From cash to clicks

How digital payments are changing microfinance in Bangladesh

Published :

Updated :

Bangladesh's financial services landscape has significantly transformed over the past decade, with the rapid shift from traditional cash-based transactions to digital payments. This evolution is particularly pronounced in microfinance, which has long been crucial in addressing financial inclusion, poverty alleviation, and economic empowerment. The rise of digital payments in microfinance marks a paradigm shift as it integrates technology with finance, creating opportunities for increased efficiency, transparency, and access.

Microfinance institutions (MFIs) in Bangladesh have traditionally operated through a network of field officers who would physically collect payments, disburse loans, and provide financial services to borrowers, primarily in cash. The growth of digital infrastructure, the availability of mobile technology, and the expansion of mobile financial services (MFS) have set the stage for the transition from cash to clicks.

Microfinance in Bangladesh has historically relied on cash-based transactions, where loan officers would travel to rural and semi-urban areas to disburse loans and collect payments. While this method effectively reached underserved communities, it was fraught with challenges. The physical handling of cash posed security risks, led to inefficiencies in loan disbursement and repayment, and resulted in delays in processing. Moreover, manual record-keeping increased the likelihood of errors and discrepancies.

Digital transformation refers to integrating digital technologies into all business areas, fundamentally changing how the business operates and delivers value to its customers. In Bangladesh's microfinance context, this transformation is marked by the adoption of mobile banking, online payment systems, digital credit scoring, and data analytics using third-party software for better decision-making. Initially, MFIs relied heavily on manual processes, which were time-consuming and prone to errors. With digitalisation, these processes have become faster, more reliable, and more transparent.

The advent of digital payments, primarily through mobile banking services such as bKash, Rocket, Nagad, and others, has enabled a fundamental shift. Microfinance institutions can now offer services digitally, allowing borrowers to receive loans and repay them through mobile devices. This transition has made transactions faster, more secure, and more transparent. Borrowers no longer need to wait for field officers to visit them, and loan officers can spend more time on activities such as customer support and financial education rather than cash handling.

A report by the United Nations Capital Development Fund (UNCDF) of 2019 mentioned that nearly all microfinance organisations in Bangladesh have embraced digitalisation, with only a few exceptions. Most institutions rely on loan management system solutions that integrate data from other applications, such as financial information systems (FIS), management information systems (MIS), and human resource information systems.

Many of these microfinance institutions (MFIs) use third-party loan management solutions provided by companies like Grameen Communication, Datasoft, and Benchmark. Around 75 per cent of organisations have implemented centralised, web-based, real-time loan management systems, with 81per cent utilising third-party services. Only 18 per cent of institutions have digitalised their loan disbursement and repayment processes, and 19 per cent have adopted cashless systems for loan disbursement, repayment, and savings collection.

While all institutions use financial accounting software, 81 per cent have integrated human resource information systems, and 38 per cent use inventory and asset management systems. Despite these advancements, a survey revealed that 77 per cent of institutions have yet to make immediate plans to implement artificial intelligence in their operations.

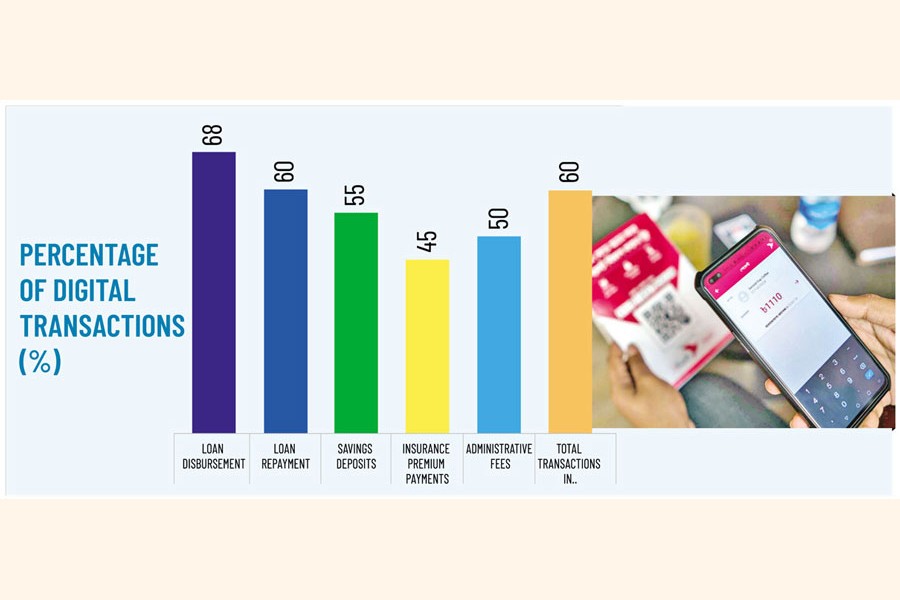

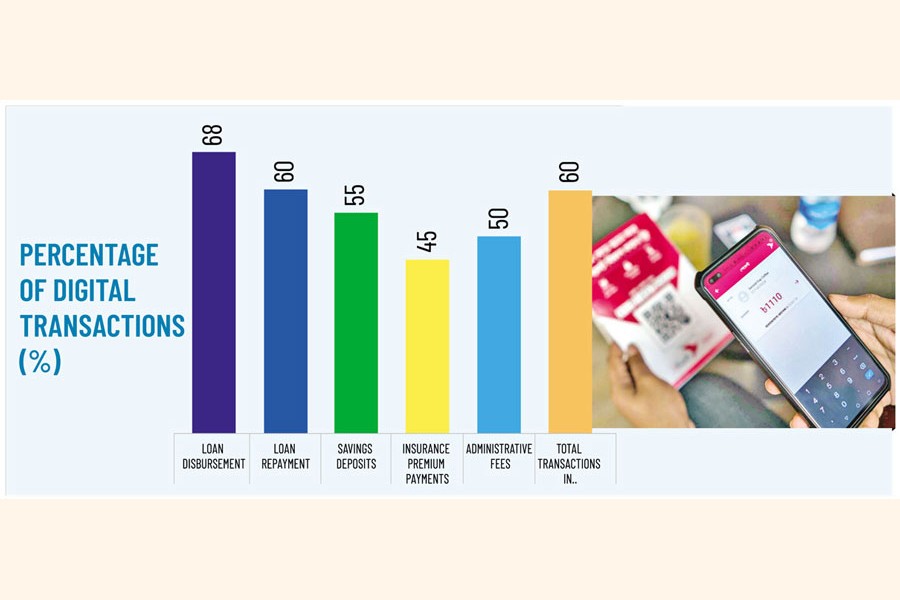

However, reviewed literature revealed that approximately 60 per cent of the microfinance transactions in Bangladesh have transitioned to digital platforms. This shift was primarily driven by the rapid expansion of mobile financial services and the increased penetration of smartphones, particularly in rural areas. The shift to digital payments has been most prominent among younger borrowers and urban microfinance clients. At the same time, traditional cash-based methods continue to hold sway in more remote and less technologically connected regions.

This figure highlights the shift toward digitalisation, with more than half of all microfinance transactions conducted via digital platforms. The most significant digital adoption has occurred in loan disbursement, where 68 per cent of transactions are now performed digitally. This trend signifies a broad acceptance of digital payments within the sector, though certain areas, such as insurance premium payments, still lag.

One of microfinance's primary goals is to promote financial inclusion by providing low-income individuals and marginalised communities with access to financial services. The shift to digital payments in microfinance has significant implications for financial inclusion in Bangladesh.

Digital payments enable MFIs to reach underserved communities more effectively.

Physical bank branches are scarce in many rural areas, and traditional banking services are often inaccessible to low-income individuals. However, with the proliferation of mobile phones and the widespread availability of mobile banking services, even individuals in remote areas can now access financial services. This reduces the dependency on physical infrastructure and allows more people to participate in the formal financial system.

Furthermore, digital payments reduce the cost of transactions for both MFIs and borrowers. Traditional cash-based transactions involve transportation costs, manual labour, and theft risk. Digital payments, conversely, are cost-effective and secure, reducing the overall cost of providing financial services. This allows MFIs to pass on the savings to borrowers through lower interest rates or reduced fees.

For borrowers, the convenience of digital payments is another critical factor in promoting financial inclusion. Borrowers can make payments at any time, from anywhere, without relying on a field officer's presence. This flexibility is particularly beneficial for individuals with irregular income patterns, such as small farmers, informal sector workers, or women engaged in home-based enterprises.

The transition to digital payments has also significantly impacted the empowerment of women, who comprise most of the microfinance clients in Bangladesh. Many women, particularly in conservative rural communities, face restrictions on mobility and may not have been able to engage in traditional cash-based transactions easily. Digital payments provide a more discreet and convenient way for women to access financial services, helping them gain greater economic independence and autonomy.

The shift from cash to clicks has introduced several operational efficiencies for microfinance institutions. Digital payments streamline the loan disbursement and repayment processes, reducing the need for manual intervention and minimising the chances of human error. This has led to quicker loan processing times and turnaround for loan approval and disbursement, enhancing the overall experience for borrowers.

Moreover, digital payments improve transparency in microfinance transactions. One of the challenges associated with cash-based transactions is the need to track and audit cash flows. Digital payments, on the other hand, provide a digital footprint for every transaction, making it easier for MFIs to monitor and audit their financial activities. This helps reduce fraud and corruption, which can be a concern in cash-based systems, particularly in large-scale microfinance operations.

In addition, digital payments allow for real-time monitoring and data collection. MFIs can track borrowers' repayment behaviour, assess credit risk more accurately, and use data analytics to improve decision-making processes. This helps identify potential defaulters early and enables MFIs to offer tailored financial products based on individual borrowing patterns and repayment history.

Digital payments offer greater transparency and accountability for borrowers. Through mobile apps or SMS notifications, borrowers can easily track their loan disbursement, repayment schedules, and outstanding balances. This reduces the risk of misunderstandings or disputes regarding loan terms and repayment amounts, enhancing trust between MFIs and their clients.

The transition from cash to digital payments in microfinance has broader implications for Bangladesh's economy. By increasing financial inclusion, digital payments contribute to the formalisation of the economy. As more individuals and small businesses engage in digital financial transactions, they become part of the formal financial system, which helps the government and regulatory authorities track economic activities more effectively. This formalisation can lead to a broader tax base and improved economic planning.

Digital payments in microfinance also support the development of a cashless economy, a key policy objective of the Bangladesh government. By reducing the reliance on cash, digital payments help to reduce the costs associated with cash handling, such as printing and transportation of physical currency. Moreover, a shift toward a cashless economy can help reduce the size of the informal economy, where cash transactions often go unreported and untaxed.

Another economic benefit of digital payments in microfinance is the increased efficiency in financial intermediation. By reducing transaction costs and improving operational efficiencies, digital payments allow MFIs to scale their operations and reach more borrowers. This, in turn, can lead to greater access to credit for small businesses and entrepreneurs, stimulating economic growth and job creation in rural and underserved areas.

Digital payments also play a significant role in promoting financial literacy. As individuals become accustomed to mobile banking apps and digital payment platforms, they gain exposure to a broader range of financial services, such as savings, insurance, and investment products. This can improve financial decision-making and better financial management practices, contributing to overall economic stability.

While the transition to digital payments in microfinance presents numerous benefits, it has challenges. One of the primary obstacles is the digital divide, particularly in rural areas where access to smartphones, the internet, and digital literacy may be limited. Although mobile phone penetration is high in Bangladesh, there are still regions where access to mobile financial services is constrained by inadequate infrastructure or low levels of digital literacy.

Another challenge is the trust deficit among some borrowers, particularly older individuals or those with limited technology experience. Many borrowers are accustomed to cash-based transactions and may hesitate to adopt digital payments due to concerns about fraud, data privacy, or the security of their financial information. Overcoming these trust barriers will require concerted efforts from MFIs, mobile financial service providers, and government authorities to promote digital literacy and build confidence in the security and reliability of digital payments.

Regulatory challenges also exist regarding data privacy, consumer protection, and cybersecurity. As the digital financial ecosystem expands, there is a growing need for robust regulatory frameworks that protect consumers' rights and ensure the security of digital transactions. The Bangladesh government and regulatory authorities must work closely with industry stakeholders to develop and enforce regulations that promote innovation while safeguarding the interests of borrowers.

The transition from cash-based transactions to digital payments in microfinance is reshaping Bangladesh's financial landscape. This shift offers numerous advantages, including increased financial inclusion, operational efficiency, and transparency.

Digital payments enable microfinance institutions to reach underserved communities more effectively, reduce transaction costs, and promote financial independence, particularly among women. The broader economic implications of this transition are equally significant, as digital payments contribute to the formalisation of the economy, the development of a cashless society, and the promotion of financial literacy.

However, challenges remain in ensuring that the benefits of digital payments are accessible to all, particularly in rural areas where the digital divide persists. Addressing these challenges will require collaboration between MFIs, mobile financial service providers, government authorities, and other stakeholders. By investing in digital infrastructure, promoting digital literacy, and developing robust regulatory frameworks, Bangladesh can continue to harness the power of digital payments to drive economic growth and financial inclusion in the years to come.

The writer is a researcher and development worker.

matiurrahman588@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.