Published :

Updated :

The International Monetary Fund (IMF) on last Tuesday (April 11) released its Global Economic Outlook (WEO) report in Washington D.C. The global economy, the IMF warned in its report, is “entering a perilous phase during which economic growth remains low by historical standards and financial risks have risen, yet inflation has not decisively turned the corner.”

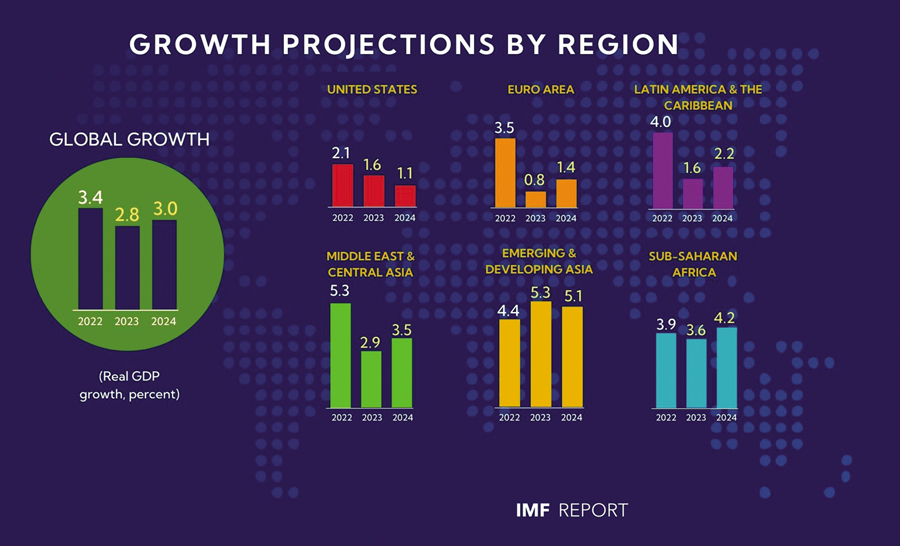

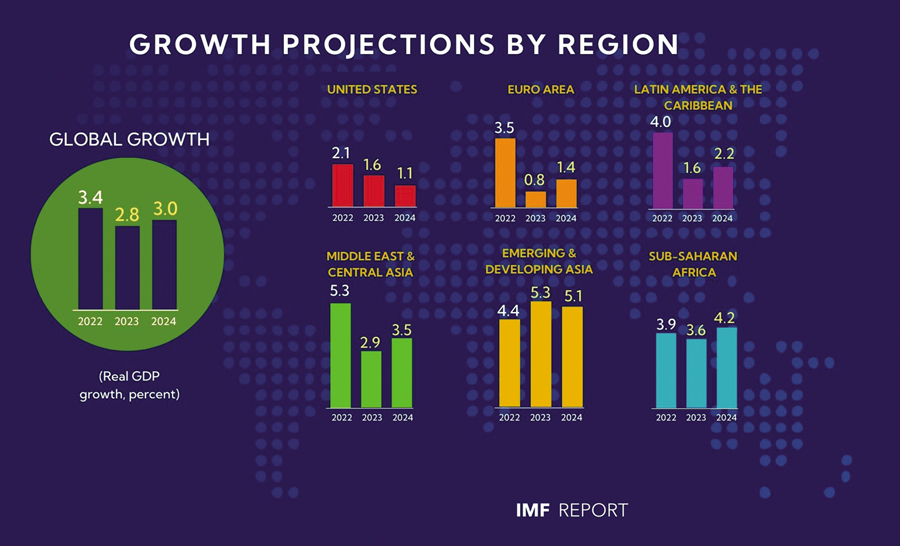

The report says that the global economy is heading for the weakest period of growth since the 1990s in the next five years from now. According to the IMF, global GDP growth will slow from 3.4 per cent in 2022 to 2.8 per cent in 2023 compared to its estimated 2.9 per cent made in January this year before rising to 3.0 per cent in 2024. In addition, advanced economies are expected to see an especially pronounced growth slowdown from 2.7 per cent in 2022 to 1.3 per cent in 2023.

“The world economy is not currently expected to return over the medium term to the rates of growth that prevailed before the pandemic”, the report further mentioned. Global GDP is expected to grow at about 3 per cent over the next five years compared to an average of 3.8 per cent seen in the last 20 years. This represents the lower medium-term economic performance over the last 30 years. Some of this decline reflects the slowing down of formerly high-performing economies like China and South Korea.

The IMF further added that slower global labour force growth and geo-political fragmentation, such as Brexit and the conflict in Ukraine, also played their role. IMF managing director Kristalina Georgieva, a couple of days before the WEO report was released, warned against economic fragmentation stemming from geo-political tensions and urged countries to take action to boost global productivity. She also cautioned about the economic consequences of restrictions on trade, capital and labour flows.

The report points out that this year’s economic slowdown is concentrated in advanced economies like the euro area and the UK. Growth is expected to fall to 0.8 per cent and -0.3 per cent this year before rebounding to 1.4 per cent and 1.0 per cent, respectively. Also, the German economy is now forecast to contract by 0.1 per cent in 2023, and Japan will grow by 1.3 per cent this year. The US economy will expand by 1.6 per cent, and China’s GDP is expected to grow by 5.2 per cent this year. The report tries to put the best possible face on a worsening situation.

But even with a 0.5 per cent downward revision, many emerging and developing economies are picking up their growth momentum, with year-on-year growth accelerating to 4.5 per cent in 2023 from 2.8 per cent in 2022. The Bangladesh economy is projected to grow by 5.5 per cent this year and 6.5 per cent in 2024. Emerging and developing economies, however, would be hit hard by lower demand for exports, currency depreciation and rising inflation.

This baseline forecast assumes that the recent financial sector stresses are contained, indicating that the continual threat of a major financial crisis can rapidly upend whatever limited expansion is likely to occur. IMF chief economist Pierre-Olivier Gourinchas in his blog on the WEO report, warned that while there was the appearance of a gradual recovery but “below the surface, however, turbulence is building, and the situation is quite fragile”.

The report said, “Uncertainty is high, and the balance of risks has shifted firmly to the downside so long as the financial sector remains unsettled”. So, the IMF also provides a plausible alternative growth scenario with increased financial sector stress. Under this alternative scenario, global growth declines to 2.5 per cent in 2023, with advanced economies’ growth falling below 1.0 per cent.

Global economic conditions have become more complex and confronting relatively to even a few months ago. The IMF acknowledged forecasting was difficult “With the recent increases in financial market volatility, the fog around the world economic outlook has thickened”. The threat of a financial crisis looms large over the slowing global economy.

The recent bank failures shed light on the consequences of the turn in central banks across many advanced economies, including the US tightening monetary policy by interest rate hikes to bring down high inflation. However, according to the IMF, Inflation is proving to be stickier than expected. It further noted, “A hard landing – particularly for advanced economies – has become a much larger risk. Policymakers may face difficult trade-offs to bring down sticky inflation while preserving financial stability”.

The IMF also warns that high inflation has yet to be tamed despite aggressive rate hikes globally. But global headline inflation in the baseline is expected to fall from 8.7 per cent in 2022 to 7 per cent in 2023 as commodity prices moderate. As a result, inflation is unlikely to return to central bank targets before 2025.

While inflation proves to be stickier than anticipated, the IMF has seen no sign of a wage-price spiral. But it did detect business enterprises taking advantage of a pickup in demand to boost profit margins. It is estimated that rising profit margins have contributed 45 per cent to rising inflation in the US while wage rises contributed 20 per cent with 35 per cent coming from increased consumer demand.

The IMF raised its core inflation forecast to 5.1 per cent this year from 4.5 per cent forecast made in January. But core inflation, which excludes energy and food prices, is expected to take longer to moderate. It is to be noted that the IMF forecasts have not considered the impact of a recent oil output cut by OPEC-plus countries that have already caused oil prices to spike, nor the current drought affecting Canada and its impact on global food grain supply.

The report points out that deteriorating financial conditions can weaken the real economy “with the chances of a hard landing having risen sharply”. It further mentioned that policy makers attempting to tame inflation while at the same time trying to avert a “hard landing” or a recession “may face difficult trade-offs”.

Recent turmoils in the global financial market arising from the collapse of some banks in the US and Europe have prompted the IMF to warn that there is a 15 per cent probability of another financial shock coming from the banking crisis, which would cause a global recession. Even moderate tightening of financial conditions could lead to an additional 0.3 per cent point off global growth to 2.5 per cent.

It also warns that pockets of sovereign debt distress could, in the context of higher borrowing costs and lower growth can, become more systemic. Yet, the IMF insists that the current central bank monetary policy tightening with interest rate hikes continues as the key policy instrument to tame inflation to its target rate. IMF chief economist Gourinchas told Reuters that central banks should not halt their fight against inflation because of financial stability risks which looked “very much contained”.

Gourinchas in his blog, also adds, “A silver lining is that the banking turmoil will help slow aggregate activity as banks curtail lending. In and itself, this should partially mitigate the need for further monetary tightening to achieve the same policy stance”.

He also warned that some of the recent slowdowns in medium-term prospects might also reflect more “ominous forces”, such as the scarring impact of the pandemic and slower pace of structural reforms. Also, rising threats of geoeconomic fragmentation impact trade and investment flow as well as a slower pace of innovation and technology adoption across fragmented “blocs”.

Gourinchas then gave a veiled warning against the consequences of deglobalisation and wrote, “A fragmented world is unlikely to achieve progress for all or to allow us to tackle global challenges such as climate change or pandemic preparedness. We must avoid that path at all costs”.

In this uncertain global economic environment, developing countries like Bangladesh need to strike the right balance between dealing with the current challenges and preparing for the future to safeguard the economy against global risks.

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.