Published :

Updated :

Increasing export is always a challenge for any country, big or small. Global economic climate sets the tone of challenge while internal condition also plays a critical role. Sometimes it becomes difficult to measure the extent of impact of global or internal factors on the ups and downs of merchandise exports. Though global factor appears more visible than internal conditions, the former is not always responsible for sluggishness in export.

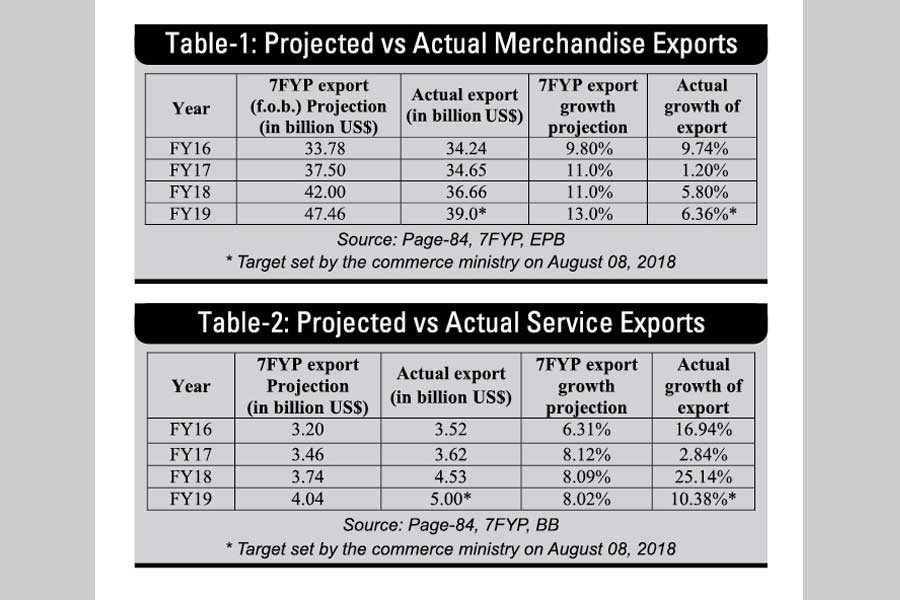

For the last couple of years, the annual growth rate of Bangladesh's merchandise export came down to a single digit. The average growth of export in the last four years, between FY15 and FY18, stood at 5.03 per cent. Moreover, export earnings in the last three years increasingly fall behind the annual projection of the Seventh Five-Year Plan (7FYP). In the past fiscal year, value of merchandise export stood at $36.66 billion against the projection of $42.0 billion (see Table-1).

Actual export earnings crossed the projected figure of 7FYP in FY16 when actual growth almost touched the projected rate. But the trend didn't continue in the next two years.

Now the government has set the annual target of export earnings at $39.0 billion for the current fiscal year (FY19). It is much lower than the projected figure of $47.46 billion. The growth rate is thus estimated at 6.36 per cent over the earnings of past fiscal year while the projection in 7FYP is 13.0 per cent.

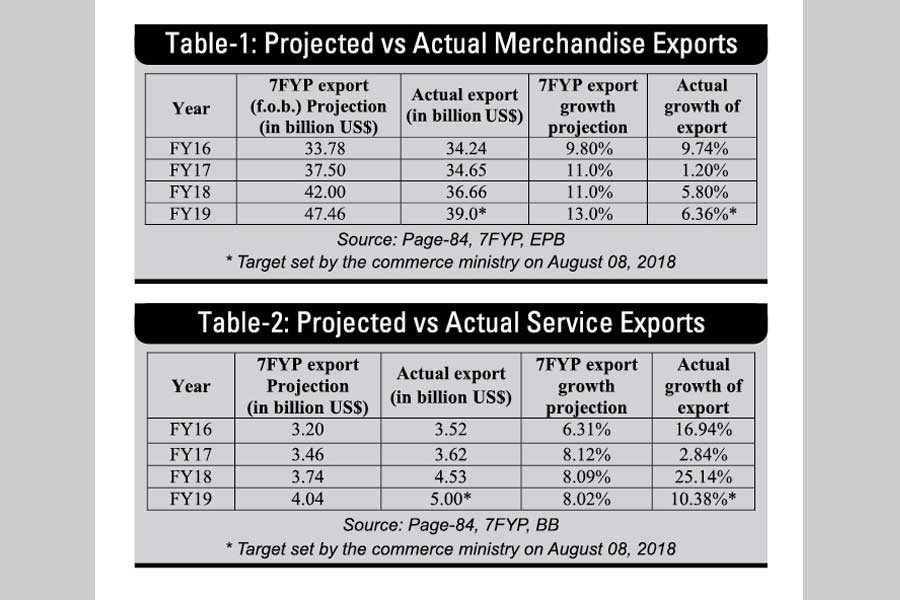

The government also set the annual target of service export at $5.0 billion in the current fiscal year against the actual export of $4.53 billion in FY18. In fact, exports of services have been registering good growth and also have achieved the projection made in the 7FYP (see Table-2)

No doubt that the ongoing tension in the global trade arena enhances the uncertainty of the multilateral trade regime. The tariff war, triggered by US President Donald Trump, has shaken the global trade order. Trump has been jolting the global trade order since he assumed the presidency in early 2017. His hard stance against the World Trade Organisation (WTO) compelled the members of the organisation to conclude the 11th ministerial meeting without any declaration.

Now the US is fully in a tariff war with China. In July the US imposed 25 per cent tariff of Chinese goods worth $34 billion and China retaliated. The US is again going to impose a 25 per cent tariff on $16 billion worth of Chinese goods starting August 23. China will also retaliate.

The tariff war is already provoking many other countries to increase tariffs on their imports. For instance, India doubled the tariff on more than 300 textile products to 20 per cent on August 07. The hike is mainly targeted to contain import from China.

Export from Bangladesh to India surged by around 30.0 per cent in the past fiscal year and stood at $873.27 million compared to $672.40 million in FY17. This is for the first time Bangladesh's export to India crossed $800 million. Textile products, ready-made garment (RMG) to be precise, contributed significantly to the increase of export to India where Bangladesh is enjoying tariff-free market access. The increased tariff will not, however, be applicable to countries which have free trade deals with India.

Nevertheless, such kind of hike in tariff undermines the long trend of tariff reduction and trade liberalisation across the world. Moreover, it encourages other countries to increase tariffs. Tariff hike ultimately makes products costlier and consumers have to pay higher prices.

The United Nations Conference on Trade and Development (UNCTAD) estimate shows that Bangladeshi products may face an average tariff over 40.0 per cent in case the world enters into a full-fledged trade war. The UN body fears that a trade war would be a severe blow to the world's poorest countries and dash the hope of doubling the share of the Least Developed Countries' (LDCs) in global exports by 2020 under the Sustainable Development Goals (SDGs).

According to the World Trade Statistical Review 2018, merchandise exports of the LDCs increased by 13 per cent and reached at US$ 164.23 billion which is around 0.96 per cent of the total global export in 2017. As per the SDGs target, the share of LDCs' export to global exports would have to reach 2.0 per cent. In the ongoing volatile trade regime, it is unlikely that the LDCs will be able to reach the target within three years.

Bangladesh, which is the largest exporter among the LDCs, will also not be able to increase its exports significantly in the current situation. The country's export share in total exports of LDCs stood at around 22.0 per cent in the past year while in the global exports it was only 0.29 per cent.

Pushing the export now requires revamping the export policy. The tenure of the three-year export policy ended in June this year. But the government is yet to take any concrete step to prepare and finalise a new export policy. The existing policy will, however, remain valid until a new policy is adopted.

But delay in finalising and enforcing the new policy may give a wrong message to the businesses, especially the exporters. The potential sectors would not get adequate policy and fiscal supports. Efforts of exploring new markets and increasing the shares in the emerging markets may also slow down.

A long-term trade strategy is essential to prepare the country to face the challenges of the global trade war.

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.