Published :

Updated :

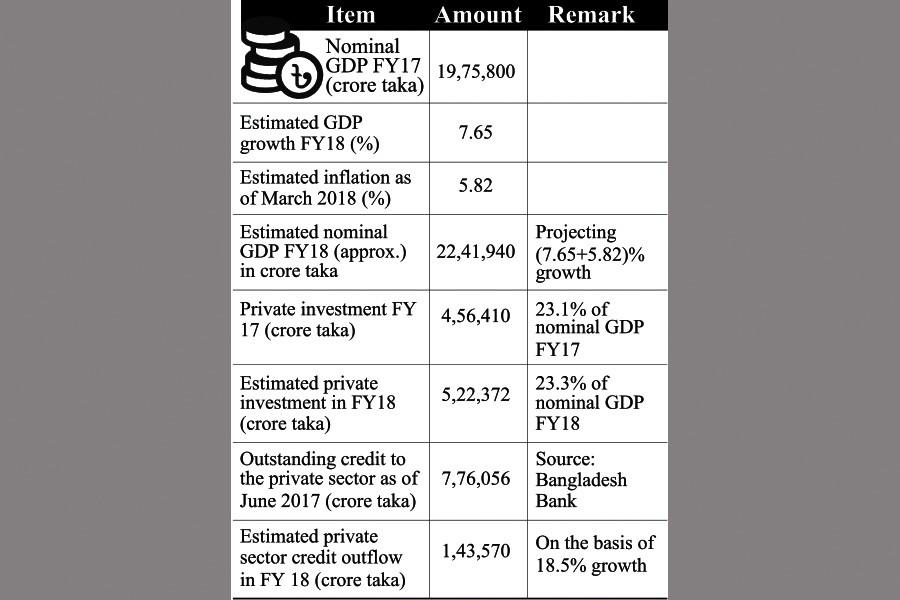

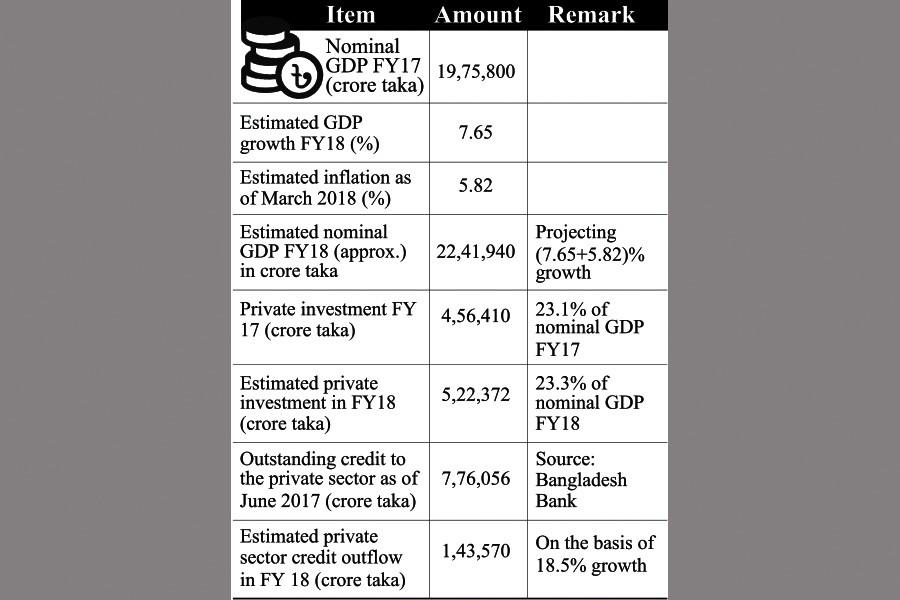

One of the points made by the Centre for Policy Dialogue (CPD) in their review of the economy presented on April 17, according to newspaper reports, is that private investment/GDP (gross domestic product) ratio remained almost unchanged at 23.3 per cent during the current year implying a 7.65 per cent growth in private investment, same as the estimated GDP growth. CPD points out that in contrast, growth of credit to the private sector during the current year has been around 18.5 per cent against Bangladesh Bank (BB) target of 16.3 per cent. According to them, higher growth rate in private sector credit compared to lower growth rate in private investment raises a question, where did the rest of the money go?

CPD seems to be missing the point that GDP growth has been expressed in real terms while private sector credit growth has been expressed in nominal terms. Moreover, the two percentages have been calculated on two different bases - one is the stock of outstanding credit to the private sector as of June 2017 and the other is the flow of private investment during FY17.

As the numbers in the Table show and as would be expected, the estimated private investment in FY18 is much higher than the estimated supply of credit to the private sector. One needs to remember that neither all private investments are financed out of credit, nor all private sector credits go to finance investment. The levels of domestic and national savings well explain the gap between private investment and credit to the private sector.

As an illustration of the possible destination of the missing money, CPD has mentioned that many commercial banks have purchased share in the capital market beyond the limit permitted by the BB. But purchase of share by commercial bank is the bank's investment and not a part of its advances to the private sector.

It is one thing to suggest that part of the private sector credit may have been taken out of the country through over invoicing of imports or diverted to the capital market to buy shares, it is quite another to smell missing money because private sector credit growth has been higher than the target while investment/GDP ratio remained unchanged. The latter, surely is a case of misplaced emphasis.

The policy prescription that follows from such a case of misplaced emphasis is to put a brake on the growth of credit to the private sector. The argument that is put forward is that the quality of lending will improve if the volume of credit to the private sector is smaller. It is also recommended out of the concerns over balance of payments and the concerns relating to inflationary pressure in an election year.

If past evidence is any guide, the size of non-performing loan (NPL) and its distribution amongst the financial institutions have very weak links with the volume of credit disbursed. Much more effective antidote to NPL involves quick disposal of all NPL-related legal proceedings, particularly the writ cases through setting up dedicated benches for NPL and withholding political support to the loan defaulters.

Similarly, the issue of money laundering through import mispricing needs to be addressed through effective scrutiny at all levels rather than through smothering credit flow to the private sector. Surely, chopping off the head to get relief from headache is no solution.

One factor that contributed to the declining current account balance in recent times was the diversion of remittance money from legal to illegal channels, particularly through unauthorised use of mobile financial services (MFS). BB deserves praise for diagnosing the problem correctly and taking administrative measures that have already started yielding results. If these measures are strengthened further and remittance inflow goes back to the usual rhythm of double digit growth, there will be less reason to worry about current account deficits.

Finally, on the issue of inflationary threat, the quality of public expenditure assumes far greater importance in terms of its incidence compared to the size of private sector credit.

Dr Zaid Bakht is Chairman of Agrani Bank Limited.

zaidbakht@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.