to $475 billion in 2022 - the highest nominal dollar amount in recorded history. Relative to the size of the economy, such costs were 1.9 per cent of GDP, the highest level in 21 years.

It is expected that debt interest payment in the US will reach an all-time high by 2030 when interest rates are expected to fall. But the Fed last Wednesday (July 25) raised its benchmark rate by a quarter point to 5.25 -5.50 per cent range, lifting interest rates to their highest level in 22 years and hints at another increase this year.

Compared to the US, developing countries like Sri Lanka and India have a much higher debt interest payments to GDP ratio -80 per cent and 27 per cent respectively. Although developing countries have much less debt levels, they need to pay far more than developed countries in interest payments. This is what the UNTAD has described as inherent inequities in the international financial system burdening developing countries disproportionately.

If the global economy now goes into recession, GDP will fall and the debt interest payments/GDP ratio for developing countries will further rise. In fact, the IMF in its update on "World Economic Outlook" published last Tuesday (July 25) said, "the balance of risks to global growth remains tilted to the downside. Inflation could remain high and even rise if further shocks occur".

As international debt in most instances is usually denominated in the US dollar (USD), so interest payments are to be made in the USD. As such developing countries need to have sufficient US dollars to pay up. But many countries now face USD shortages. The only way out for these countries is to ask for bail-out from the IMF as Sri Lanka and Pakistan did last year which further adds to the pile of already accumulated debt.

Also, developing countries that run current account deficits (i.e. net importers) face foreign exchange shortages. This problem gets further compounded if the country also experiences currency depreciation which makes imports more expensive leading to a fall in foreign exchange reserve. In summary, as the levels of debt rise, so also costs of debt servicing, leading to a fall in foreign exchange reserve. Over the last one year about 90 countries experienced fall in their foreign exchange reserves.

Public debts are likely to go up further. The fear is-- public debt can become unmanageable if interest rates continue to rise. Every attempt to borrow more now will limit government's ability to respond to the next crisis. To mitigate the risk of a financial crisis which will lead to recession, trade-offs between spending and saving may be needed along with the necessary taxation reform to raise revenue by increasing direct taxation.

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.