Published :

Updated :

To tap the liquidity of Sharia-compliant banking area for financing the government’s deficit budget and for supporting the country’s overall development, a decision was made to introduce Islamic bond, or ‘Sukuk’, in the fiscal year 2019-20.

On the one hand, a significant number of investors were disinclined to invest in interest-bearing Treasury bills and bonds, and other government securities, and on the other hand, the liquidity of Sharia-based banks and financial institutions remained largely unutilised due to the lack of opportunities to invest in conventional securities. In this context, the government issued the ‘Bangladesh Government Investment Sukuk Guideline, 2020’ on October 8, 2020, and appointed the Bangladesh Bank to act as the Special Purpose Vehicle (SPV) and Trustee. Additionally, the Finance Division of the Ministry of Finance serves as the originator for issuing Sukuk, and there is also a robust Sharia Advisory Committee in place to look after the Sharia compliance.

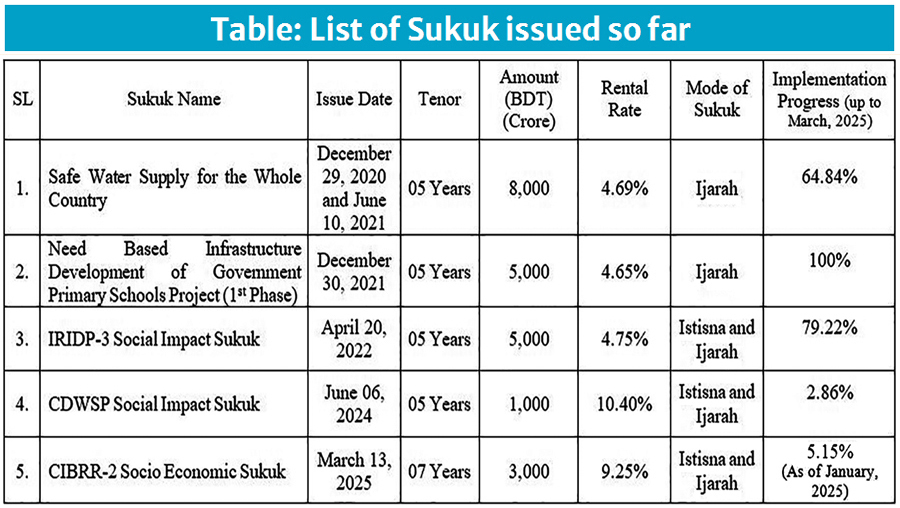

In the past few years, the Bangladesh government has raised Tk 220 billion by issuing five separate investments Sukuk. In furtherance, a decision has been made to issue the 6th Bangladesh Government Investment Sukuk, worth Tk 20 billion with seven-year tenure, using the Ijara methods for the project titled ‘Rajshahi Division Important Upazila & Union Road Widening & Strengthening Project (RDIRWSP)’.

SIXTH SUKUK: The prospectus for issuing the Bangladesh Government Investment Sukuk (RDIRWSP Socio-Economic Development Sukuk) has been finalised with the approval of the Sharia Advisory Committee of the Bangladesh Bank. The auction for the mentioned Sukuk will be held on May 19, 2025 at the head office of the Bangladesh Bank and will be issued on the next working day, which is on May 20, 2025. According to the prospectus, the Sukuk will be issued under the Ijara methods, with seven year tenure, that means maturity date would be May 20, 2032. Investors will be paid Tk 2.10 billion annually (at a rate of 10.50 per cent) as rent on a semi-annual basis. Banks and financial institutions with a current account/Al-Wadiah current account with the Bangladesh Bank can participate directly in the auction. Additionally, domestic and foreign individual investors, insurance companies, provident funds, and the Deposit Insurance Fund can participate through banks/financial institutions having a current account/Al-Wadiah current account with the Bangladesh Bank.

Various infrastructural projects require investment to carry out the country’s economic development activities, which are planned in the budget of each fiscal year. In general, to support the budget deficit, the government raises fund by issuing treasury bills and bonds through conventional banks. About one-fourth of the total assets held by Sharia-based banks in the banking sector had led the government to introduce Islamic bonds or Sukuk to utilise the liquidity of Sharia-based banks for government developmental activities. Currently, due to the high demand for Sukuk among the clients of conventional banks, the fourth Sukuk has been made more universal.

The term ‘Sukuk’ is actually the plural of ‘Sakka’—a type of legal document or contract. The first issuance of Sukuk took place in the seventh century in Damascus, present-day Syria. Sukuk represents Islamic certificates that signify undivided ownership rights in services, projects, investments, or real estate or their usufruct. In other words, Sukuk is a document indicating partial ownership of a tangible or intangible asset or a service.

The crucial difference between conventional bond and Sukuk is that Sukuk are issued based on ownership or rights over an asset. This means that Sukuk is not a debt rather a form of partial ownership or rights. The prime feature of Sukuk is that it is entirely managed according to Sharia principles, which means it is free from riba or interest.

Various structures or methods can be followed in issuing Sukuk, such as Mudarabah, Musharakah, Murabaha, Istisna, Salam, Ijara, and Qard Hasan. The implementation work of the project titled ‘Rajshahi Division Important Upazila & Union Road Widening & Strengthening Project (RDIRWSP)’ is in its initial stages. The sixth Sukuk based on the above project will be issued using the Ijara methods and main underlying contracts are Istisna and Ijara, where the asset will be prepared under the Istisna contract and then leased out under the Ijara contract, with the rental payments serving as the profit for the Sukuk holders amounting Tk 14.70 billion. In general, Ijara Sukuk is issued by the property owner to lease or rent the property in exchange of rental payments. Sukuk holders become owners of the underlying asset in exchange of their subscription.

According to the type of investors, the allocation percentages for the sixth Sukuk are as follows: (1) Shariah-based banks, financial institutions, and insurance companies—70 per cent of the issued Sukuk, (2) Islamic branches and windows of conventional mainstream banks—10 per cent of the issued Sukuk, and (3) individual investors, provident funds, deposit insurance etc—20 per cent of the issued Sukuk.

Additionally, besides the aforementioned three categories, all conventional banks/finance companies/insurance companies can participate in the Sukuk auction. The allocation of Sukuk to investors will follow three steps:

- If the bids submitted by any of the three categories exceed the designated proportion, the Sukuk will be allocated to the bidders within that category on a pro-rata basis.

- If fewer bids than the designated proportion are submitted in any category, and more bids than the designated proportion are submitted in another category, the remaining Sukuk will be allocated to the bidders who submitted higher bids on a pro-rata basis.

- If the required subscription is not met across the three categories, the remaining Sukuk will be allocated proportionately among the participating conventional banks, financial institutions, and insurance companies.

Sukuk-1: The first Bangladesh Government Investment Sukuk was issued in two phases on December 29, 2020, and June 10, 2021, aiming to raise Tk 80 billion for the ‘Safe Water Supply Project Nationwide’ with bids reaching 3.79 times and 8.18 times of the issued amount respectively. Bids amounting Tk 478.79 billion were submitted. This five-year Ijara Sukuk has a rental rate of 4.69 per cent and will mature on December 29, 2025. The Department of Public Health Engineering is the implementing agency for the project, which is nearly 65 per cent complete.

Sukuk-2: The second five-year Sukuk of Tk 50 billion, was successfully issued on December 30, 2021, to finance the ‘Demand-Based Government Primary School Development Project (Phase 1)’. Structured under the Ijara method, the Sukuk offered a competitive rental rate of 4.65 per cent to investors. The issuance received a robust response, with bids reaching 4.66 times of the offered amount, reflecting strong investor confidence. The project was implemented by the Directorate of Primary Education under the Ministry of Primary and Mass Education and has now been fully completed, marking a significant milestone in the enhancement of primary education infrastructure.

Sukuk-3: The third five-year Sukuk, named IRDP-3 Social Impact Sukuk, worth TK 50 billion was issued on April 20, 2022, for the ‘Priority Rural Infrastructure Development Project-3’. This Sukuk was issued under the Istisna and Ijara methods, with a rental rate of 4.75 per cent for Sukuk holders. The Local Government Engineering Department is the implementing agency, and the project is currently 80 per cent complete.

Sukuk-4: The CDWSP Social Impact Sukuk, amounting to Tk 10 billion, was issued on June 6, 2024, under the ‘Chattogram Division Upazila & Union Road Widening & Strengthening Project (CDWSP)’. Aimed at improving connectivity and transportation across both rural and urban areas, the project focuses on widening and strengthening local roads in Upazilas and unions to support economic growth in the Chattogram Division. Structured under Istisna and Ijara contracts, the Sukuk offers a 10.40 per cent rental rate and attracted strong investor interest, with bids reaching 4.41 times of the issued amount.

Sukuk-5: The first Seven-year Social Impact Sukuk named ‘Construction of Important Bridges on Rural Roads (Phase-II) project (CIBRR-2)’ worth Tk 30 billion, aimed at improving rural connectivity in Bangladesh that focuses on building vital bridges on rural roads to facilitate better transportation, promote economic activity, and improve the quality of life for people living in rural areas. This Sukuk was issued under the Istisna and Ijara methods, with a rental rate of 9.25 per cent for Sukuk holders, and it was issued on March 13, 2024, with bids reaching 3.64 times of the issued amount.

End note: Sukuk play a pivotal role in driving socio-economic development and enhancing the stability of the Islamic financial sector in Bangladesh. By funding key infrastructure projects such as roads, schools, bridges, and water systems, Sukuk contribute to employment generation, to increase productivity, and broader economic growth. These instruments also support poverty alleviation and empowerment of rural people by improving connectivity and public welfare in underdeveloped regions. Moreover, Sukuk promote financial inclusion by offering Sharia-compliant investment opportunities to individuals and institutions that are hesitant to invest in interest bearing instruments due to religious restrictions.

Sukuk have emerged as a transformative financial tool in Bangladesh, advancing socio-economic development while fostering a stable and inclusive Islamic financial ecosystem. By aligning public financing with ethical and faith-based investment principles, Sukuk not only meet developmental needs but also solidify the foundation of Islamic finance in the country.

Istequemal Hussain is Director, Debt Management Department, Bangladesh Bank, and Member Secretary, Shariah Advisory Committee, Bangladesh Bank. stequemal.hussain@bb.org.bd

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.